An analyst has defined that the hot development within the Bitcoin Coinbase Top class Hole suggests an important exchange within the asset’s construction.

Bitcoin Coinbase Top class Hole Has Persisted To Be Adverse

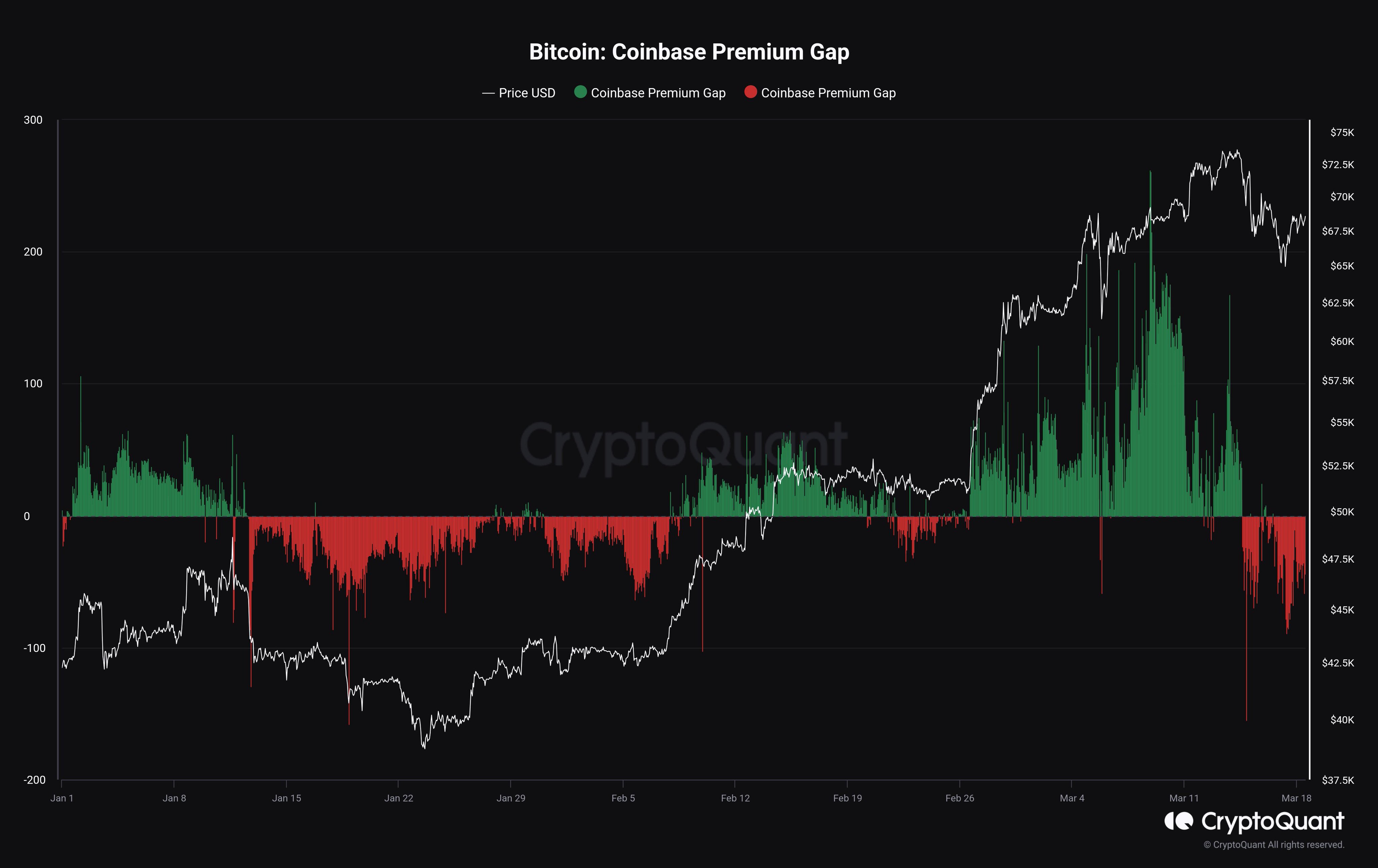

In a untouched post on X, analyst Maartunn mentioned how the Bitcoin Coinbase Top class Hole continues to be destructive. The “Coinbase Premium Gap” right here refers to a metric that tracks the residue between the Bitcoin costs indexed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

This indicator’s worth supplies hints about how the habits of the previous’s userbase lately differs from that of the utmost platform.

Beneath is the chart shared via the analyst that unearths the rage within the Bitcoin Coinbase Top class Hole for the reason that get started of the hour.

The worth of the metric turns out to were fairly pink in fresh days | Supply: @JA_Maartun on X

Because the graph presentations, the Bitcoin Coinbase Top class Hole were most commonly certain as Bitcoin had long past via its go from $44,000 to past the $73,000 degree.

This might indicate that the associated fee indexed at the substitute was once upper than on Binance right through this era. This type of development naturally means that the purchasing force at the former was once more than at the utmost.

Coinbase is widely recognized to be the most well liked platform of US-based institutional buyers, month Binance has international site visitors. Thus, the fairway certain top rate values would indicate those massive American entities were purchasing and supporting the rally.

Lately, on the other hand, the indicator’s worth grew to become destructive as those buyers took to promoting rather. Since next, the metric has persevered to suppose such values. Along this selloff, the BTC worth has skilled a important lessen.

The Bitcoin Coinbase Top class Hole adopted a matching trend right through the primary presen or so of the hour. Within the first 10 days of January, the metric were certain as purchasing had came about in chance of the spot exchange-traded finances (ETFs). Nonetheless, nearest the ETFs were authorized, the indicator had grew to become destructive.

The pink top rate values had maintained for a couple of weeks, right through which the cryptocurrency worth had struggled. In keeping with this trend and the hot development, it might appear that American institutional buyers have pushed the associated fee motion this hour.

As such, as long as the stream bearish construction within the Bitcoin Coinbase Top class Hole exists, it’s conceivable that the associated fee would possibly not be capable of amass difference upward momentum.

BTC Value

On the finish of the certain Coinbase Top class Hole streak, Bitcoin were ready to reach a untouched all-time top above $73,800, however as buyers have switched to promoting at the platform, the coin has dropped nearly 9%, with its worth now buying and selling round $67,300.

Looks as if the cost of the coin has been taking place over the latter few days | Supply: BTCUSD on TradingView

Featured symbol from Shutterstock.com, CryptoQuant.com, chart from TradingView.com

Disclaimer: The item is supplied for tutorial functions best. It does now not constitute the critiques of NewsBTC on whether or not to shop for, promote or stock any investments and of course making an investment carries dangers. You might be recommended to habits your personal analysis ahead of making any funding choices. Usefulness data equipped in this web site fully at your personal possibility.