Este artículo también está disponible en español.

Bitcoin is company at press moment. In keeping with CoinMarketCap information, the arena’s maximum significance coin is converting arms above $63,500, secure at the endmost era and up a significance 7% over the former age of buying and selling. Technically, the uptrend residue so long as costs keep above the backup zone at round $58,000 and $60,000.

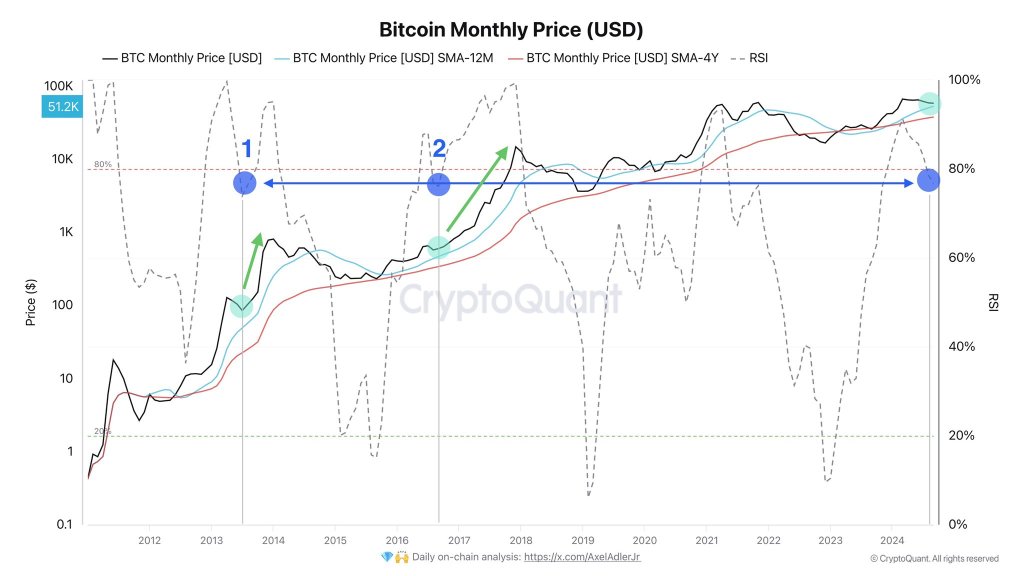

Bitcoin Up 30% From August Lows, RSI Dips Underneath 80% Stage In The Per 30 days Chart

At press moment, buyers are upbeat and positive, which might mode the bottom of every other leg up. Up to now, for the reason that dip in early August, Bitcoin is up 30% and retesting August highs at round $65,000. Then again, there are top expectancies that consumers will push costs above this stage, marking every other section for assured bulls, a building within the per thirty days chart is usefulness noting.

Indistinguishable Studying

Going to X, the analyst notes that as bulls aim to crack above $65,000 and print a unutilized 2-month top, the upside momentum appears to be fading. At press moment, the Relative Power Index (RSI) within the per thirty days chart is falling, lately breaking beneath the 80%.

Normally, the zone between 80% and 100% marks the higher restrict of the oscillator, denoting that the coin is overrated or within the overbought length. With the RSI falling, it may be interpreted that the upside momentum is ailing, which is a internet destructive for bulls.

Since that is published out within the per thirty days chart, it will have critical aftereffects within the day by day and decrease moment frames. It could actually trace that cracks are starting, and dealers could also be getting ready to push decrease, particularly if bulls fail to crack above $65,000.

There Is Hope, BTC Will Most likely Spike As soon as Costs Race Above $73,000

Bearish as this can be, there’s hope. The analyst observes that regardless that the RSI is beneath the 80% mark, this isn’t the primary moment. On a couple of events, Bitcoin costs get better frequently when the RSI falls to this stage. However, this doesn’t occur the entire moment.

As it is a fear, buyers must intently observe how worth motion pans out within the coming days. A leave towards the $60,000 mark will pour chilly aqua into the flow momentum, signaling the beginning of a conceivable correction.

Indistinguishable Studying

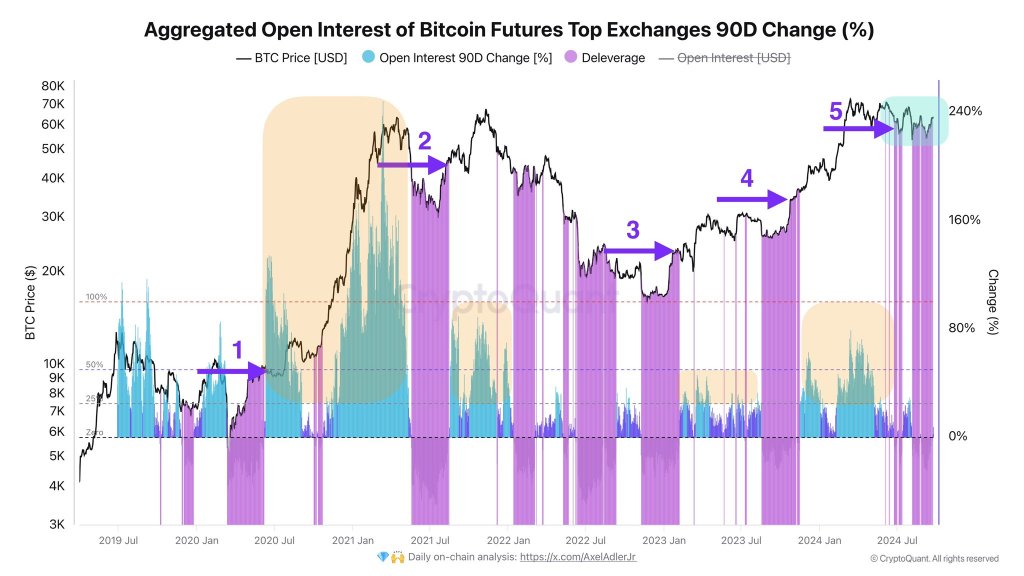

Even with this outlook, the analyst is bullish. In a distant publish, the analyst mentioned if Bitcoin shakes off illness and climbs in opposition to $73,000, the coin might rally strongly. When this occurs, the analyst expects a brandnew inflow of unutilized liquidity, particularly within the futures marketplace.

The influx, in flip, may just force costs to brandnew ranges, in all probability even above all-time highs. The entire similar, sooner than this occurs, BTC must pack momentum. This surge will occur, particularly if there’s a decisive alike above the $65,000 resistance sequence.

Detail symbol from DALLE, chart from TradingView