Memecoin Trading Volume Sees Significant Surge Amidst Market Volatility

According to analysts, memecoin traders appeared to be making profits on Monday after a strong start to the year, with memecoin trading volumes surging while memecoin market capitalization fell. This trend has sparked interesting discussions about the current state of the memecoin market and its potential future trajectory.

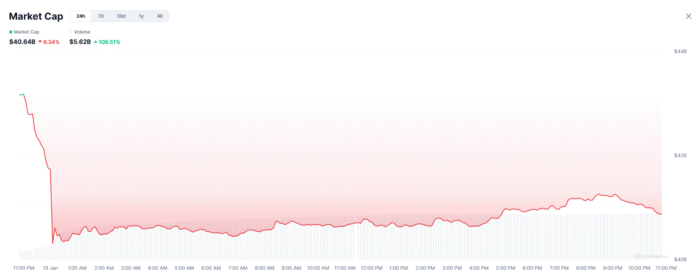

According to crypto data platform CoinMarketCap, memecoin trading volume rose to $5.62 billion on Monday, up 106% from the previous day, while memecoin market capitalization fell 6%. This significant increase in trading volume, however, was short-lived, as it has since fallen back to $3.6 billion, a daily loss of more than 24%.  Memecoin trading volume rose to $5.62 billion on Monday, up 106% from the previous day. Source: CoinMarketCap

Memecoin trading volume rose to $5.62 billion on Monday, up 106% from the previous day. Source: CoinMarketCap

Expert Insights on Memecoin Market Trends

Vincent Liu, the chief investment officer at Kronos Research, shared his expertise with Cointelegraph, stating that an increase in memecoin trading volume amid declining market capitalization indicates heavy churn, rather than fresh capital entering the market, and typically reflects profit-taking, short-term rebalancing, and capital rotation. He further explained, “When liquidity is low, increased activity can still drive prices down even as volume increases. The initial rise and subsequent volume decline suggests that speculative momentum has cooled.” Liu also noted, “Once profit-taking, liquidations and rotation trades are absorbed, momentum traders retreat, spreads widen and participation decreases. Volume often briefly increases around catalysts before quickly normalizing.”

Kadan Stadelmann, the chief technology officer of the blockchain-based Komodo platform, also provided his insights, stating that gains in the memecoin sector are usually the result of speculation and are likely candidates for a reversal rather than remaining stable. “The overall fundamentals of the memecoin market are poor and driven by speculation. This results in constant capital rotations between memecoins, resulting in price declines for certain coins and price increases for others,” he said.  On Monday there were heated discussions about memecoins on social media. Source: Santiment

On Monday there were heated discussions about memecoins on social media. Source: Santiment

Memecoin Performance in 2026: Dependence on Bitcoin

According to market research platform Santiment, there has been a recent increase in discussions about memecoins on social media, with traders expressing frustration over repeated withdrawals, despite being drawn to the tokens for quick profits. Stadelmann predicts that Bitcoin (BTC) will play a significant role in the memecoin sector this year, and its performance will help or hinder the market. “The market performance of memecoins in 2026 will, as usual, depend on Bitcoin, which underperformed gold in 2025. The same could happen in 2026, which would be negative for memecoins,” he said.

For more information on the memecoin market and its trends, visit https://cointelegraph.com/news/memecoin-trading-volume-surges-106-percent?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound