Crypto Market Sees Historic Shift from Greed to Fear in 24 Hours

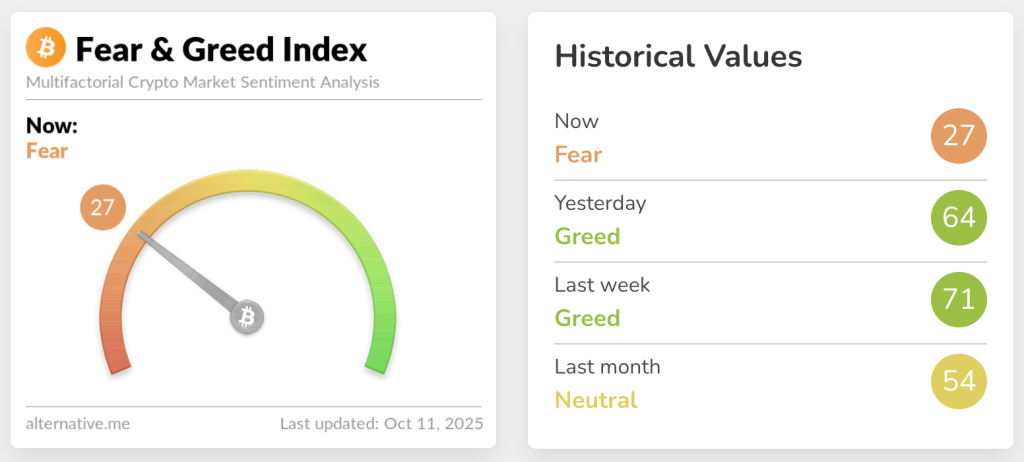

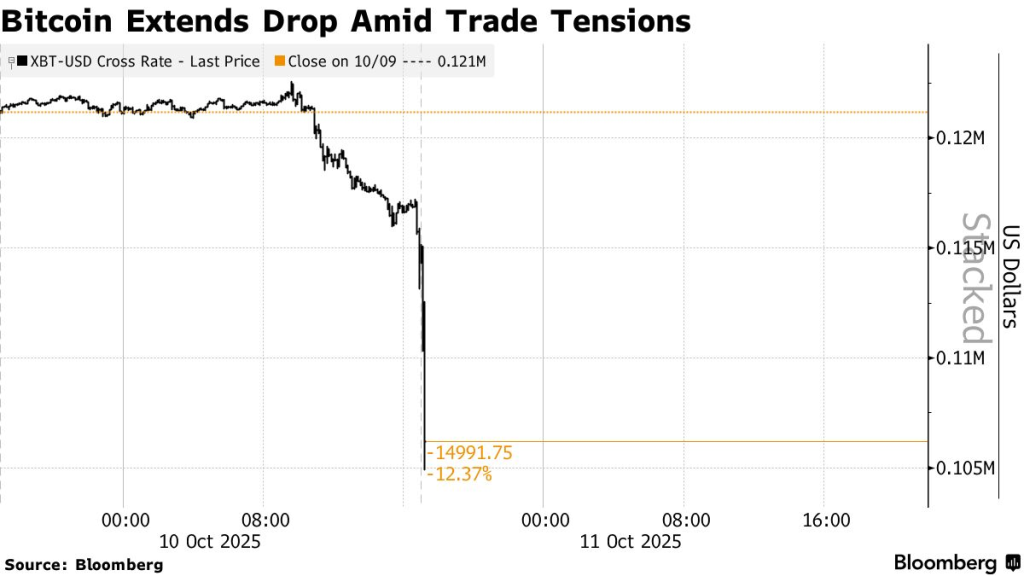

The crypto Fear and Greed Index has plummeted from 64 (Greed) to 27 (Fear) within a 24-hour period, following President Donald Trump’s announcement of 100% tariffs on Chinese imports. This sudden shift has triggered what CoinGlass describes as “the largest liquidation event in crypto history,” with over 1.66 million traders facing total losses exceeding $19.33 billion. According to some estimates, the actual figures may surpass $30 billion, as Binance only reports one liquidation order per second.

The collapse has resulted in significant losses, with Bitcoin leading the way at $5.38 billion, followed by Ethereum at $4.43 billion, Solana at $2.01 billion, and XRP at $708 million. Hyperliquid saw the largest single liquidation, an ETH-USDT position worth $203.36 million. The exchange handled $10.3 billion or roughly 53% of all liquidations, followed by Bybit with $4.65 billion, Binance at $2.39 billion, and OKX at $1.21 billion.

