Coinbase Global Inc., a leading cryptocurrency exchange, is expanding its stablecoin offerings following significant legislative developments in the United States. The new wave of interest in blockchain-based payments has sparked a renewed focus on stablecoins, with major corporations exploring their potential. As part of this effort, Coinbase is reportedly in advanced talks to acquire BVNK, a stablecoin infrastructure startup, in a deal valued at $2 billion.

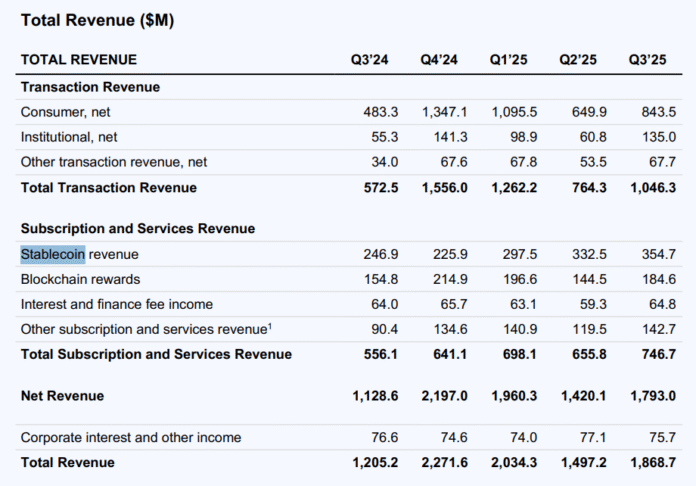

According to sources familiar with the matter, the acquisition is expected to close by the end of this year or early 2026, subject to Coinbase’s due diligence. This move is seen as a strategic step to diversify Coinbase’s revenue streams, which currently rely heavily on cryptocurrency trading fees. The stablecoin market presents a significant opportunity for growth, with Coinbase already generating substantial revenue from stablecoins. In the third quarter of 2025, the exchange reported that $246 million, or 20%, of its revenue came from stablecoins.

Coinbase total revenue, millions, third quarter 2025. Source: investors.coinbase.com

Stablecoin Infrastructure and the GENIUS Act

BVNK, a London-based startup, offers enterprise-grade stablecoin payments to merchants. The company has raised $90 million in funding from prominent investors, including Citi Ventures, Visa, and Haun Ventures. Coinbase Ventures, the exchange’s venture capital arm, is also an investor in BVNK. The acquisition would provide Coinbase with a robust stablecoin infrastructure, enabling it to expand its offerings in this area.

The passage of the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act in July has played a significant role in sparking corporate interest in stablecoins. The legislation sets clear rules for collateralizing stablecoins and requires compliance with anti-money laundering laws. According to Andrei Grachev, managing partner at DWF Labs and Falcon Finance, the GENIUS Act has “legitimized” stablecoins for institutional use, paving the way for a unified digital financial system.

Corporate Adoption of Stablecoins

The GENIUS Act has inspired several payments giants to announce plans for stablecoin adoption. In September, Visa launched a pilot program allowing banks, businesses, and remittance companies to fund international payments directly with stablecoins. This development is expected to drive further growth in the stablecoin market, with Coinbase well-positioned to capitalize on this trend through its potential acquisition of BVNK.

As the cryptocurrency and stablecoin markets continue to evolve, it is essential to stay informed about the latest developments and trends. For more information on this topic, visit https://cointelegraph.com/news/coinbase-2b-bvnk-acquisition-stablecoin-push?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound