Introduction to Cryptocurrency Market Trends

The cryptocurrency market has been experiencing a mix of trends, with some coins like Bitcoin (BTC) facing a downturn, while others such as Ethereum (ETH), Cronos (CRO), Solana (SOL), KuCoin Token (KCS), Hyperliquid (HYPE), and Story Protocol (IP) are gearing up for a potential recovery. This article aims to provide an in-depth analysis of the current market situation, highlighting the performance of top altcoins and the factors that could influence their future prices.

Top 5 Altcoin Price Analysis

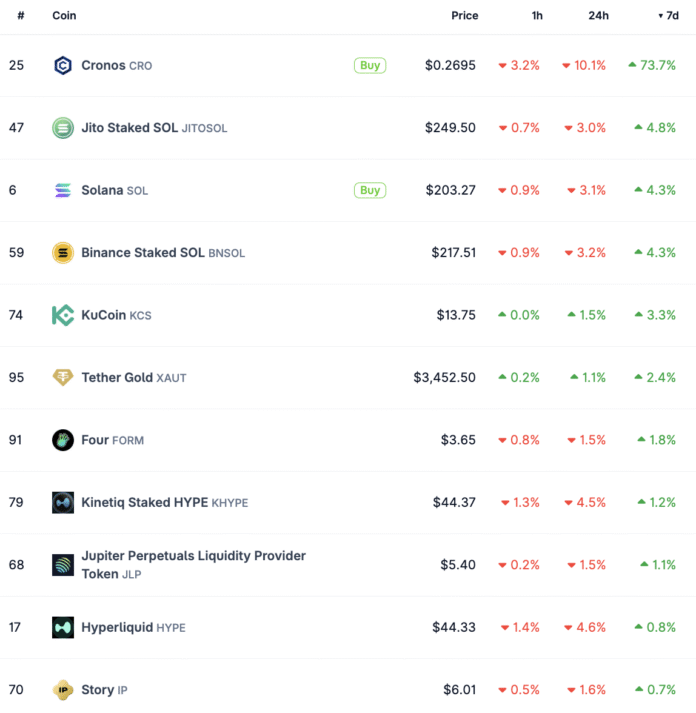

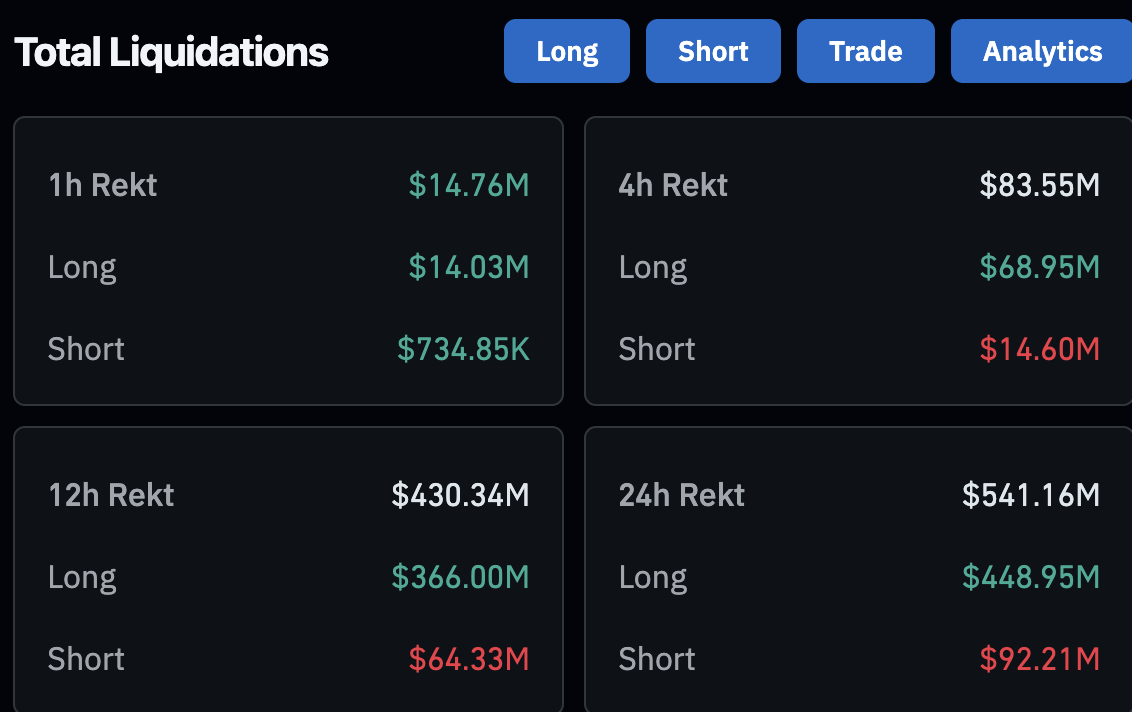

According to data from Coingecko, the top 5 altcoins by seven-day profits are Cronos (CRO), Solana (SOL), KuCoin Token (KCS), Hyperliquid (HYPE), and Story Protocol (IP). These coins have shown significant gains, with CRO leading the pack with a 90% increase in the past seven days. The following image illustrates the top 5 altcoins by seven-day profits:

Source: Coingecko

Cronos (CRO) Price Analysis

Cronos (CRO) is currently trading at $0.2713, close to the psychologically important level of $0.2552. The coin has set support at two key levels, $0.2013 and $0.2552. CRO was able to test the resistance at $0.3878, as can be seen in the following CRO/USDT price chart:

CRO/USDT Daily Price Chart | Source: crypto.news

Two important indicators, RSI and MacD, support a thesis of restoration for CRO.

Solana (SOL) Price Analysis

Solana (SOL) continues to support the altcoin, with eyes on a renewed test of the $250 resistance if it maintains its upward trend. Solana has consistently outperformed Ethereum in terms of Dex metrics, while it remains as a total value locked by the blockchain. The Solana dynamic indicators for the daily time frame support a bullish thesis for the token and are currently less than 25% away from the resistance of $250.

