The cryptocurrency market is experiencing a wave of negative sentiment, with traders expressing fear, uncertainty, and doubt (FUD) about the future of Bitcoin (BTC) and altcoins. According to the Onchain-Analytics platform Santiment, the price of Bitcoin and altcoins has been on a downward trend, leading to a bear market. However, analysts believe that this negative sentiment is temporary and that the market will recover soon.

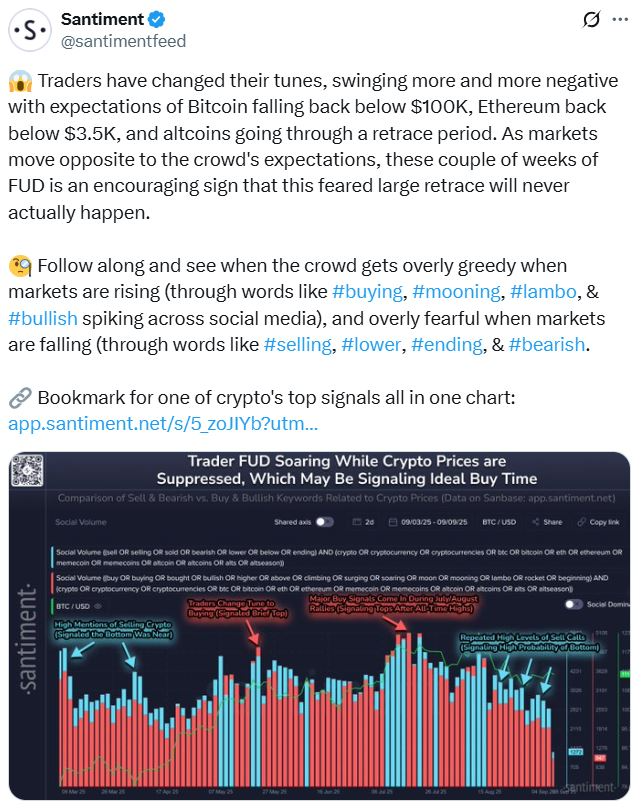

Santiment reported on X that the market has been experiencing a “traceacial period” of sales, with the price of Bitcoin and altcoins dropping. The platform also noted that the market often moves opposite to the expectations of the crowd, suggesting that the recent FUD is an encouraging sign that the feared downturn may not actually happen. The crypto market sentiment has been causing fear among investors, with many showing signs of temporary resignation.

Source: Santiment

Analysts have announced that the negative sentiment will likely pass soon, as the price of Bitcoin is expected to recover and a possible US tariff shortening is on the horizon. Pav Hundal, senior market analyst at Australian Crypto Broker Swyftx, told CoinTelegraph that all eyes are on the Fed meeting next week, and a rate cut of any kind may be “the next key catalyst for positivity”.

US Rate Reduction: A Key Catalyst for Positivity

Some financial institutions and market analysts predict that the US Federal Reserve will reduce interest rates at least twice in 2025. Hundal added that the worries about the bond markets are attracting the attention of the market and will only calibrate with a “healthy correction” after it has replaced a very high mood. He also mentioned that the rolling 30-day performance of Bitcoin is negative, indicating that the market has already passed a correction that will have shaken many weak hands since reaching the top of $124,000.

$117,000 Breakout: A Potential Bullish Sentiment for Bitcoin

The Crypto Fear & Greed Index, which tracks the wider atmosphere of the crypto market, has been in “fear” since Monday after several days of registering an average rating of “greed” last month.

The Crypto Fear & Greed Index returned to the neutral area on Monday. Source: alternative.me

Charlie Sherry, finance manager of the BTC Markets Crypto Exchange, told CoinTelegraph that trader sentiment is often extreme in both directions. If traders lean strongly bearish, this can often mark the end of the movement, not the start. He added that if Bitcoin recaptures $117,000, sentiment would swing back quickly, and there are already early signs that Bitcoin is bouncing back from its current level.

Another factor that could have a positive impact on the crypto market is the increasing adoption of cryptocurrency by companies. In one of the latest cases, the design and manufacturing company Forward Industries announced that it received $1.65 billion in cash and stable coins for the introduction of a Solana (SOL) strategy for crypto treasury.

Traders in September: A Month of Volatility

CK Zheng, co-founder and Chief Investment Officer of ZX Squared Capital, told CoinTelegraph that September was “worst at the worst” in terms of return on equity. However, he also believes that the negative representative mood is only temporary and that a shift in factors such as the consumer price index, the producer price index, and the effects of US President Donald Trump’s tariffs depends.

Read more about the crypto market sentiment and its expected recovery at https://cointelegraph.com/news/rypto-sentiment-drops-but-recovery-expected?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound