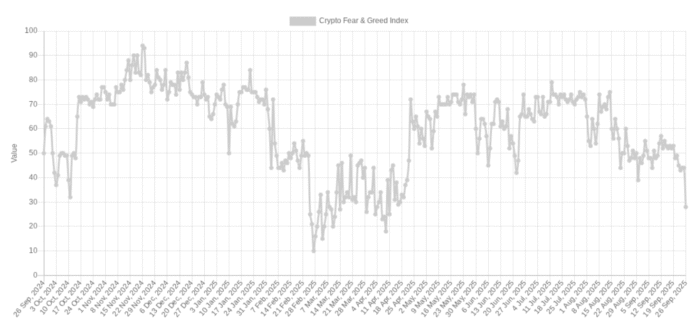

The cryptocurrency market is experiencing a significant shift in sentiment, with the Crypto Fear & Greed Index plummeting to levels not seen since Bitcoin traded at $83,000. This index, which measures market sentiment, has dropped to 28/100, marking its lowest level since April 11. The sudden decline in market sentiment has sparked debate among analysts, with some wondering if the current price dip could be a turning point for Bitcoin.

Market Sentiment and the Fear & Greed Index

The Fear & Greed Index is a widely followed metric that gauges market sentiment by analyzing various factors, including volatility, market momentum, and social media trends. A reading of 28/100 indicates that fear is currently driving the market, with investors becoming increasingly cautious. This level of fear has not been seen since April, when Bitcoin was trading at around $83,000. According to data from Cointelegraph Markets Pro and TradingView, the last time the Fear & Greed Index was below 30/100, BTC/USD traded at about $83,000, days after its recovery from $75,000 lows.

Crypto Fear & Greed Index (screenshot). Source: Alternative.me

Crypto YouTube channel host Michael Pizzino noted that the emerging divergence between price and sentiment could be a sign of an impending market reversal. “MORE fear and a HIGHER price,” Pizzino said in an X post, referring to the potential for a price rebound. Accompanying analysis suggests that the time is right for a market reversal, with Pizzino asking, “Could this be the turning point Bitcoin and Crypto has been waiting for? The analysis looks good, but it has not been confirmed.”

Social Media Trends and Market Analysis

Social media trends are also indicating that a price rebound could be on the horizon. Research platform Santiment showed that social media users were already convinced that lower prices would soon come, with a “high amount of impatience and bearishness emerging from the retail crowd.” At the same time, data revealed that large-volume traders have been adding exposure in recent days. This contrast between retail and institutional sentiment could be a sign of an impending market shift.

Bitcoin price social media activity data. Source: Santiment/X

While the current market sentiment is cautious, some analysts believe that the worst may be over. The Fear & Greed Index has been known to be erratic, and the current level of fear could be a sign of a market bottom. As the cryptocurrency market continues to evolve, it’s essential to stay informed and up-to-date with the latest market trends and analysis. For more information, visit the original source.