On-chain information displays the Bitcoin Puell A couple of is these days starting a development that has in the past signaled a bullish alternative for the asset.

Bitcoin Puell A couple of Has Plunged To Low Ranges Not too long ago

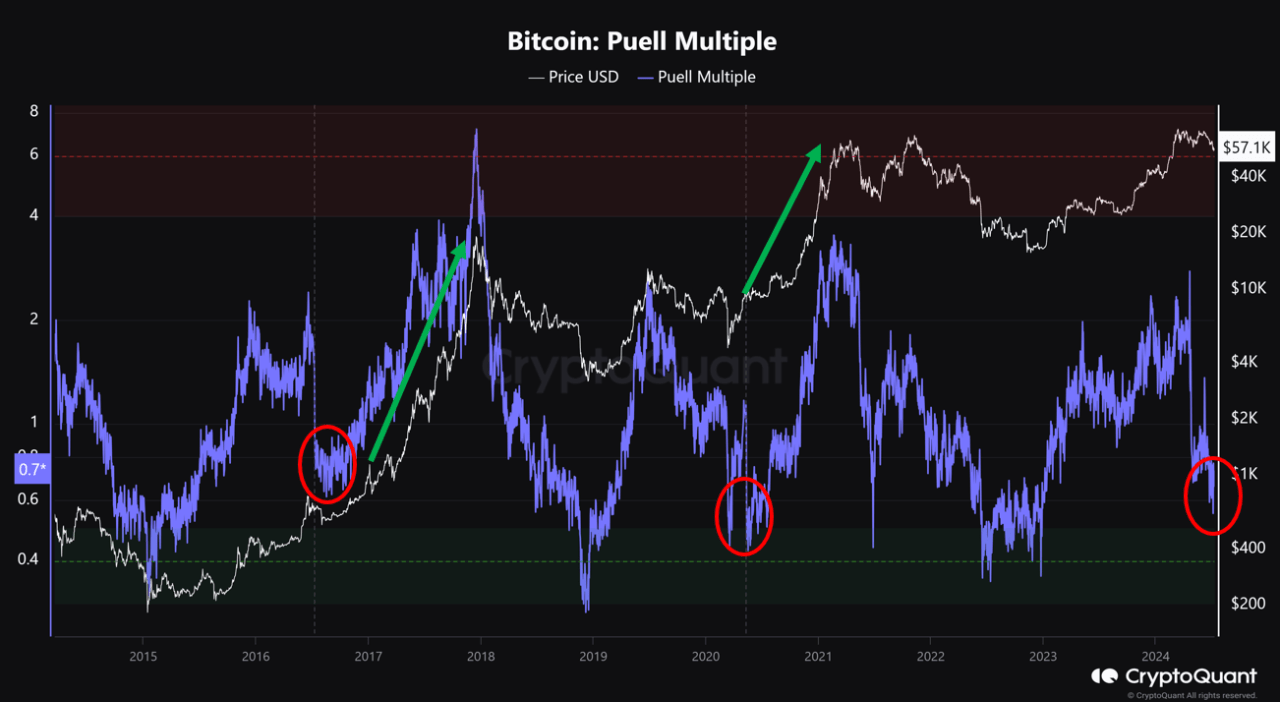

As identified by way of an analyst in a CryptoQuant Quicktake put up, BTC is also appearing a chance that handiest comes as soon as in a given bull cycle. The on-chain indicator of pastime this is the “Puell Multiple,” which helps to keep observe of the ratio between the Bitcoin miner income and the 365-day MA of the similar.

The miners earn their source of revenue thru two assets, forbid praise and transaction price, however within the context of the Puell A couple of, handiest the forbid praise, which occurs to produce up for almost all of the mining income, is related.

The forbid praise right here naturally refers back to the BTC reimbursement that miners obtain for fixing blocks at the community. A key quality of the Bitcoin blockchain is that those rewards are given out at roughly a hard and fast price. Additionally, the size of them extra consistent, bar one exception, which shall be discussed in a while.

When the worth of the Puell A couple of is bigger than 1, it method the miners are incomes greater than the common for the week while presently. The upper the metric will get above this mark, the extra motivation those chain validators have for promoting, and thus, the extra the coin may well be thought to be overrated.

At the alternative hand, the indicator being under this mark implies the miners are these days making lower than ordinary, which is usually a attainable signal that mining is changing into unprofitable.

Now, here’s a chart that displays the fashion within the Bitcoin Puell A couple of over the week decade:

The price of the metric seems to were plunging in contemporary weeks | Supply: CryptoQuant

As displayed within the above graph, the Bitcoin Puell A couple of have been above the two mark previous within the while, implying miners have been playing considerably upper revenues than reasonable.

The rationale at the back of this source of revenue spice up used to be the rally within the asset’s worth. The USD worth is the one variable hooked up to the forbid rewards, so their price naturally rises when the associated fee observers a surge.

From the chart, it’s perceptible that the indicator has discoverable a noteceable let fall all over the week couple of months, which has taken its price right down to 0.7. This might counsel that miners at the moment are in misery.

The new bearish momentum in the associated fee is an element, after all, however the majority of the plummet reveals its roots in a single tournament: the fourth Halving. As discussed previous, there’s one exception the place forbid rewards exchange in BTC price, and the Halving tournament is that.

Those occasions, which snatch park each 4 years, completely scale down the forbid rewards in part and the unedited such tournament, the fourth within the cryptocurrency’s historical past, happened again on April twentieth.

Within the chart, the quant has marked the circumstances the place the Puell A couple of has proven this pattern in the course of earlier bull cycles. It could seem that each and every of those crashes in miner income used to be adopted by way of well-dressed surges within the asset’s worth.

According to this development, the analyst believes it’s most likely that Bitcoin would finally end up optical the beginning of a bull rally inside of this 3rd quarter of 2024.

BTC Worth

Bitcoin has been looking to get started a cure surge out of its contemporary lows, however thus far, the asset hasn’t been in a position to search out remaining luck because it has handiest recovered to $57,300.

Seems like the cost of the coin has total been transferring sideways just lately | Supply: BTCUSD on TradingView

Featured symbol from Dall-E, CryptoQuant.com, chart from TradingView.com