The cryptocurrency market has experienced a significant downturn, resulting in a staggering $1.19 billion in liquidations. The total market capitalization has plummeted to nearly $3.5 trillion, sparking widespread concern among investors. This article delves into the reasons behind the decline of major altcoins and the factors contributing to the crypto market crash.

Crypto Market Crash: A Closer Look

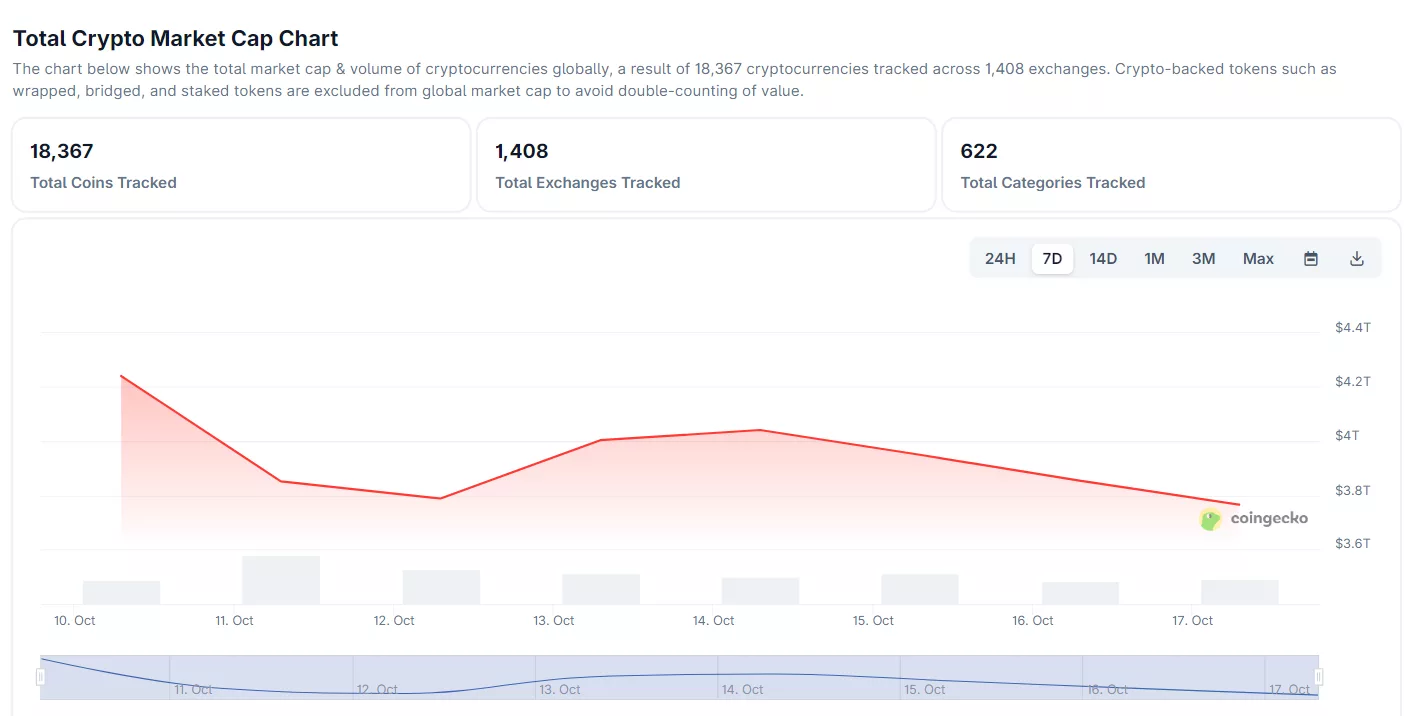

The crypto market cap has fallen by 7.3% to around $3.6 trillion, triggering a wave of liquidations that has wiped out over $1.2 billion in 24 hours. The majority of these liquidations came from long positions, amounting to $920 million, while short positions accounted for $309 million. In the last hour alone, $118 million was liquidated, with the split between long and short positions being almost equal.

Altcoins Suffer Sharp Declines

Altcoins continue to suffer sharp declines due to a combination of cascade unwinds, profit-taking, and macroeconomic uncertainty. Traders are becoming increasingly cautious amid delayed interest rate cut expectations, leading to a decline in market confidence. According to Coinglass, the crypto Fear and Greed Index has fallen into the “fear” zone at 23, approaching the extreme fear zone at 22.

Bitcoin (BTC) has remained the asset with the largest liquidations, contributing $74 million in the last hour. Ethereum (ETH) has lost about $26.5 million in liquidations over the same period, while Solana (SOL) and other altcoins have recorded smaller losses. The decline in altcoins is largely due to the broader bearish market, profit-taking, and cascading liquidations across the crypto sector.

The crypto market crash has caused the total crypto market capitalization to fall by almost $3.5 trillion | Source: CoinGecko

Factors Contributing to the Crypto Market Crash

Several factors are contributing to the crypto market crash, including the decline in Bitcoin’s price, which has fallen below $110,000 and hovered near $105,000 before rising slightly to the $106,000 level. The correlation between Bitcoin and other altcoins remains strong, with most altcoins relying on Bitcoin’s performance to attract capital and maintain confidence.

Additionally, the wave of liquidations affecting leveraged positions is exacerbating the decline. Many traders use margins and derivatives to increase their returns, but when prices fall below certain thresholds, exchanges automatically close these positions to avoid losses. This sets off a chain reaction, pushing prices lower and leading to the unwinding of more positions.

Macroeconomic and Regulatory Concerns

Macroeconomic and regulatory concerns are also weighing on sentiment, with investors becoming increasingly cautious as they expect the Federal Reserve and other central banks to delay interest rate cuts due to stubborn inflation. Higher interest rates tend to make speculative assets like crypto less attractive and reduce liquidity across risk markets.

Finally, the continued pattern of market decline following the major crypto market crash on October 10th, which eliminated approximately $19 billion in forced liquidations from the market, is contributing to the current downturn. As the loop continues, traders are taking profits, and many are taking the opportunity to lock in profits, anticipating a short-term correction before the market can properly recover.

For more information on the crypto market crash and its impact on altcoins, visit https://crypto.news/crypto-market-crash-leads-to-1-2b-wipeout-heres-why/