The cryptocurrency market has witnessed a consistent outflow of funds from digital asset investment products, with the latest week marking the fourth consecutive week of withdrawals, totaling $173 million, as reported by CoinShares in their weekly capital flows report.

The trend of outflows from digital asset investment products has been ongoing, with the total outflows over the past four weeks amounting to $3.74 billion. This significant withdrawal of funds underscores the cautious stance of investors amidst the prevailing price weakness and macroeconomic uncertainty in the cryptocurrency market.

Regional Divergence in Crypto Fund Outflows

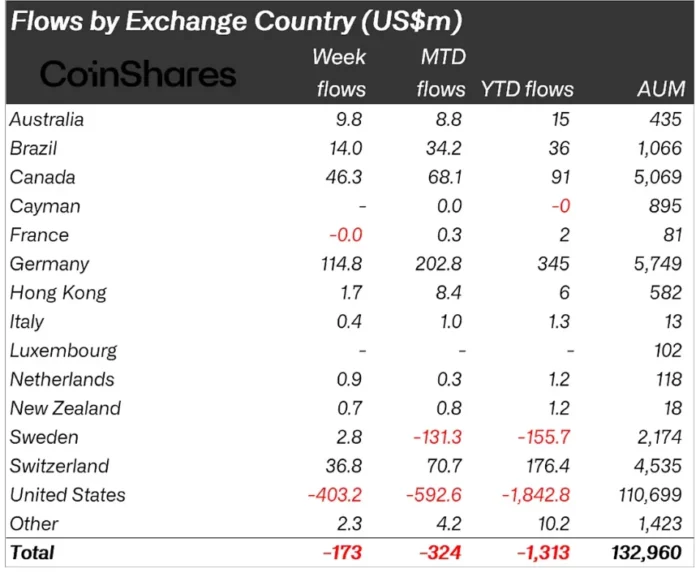

A notable aspect of the outflows is the regional divergence, with the US leading the decline at $403 million, while Europe and Canada combined saw inflows of $230 million. This disparity highlights the varying sentiments among investors in different regions, with some exhibiting a more risk-averse approach than others.

Germany, in particular, led the way with $115 million in inflows, followed by Canada with $46.3 million and Switzerland with $36.8 million. This data suggests that despite the prevailing caution in the US, there remains a keen interest in digital assets in certain parts of Europe and North America.

Asset-Specific Outflows and Resilience

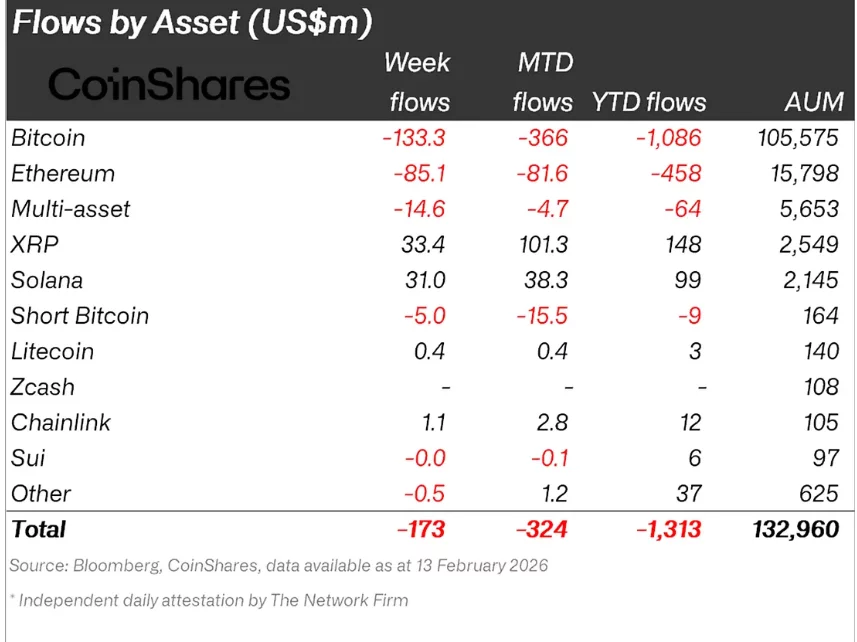

Among the digital assets, Bitcoin (BTC) and Ethereum (ETH) bore the brunt of the selling, with outflows of $133 million and $85.1 million, respectively. Interestingly, short Bitcoin products also experienced outflows totaling $15.4 million over the past two weeks, a pattern that is often observed near potential market bottoms, according to CoinShares.

In contrast to the major cryptocurrencies, select altcoins continued to attract capital. The Ripple token (XRP) led the way with inflows of $33.4 million, closely followed by Solana (SOL) and Chainlink (LINK). This selective resilience indicates that investors are not entirely withdrawing from the asset class but rather rotating their exposure to different digital assets.

Despite the recent decline, the total assets under management remain significant, demonstrating that institutional exposure to digital assets persists even amidst short-term volatility. This persistence underscores the growing acceptance and integration of digital assets into mainstream investment portfolios.

Conclusion and Market Outlook

The consistent outflows from digital asset investment products over the past four weeks reflect the cautious sentiment prevailing among investors. However, the regional divergence in outflows and the resilience of select altcoins suggest a nuanced market outlook. As the cryptocurrency market continues to evolve, it is crucial for investors to remain informed and adapt to the changing landscape.

For more detailed insights and the latest updates on cryptocurrency market trends, visit https://crypto.news/crypto-funds-bleed-for-fourth-week/.