Crypto Apps Surpass Blockchains in Earnings: A New Era for the Crypto Ecosystem

Crypto apps have officially outperformed the blockchains that power them, marking a significant shift in the way value flows across the crypto ecosystem. This development is a testament to the rapid growth and maturation of the industry, with fully developed blockchain-based applications becoming the primary drivers of profitability. According to a recent report by Delphi Digital, crypto apps are now generating more revenue than the underlying chains they rely on, with some apps earning hundreds of millions of dollars in fees.

The report highlights the impressive revenue figures of crypto apps such as PumpFun, which earned $724 million in fees last year, and Hyperliquid, which generated $667 million. In contrast, Solana, one of the most valuable large L1s, reported $2.8 billion in annual revenue and $632 million in fees. These numbers demonstrate the significant value that crypto apps are creating, with some apps generating more revenue than the blockchains themselves.

Blockchain Value Capture and Revenue Velocity Problem

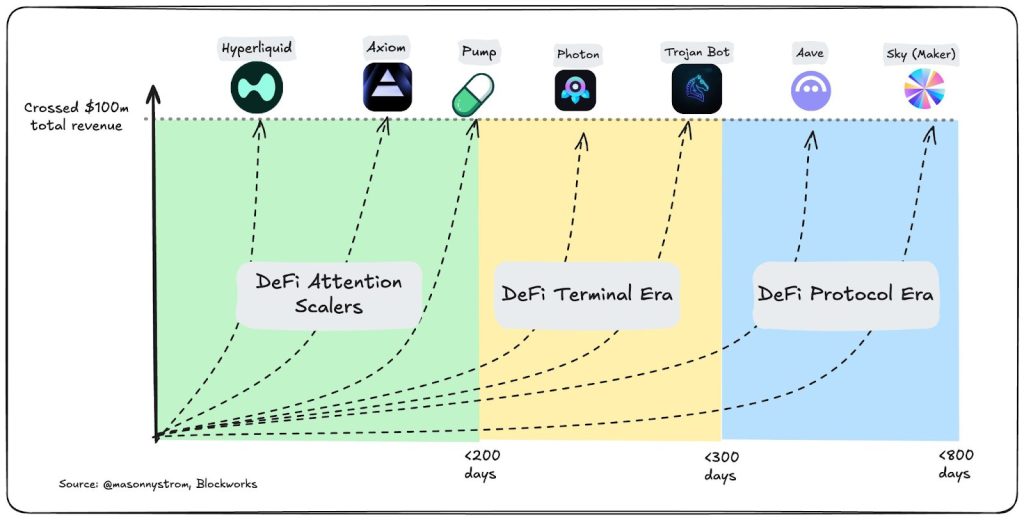

The pace of crypto revenue has accelerated as the ecosystem has evolved from protocols to applications that scale trading, attention, and monetization of market volatility. During the DeFi protocol era, crypto companies generated revenue quickly, with early protocols like Maker and Aave reaching $100 million in total revenue within a few years of monetization. However, the old protocol framework assumed that chains would capture value proportional to the activity built on them, which is no longer the case.

Vitalik’s Solution: DeFi as Ethereum’s Google Search

Ethereum co-founder Vitalik Buterin has proposed a solution to the blockchain value capture problem, suggesting that DeFi can be to Ethereum what Google Search is to Google. Buterin argues that low-risk DeFi can provide a reliable basic income for the ecosystem without compromising its principles. He points to Aave’s stablecoin lending rates as a concrete example, where blue-chip stablecoins like USDT and USDC generate returns of around 5%, while riskier assets offer over 10%.

Buterin’s proposal highlights the need for a new framework that allows blockchains to capture value proportional to the activity built on them. As the crypto ecosystem continues to evolve, it is likely that we will see new solutions emerge to address the blockchain value capture problem. For now, crypto apps remain the primary drivers of profitability, with some apps generating hundreds of millions of dollars in fees. To learn more about the latest developments in the crypto space, visit CryptoNews.