SOL/USDT Daily Price Chart | Source: crypto.news

KuCoin Token (KCS) Price Analysis

KuCoin Token (KCS) expanded its profits on Friday, August 29th. The local token of the exchange added almost 12% to its value last week. The next resistances are $14.30 and $14.60, and KCS could find support at $13. RSI and MacD will support a thesis of further profits in KCS next week.

KCS/USDT Daily Price Chart | Source: crypto.news

Hyperliquid (HYPE) Price Analysis

Hyperliquid’s HYPE token could test the resistance at $51,189, the closest level of resistance. HYPE’s daily price diagram shows that the upward trend of HYPE has a positive dynamic. However, this could let up, since the green histogram bars are shorter one after the other.

HYPE/USDT Daily Price Chart | Source: crypto.news

The HYPE could sweep the support at $42 or $35, the two main support levels for the token.

Story Protocol (IP) Price Analysis

The IP token from Story Protocol could sweep liquidity and a correction to $5.30, the next support level, were exposed to another break from consolidation. A daily candlestick that closes below $5.30 could send IP to $4. The technical indicators for the daily time frame support a bearish thesis for the token.

IP/USDT Daily Price Chart | Source: crypto.news

However, if the underlying impulse changes to positive and IP extends the latest profits, it could be exposed to resistance of $7.50 and 25% above the current price. The next key resistance is $9 and marked as a R2 in the daily price diagram.

