Coinbase’s Q4 Performance Drags Down ARK Invest’s Flagship Funds

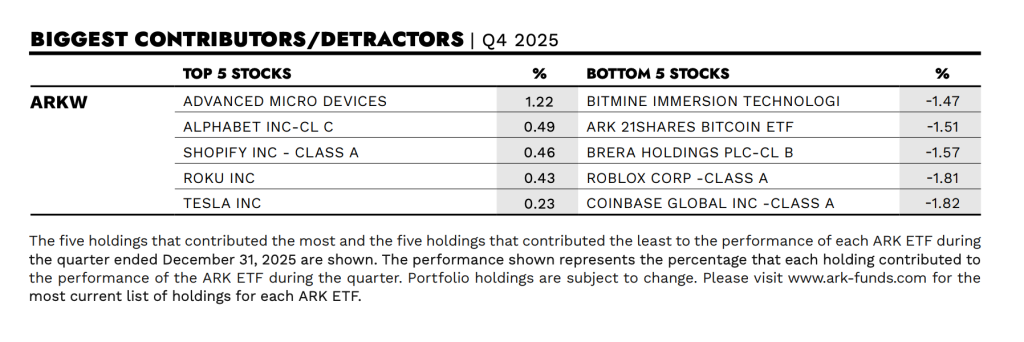

Coinbase posted ARK Invest’s worst quarterly performance in the fourth quarter of 2025, as crypto market turmoil roiled the exchange’s stocks and plunged Cathie Wood’s flagship funds into the industry’s most volatile quarter in recent history. According to its quarterly report, the exchange emerged as the biggest disruptor among ARK’s innovation-focused ETFs in the three months ended Dec. 31, with shares falling sharply while spot trading volume on centralized exchanges fell 9% quarter-on-quarter.

Coinbase has struggled despite hosting a product event that unveiled long-term strategic ambitions, including plans for on-chain stocks, prediction markets, and an AI-powered portfolio advisor. Market conditions remained challenging following a liquidation event on October 10 that wiped out $21 billion in leveraged positions across the crypto sector.

ARK Funds Weather the Crypto Downturn

The damage extended beyond Coinbase to ARK’s portfolios. Roblox joined the stock market as another major weight after the company reported 51% year-on-year booking growth in the third quarter, but expects operating margins to decline in 2026 due to higher infrastructure and security costs. Russia’s ban on Roblox due to child safety concerns lost about 8% of the platform’s total daily active users, even though the region accounted for less than 1% of total revenue.

Advanced Micro Devices emerged as the quarter’s strongest contributor after announcing significant AI partnerships, including a multi-year deal with OpenAI and a collaboration with Oracle on a public AI supercluster. AMD’s third-quarter earnings reflected 36% year-over-year revenue growth, driven by robust demand in its data center and gaming segments.

Coinbase Pursues the “Everything Exchange” Expansion

Coinbase CEO Brian Armstrong announced that the exchange will pursue an “everything exchange” strategy in 2026, combining crypto, stocks, prediction markets, and commodities into spot, futures, and options products. The plan enables Coinbase to compete directly with traditional brokers while expanding beyond its core digital assets business into tokenized securities and event-based markets, which have recently attracted billions of dollars in trading volume.

In the fourth quarter of 2025, four of ARK’s actively managed ETFs underperformed broad-based global equity indices, while two outperformed or delivered mixed results. ARK Chief Investment Officer Cathie Wood said: “The innovation space is recovering and being reassessed,” noting that “headwinds that once pressured disruptive technologies are turning into structural tailwinds.”

Tokenized Assets and Regulatory Tailwinds Drive Optimism

Additionally, Coinbase also plans to issue tokenized stocks internally rather than through external partners, marking a departure from competitors like Robinhood and Kraken that rely on third-party providers for stock tokens. With all of this important preparation for 2026, Goldman Sachs upgraded Coinbase from Neutral to Buy on Jan. 6, raising its 12-month price target to $303 and citing growing confidence in the company’s diversification strategy.

For more information, visit https://cryptonews.com/news/coinbase-drags-down-ark-invests-flagship-funds-in-brutal-q4-crypto-slump/