Citibank’s Foray into Crypto Custody Services: A New Era for Wall Street

Citigroup, one of the world’s largest financial institutions, is set to launch crypto custody services in 2026, marking a significant milestone in the adoption of digital assets on Wall Street. According to Biswarup Chatterjee, global head of partnerships and innovation, the bank has been developing this offering for two to three years, with the goal of providing a credible custody solution for asset managers and other customers.

The upcoming service will involve Citi holding native cryptocurrencies on behalf of customers, with the bank exploring both internal technology solutions and potential third-party partnerships. Chatterjee emphasized that the bank is “not ruling anything out at the moment” regarding its custody strategy, indicating a willingness to adapt and evolve in response to changing market conditions.

The Rise of Stablecoins: Opportunities and Challenges

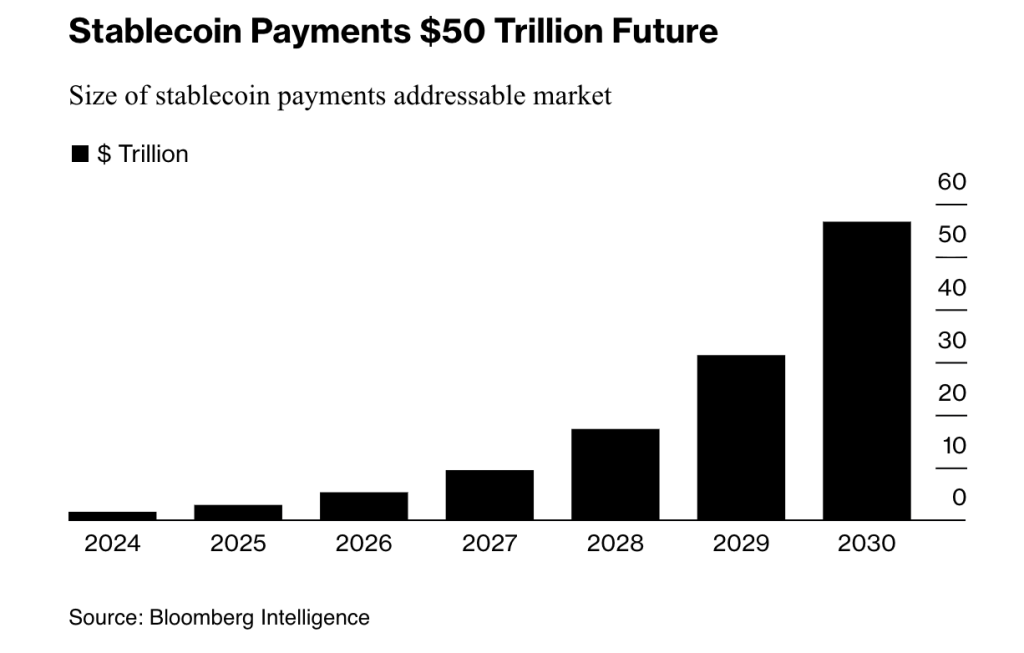

The move by Citi is part of a broader trend of banks exploring the potential of stablecoins, which are digital assets pegged to the value of traditional fiat currencies. A consortium of nine global banking giants, including Goldman Sachs, Deutsche Bank, and Bank of America, recently announced plans to develop a co-backed stablecoin focused on G7 currencies. This development has significant implications for the future of payments, financing, and liquidity, with Bloomberg Intelligence predicting that stablecoins could process over $50 trillion in annual payments by 2030.

However, the rise of stablecoins also poses challenges for traditional banks, which risk losing deposits to these new digital assets. Standard Chartered has warned that stablecoin adoption could drain over $1 trillion from banks in emerging markets by 2028, prompting regulators to consider measures such as capping ownership limits for retail customers.

Citi’s Balanced Approach: Weighing Opportunities against Risks

Citi’s aggressive expansion into digital assets is balanced against concerns about the potential impact on traditional banking. The bank’s CEO, Jane Fraser, has framed the approach as a response to customer needs and the broader shift towards always-on instant settlement, stating that “digital assets are the next evolution in the broader digitalization of payments, financing and liquidity.” However, Citi’s own analyst, Ronit Ghose, has warned that interest payments on stablecoins could trigger a deposit exodus from traditional banks, drawing parallels to the growth of money market funds in the 1980s.

Despite these concerns, Citi is pushing forward with its plans, with the 2026 launch of crypto custody services set to be a significant milestone in the bank’s strategic crypto adoption. With $2.57 trillion in assets under management, Citi’s move is likely to have a major impact on the future of digital assets on Wall Street.

For more information on Citibank’s plans to launch crypto custody services, visit https://cryptonews.com/news/citibank-to-launch-crypto-custody-services-in-2026-after-3-years-of-preparation/