Crypto Market Trends: Is the Crash Coming to an End?

The cryptocurrency market has experienced a significant downturn in recent weeks, with Bitcoin’s value plummeting to the key support level of $80,000 and the total market capitalization of all tokens dropping to $2.90 trillion. This decline has been reflected in the performance of most coins, with many experiencing double-digit losses over the past seven days. Ethereum (ETH), Ripple (XRP), Binance Coin (BNB), and Cardano (ADA) have all fallen by over 12% during this period.

Signs of a Potential Bull Run

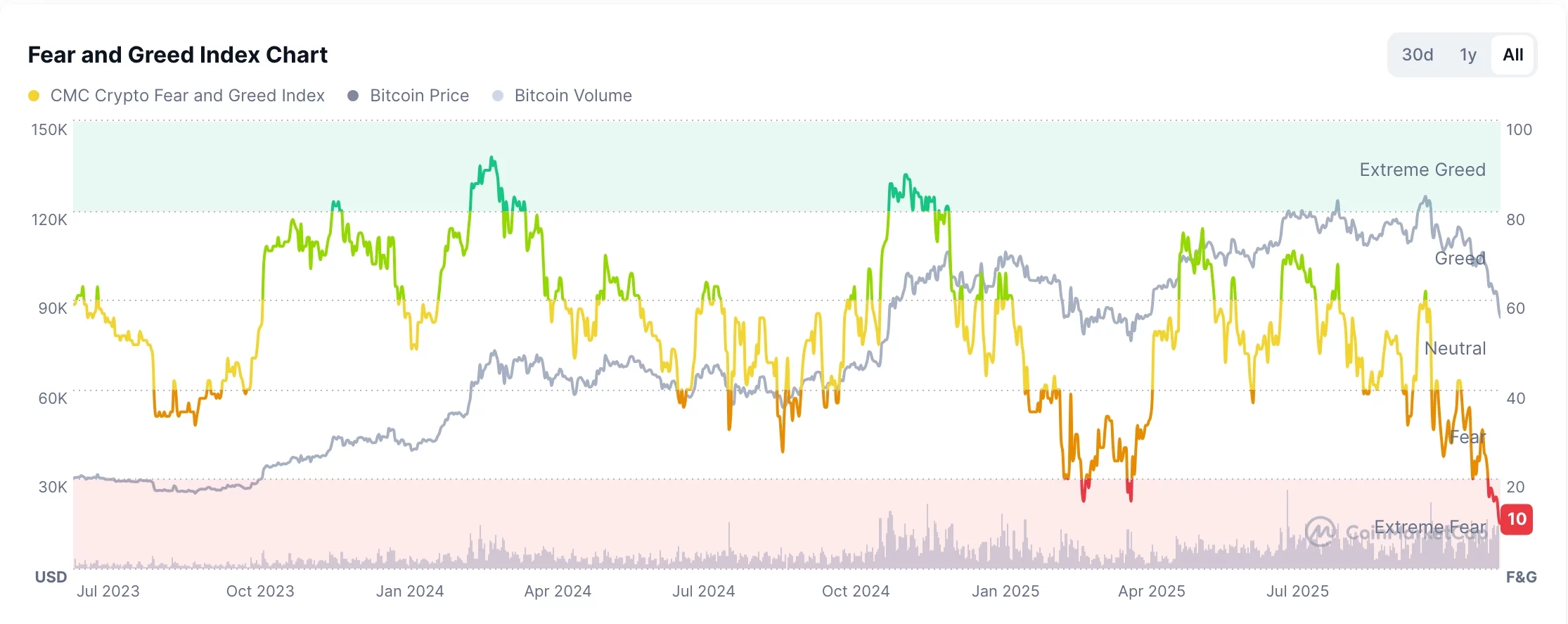

Despite the current gloom, there are indications that the crypto market crash may be nearing its end. One key factor is the Fear and Greed Index, which has tumbled to a year-to-date low of 10. This index, which measures market sentiment, has historically been a reliable indicator of impending bull runs. As seen in the past, crypto bull markets often begin when the index is in the extreme fear zone, while bear markets typically start when the index is in the green or extreme greed zone.

Crypto Fear and Greed Index | Source: CMC

Oversold Market Conditions

Another potential catalyst for a new bull run is the oversold state of the crypto market. The Relative Strength Index (RSI) of the Crypto Market Cap has dropped to an oversold level of 24, indicating that the falling divergence pattern that began in July is nearing its end. This suggests that Bitcoin and other altcoins may be due for a rebound in the coming weeks, potentially forming a double-bottom pattern.

Crypto Market Cap has become oversold | Source: TradingView

Cleansing of the Crypto Market

The ongoing cleansing in the crypto industry is another factor that could contribute to the end of the crash. The futures open interest has plunged to $123 billion, down from a year-to-date high of over $320 billion, according to data compiled by CoinGlass. Total liquidations since October 10 have jumped to over $40 billion, indicating that the market is becoming healthier as investors reduce their leverage.

Additional Catalysts for a Bull Run

Other potential catalysts for a new crypto bull run include the possibility of Federal Reserve interest rate cuts, the soaring M2 money supply, and the ongoing approval of altcoin ETFs. These factors, combined with the signs of a potential bull run and oversold market conditions, suggest that the crypto market may be poised for a rebound. For more information, visit the original source: https://crypto.news/crypto-crash-about-to-end-top-reasons-for-a-new-bull-run/