Bitcoin Whale Movement

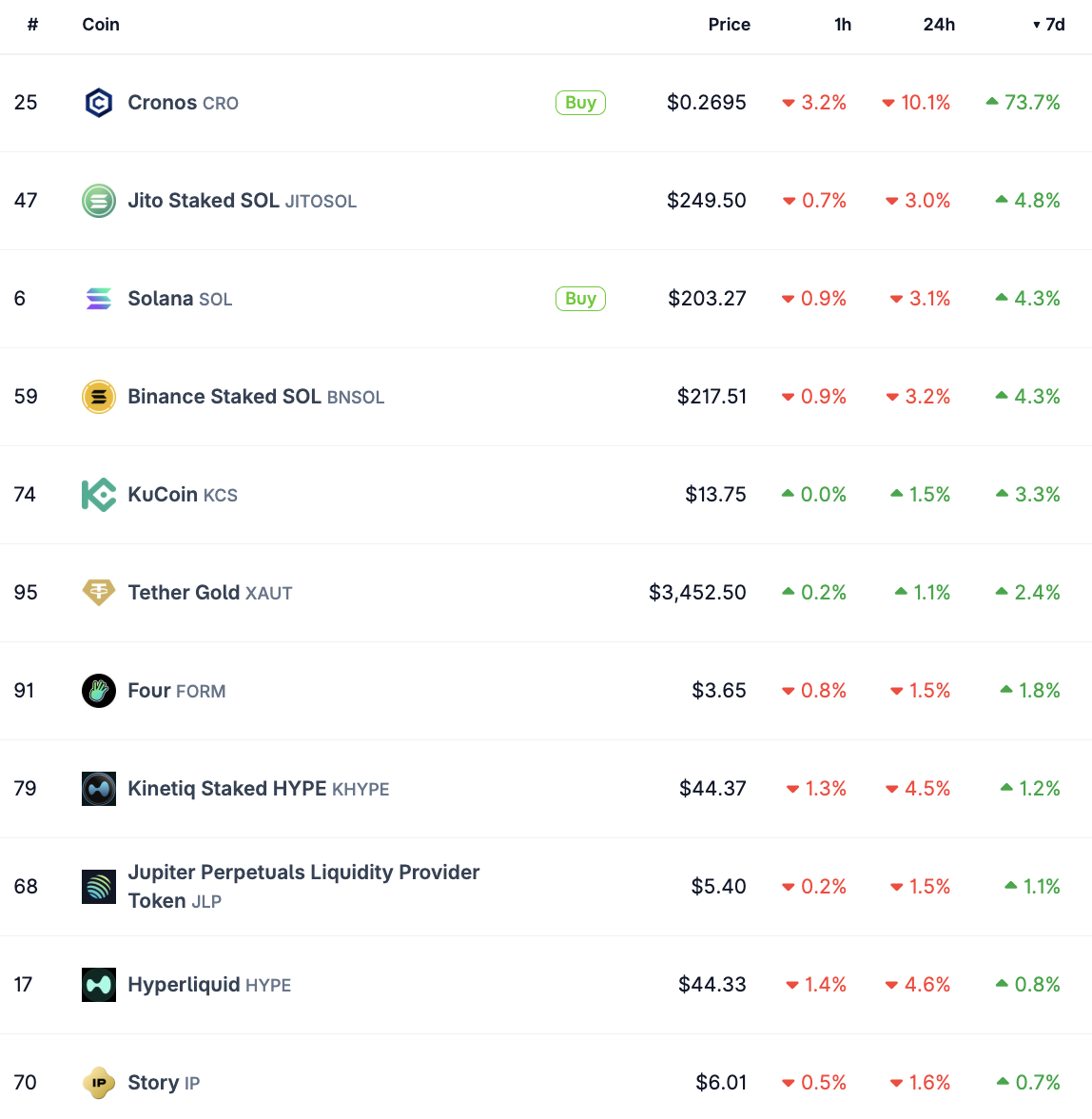

The price trend of Bitcoin and the sale of the pressure over the stock exchanges are key factors that could influence the future prices of altcoins. While the King Crypto has not undertaken significant movements in the past seven days, the activity of on-chains is pursuing the latest Bitcoin movements of a whale.

The whale in question sold 24,000 Bitcoin last week and is moved by the same wallet. A transmission of 10,000 BTC is marked on chains, with 2,000 BTC addressing to an exchange.

