Crypto Inflows Surge to $1.9B After Fed’s First Rate Cut of 2025

Digital asset investment products recorded a significant surge in inflows, reaching $1.9 billion last week, following the Federal Reserve’s first interest rate cut of 2025, according to data from CoinShares. This marked the second consecutive week of gains for the sector, lifting total assets under management (AuM) to a year-to-date high of $40.4 billion.

The Fed lowered its benchmark rate by 25 basis points on September 17, trimming the target range to 4.25%. This move was characterized as a “hawkish cut,” with policymakers signaling caution on further easing. Despite this, investors turned to crypto products later in the week, with $746 million flowing in on Thursday and Friday alone.

Bitcoin and Ethereum Lead the Charge

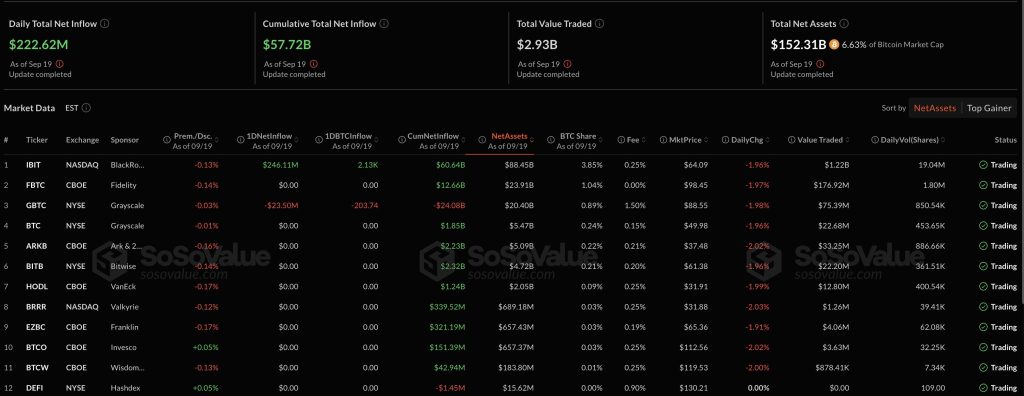

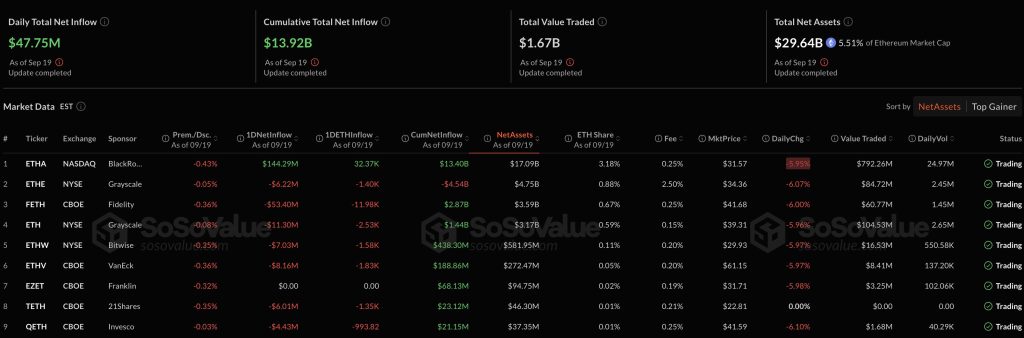

Bitcoin funds attracted the largest share, with $977 million in inflows. The gains followed $2.4 billion of inflows the prior week, bringing Bitcoin’s four-week total to $3.9 billion, according to SoSoValue. Ethereum also benefited strongly, seeing $772 million in inflows, pushing its year-to-date total to a record $12.6 billion.

Source: SoSoValue

Source: SoSoValue

Solana and XRP also drew investor interest, with inflows of $127.3 million and $69.4 million, respectively. Market reaction to the Fed’s cut was volatile, with Bitcoin briefly rising above $117,000 before retracing to $115,089 at press time, down 1.2% in 24 hours and sitting 7% below its all-time high of $124,128.

Crypto ETF Race Heats Up

The wave of fresh capital into crypto funds coincided with a flurry of ETF activity in Washington. On Tuesday, five new applications were filed with the U.S. Securities and Exchange Commission, signaling issuers’ growing appetite for products tied to assets beyond Bitcoin and Ethereum. The latest lineup includes Bitwise’s proposed spot Avalanche ETF, Defiance ETFs designed around Bitcoin and Ethereum basis trades, and Tuttle Capital’s “Income Blast” funds tracking Bonk, Litecoin, and Sui.

Source: SoSoValue

Source: SoSoValue

For more information, visit the original source: https://cryptonews.com/news/crypto-inflows-hit-1-9b-after-feds-first-rate-cut-of-2025/