Dogecoin Treasury Bet Backfires: CleanCore Stock Plunges 78% to Record Low

CleanCore Solutions’ aggressive push into Dogecoin as an official treasury asset has sparked a market reaction, with the company’s stock plunging nearly 78% in the last month as investors weigh steep quarterly losses and a sharp decline in DOGE price.

The stock, which trades under the ticker symbol ZONE on the NYSE American, fell to a record low of $0.3818 this week and ended Thursday’s session down nearly 12%.

The decline continued into Friday, increasing concerns about the company’s crypto-heavy balance sheet.

The Dogecoin Strategy is Dragging CleanCore Lower as Operating Costs Skyrocket

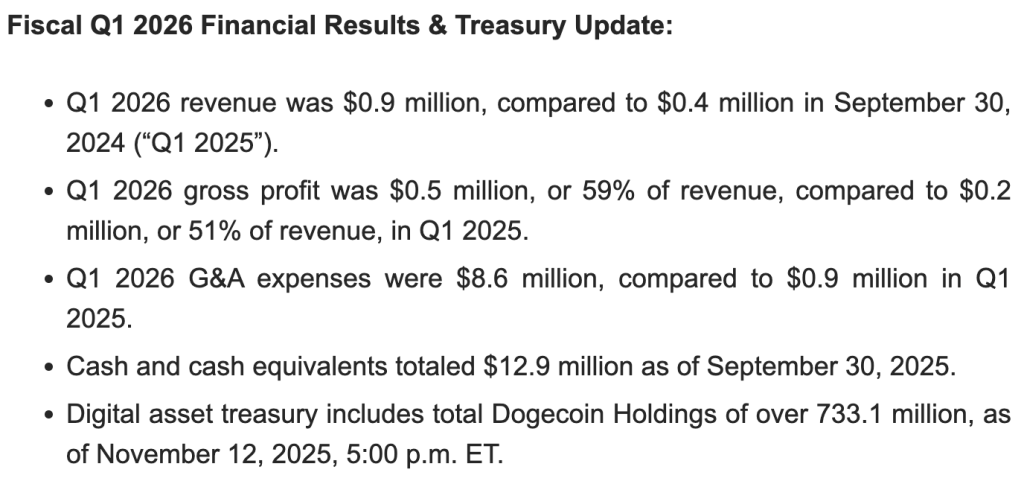

The plunge comes just days after CleanCore reported its fiscal first quarter results for the period ended Sept. 30, which showed a widening net loss of $13.4 million compared to $0.9 million in the same period last year.

Source: Yahoo Finance

Source: Yahoo Finance

While revenue doubled year-over-year to $0.9 million and gross profit increased to $0.5 million, the company’s expenses rose sharply.

General and administrative expenses increased from $0.9 million to $8.6 million, reflecting professional fees, stock-based compensation, new salaries and insurance costs related to the Dogecoin Treasury launch.

The company has placed Dogecoin at the center of its financial strategy.

CleanCore completed a $175 million private placement in partnership with House of Doge to build its “official” Dogecoin treasury, using Robinhood’s Bitstamp as its trading venue.

The company has accumulated over 733 million DOGE as of November 12th, worth approximately $117.5 million.

It reiterated its long-term goal of acquiring 5% of Dogecoin’s circulating supply to expand the token’s real-world utility.

CleanCore’s Commitment to Dogecoin

CEO Clayton Adams said the company is trying to position Dogecoin as a “trusted reserve asset” and remains committed despite recent market volatility.

“Our financial results during the quarter reflected several one-time charges related to our Treasury Strategy transaction, while our core business experienced growth and cash flow on a standalone basis,” Adams said.

Source: MarketScreener

Source: MarketScreener

But the timing was ruthless. The price of Dogecoin has fallen over 21% over the past month, falling below $0.17 as it tests a long-term support level that has held since late 2023.

Analysts warn that DOGE is facing a serious technical breakdown, with momentum turning bearish and key indicators weakening.

Source: TradingView

Source: TradingView

DOGE is currently trading near $0.163, down almost 7% in the last 24 hours.

A break below the multi-year support trend line could trigger a broader decline and potentially mark the end of the cycle that began in late 2023.

CleanCore Shares Lag Even as Corporate Adoption of Dogecoin Accelerates

CleanCore’s largest DOGE purchases occurred at an average price above current levels.

The first major acquisition on September 5th totaled 285.4 million DOGE at a price of around $0.238 per token, followed by further purchases that brought the cash balance to over 700 million