Bitcoin on-chain transfer from Whale | Source: Timechainaleindex.com

Data from a Bitcoin address explorer show that the sale of the pressure on Bitcoin can increase in the coming week, unless the buyers enter to absorb the additional BTC flow into exchange platforms.

Derivatives Data Analysis

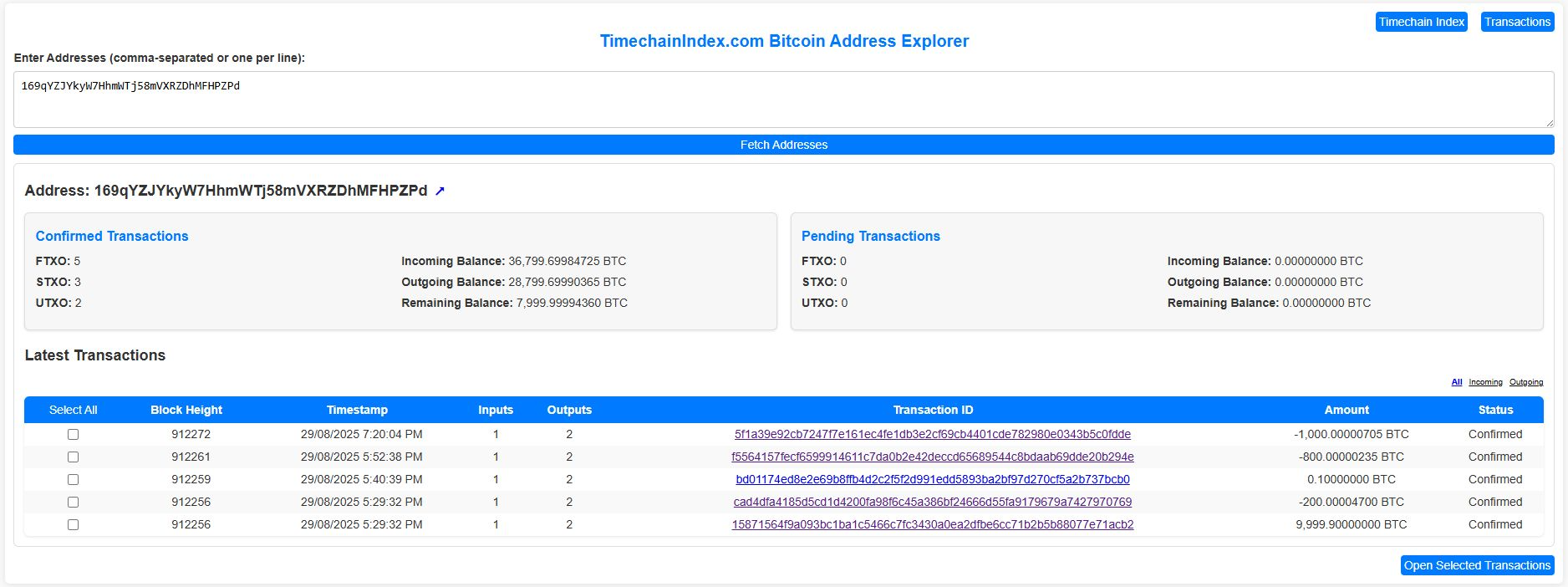

Derivatives data from Coinglass show that the crypto market was exposed to over $540 million of liquidations. The majority of the long positions paid for shorts. This implies that bullish traders are punished when the prices for top cryptocurrencies sink and retailers become bear.

Drainage data analysis | Source: Coinglass

The open interest has achieved a hit that has dropped to $200 billion and marks a decrease of 3% within a period of 24 hours.

The data of the derivatives indicate that further correction is likely to be on the market and that additional warding can occur before tokens begin at the start of their relaxation.

Source: https://crypto.news/chart-of-the-week-cro-sol-kcs-hype-and-ip-gear-for-recovery/