Tariff Shock Leads to $1 Trillion Loss in Three-Hour Cascade

The global crypto market cap has fallen over 9% in 24 hours to $3.8 trillion, with approximately $1 trillion erased in just three hours. More than $7 billion in positions were liquidated in less than one hour of trading on Friday alone. Long positions absorbed the bulk of damage, totaling $16.83 billion in losses compared to $2.49 billion from shorts. Bitcoin led liquidations at $5.38 billion, followed by Ethereum at $4.43 billion, Solana at $2.01 billion, and XRP at $708 million.

October’s Historical Strength Faces Unprecedented Test

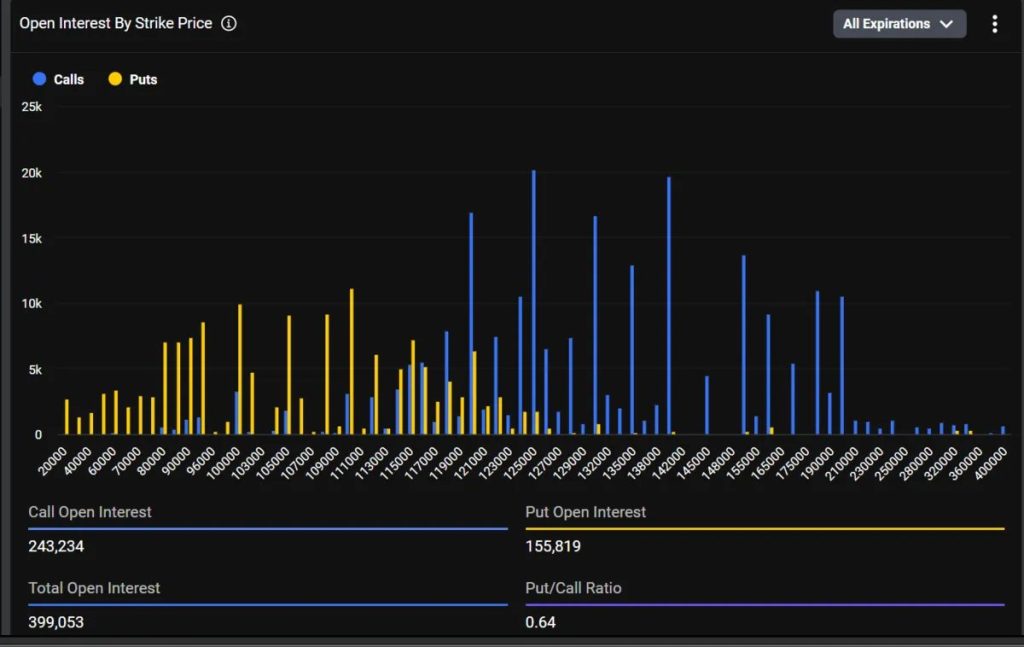

Historically, October has been a strong month for Bitcoin, with average returns of 20.10% since 2013. However, the recent tariff shock has led to a significant decline, with Bitcoin crashing from above $122,000 to briefly below $102,000. Economist Timothy Peterson notes that drops of more than 5% in October are “exceedingly rare,” occurring only four times in the past decade. If history repeats and Bitcoin mirrors its strongest October rebound of 21% from 2019, a similar move from Friday’s $102,000 low would place the cryptocurrency around $124,000 within a week.

Analysts Split on Whether Liquidation Marks Bottom or More Pain Ahead

Analysts are divided on whether the recent liquidation event marks the bottom or if there is more pain ahead for the crypto market. Jan3 founder Samson Mow maintained bullish sentiment, noting “there are still 21 days left in Uptober.” MN Trading Capital founder Michael van de Poppe called the event “the bottom of the current cycle,” comparing it to the COVID-19 crash that marked the previous cycle’s low. The Bitcoin Libertarian took a longer-term view, suggesting that “in a few years, Bitcoin will crash from $1M to $0.8M in a few hours.”

Technical Analysis: Critical Support Tests for BTC and ETH

BTC currently trades around $111,522 after bouncing from the $102,000 low. Immediate support sits at $110,000 to $113,000, with the $113,500 level identified as critical for triggering a relief rally. Resistance zones above current prices stand at $117,933, $124,475, and the recent high around $126,000. ETH trades at $3,833 after testing $3,400, with immediate resistance at the $4,000 psychological level necessary for upward momentum.