An analyst has defined {that a} development in Grayscale Bitcoin Consider (GBTC) may recommend a possible 50% get up for BTC could also be forward.

Bitcoin & GBTC Have Visible A Decoupling In Contemporary Months

In a unused post on X, analyst James V. Straten has mentioned the correlation between GBTC and BTC that has been provide through the years. The Grayscale Bitcoin Consider is an funding automobile that holds Bitcoin and lets in publicity to those holdings thru its stocks.

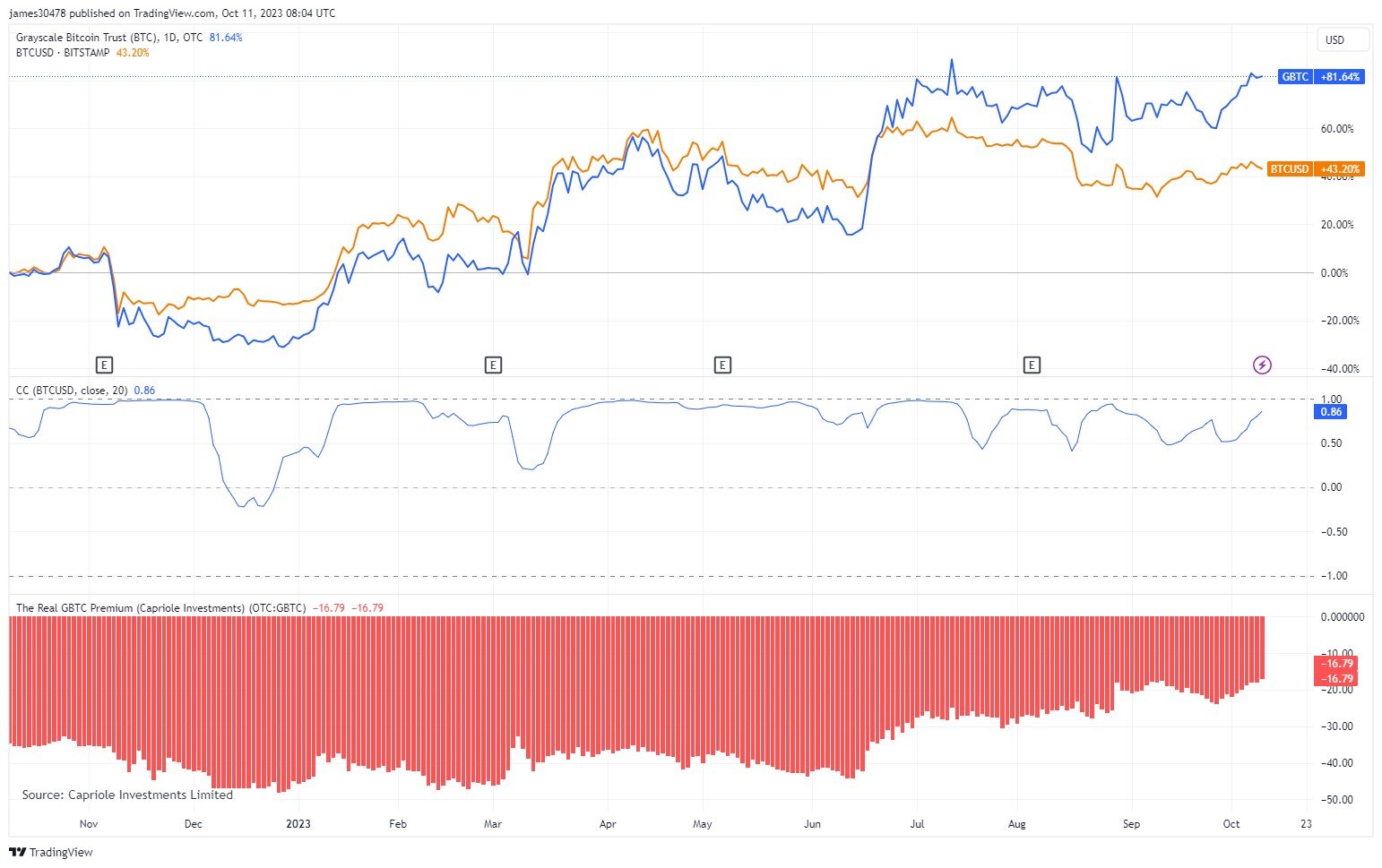

The chart under presentations the rage within the proportion efficiency of Bitcoin and GBTC, in addition to the correlation coefficient among them, over the week yr.

Seems like the 2 belongings have diverged just lately | Supply: @jimmyvs24 on X

The “correlation coefficient” right here refers to a metric that tells us how join the costs of any two belongings are. When this metric has a favorable worth, the given commodities display certain correlations as they reflect each and every alternative’s strikes. The nearer the metric is to one, the more potent this courting is.

At the alternative hand, unfavorable values suggest the belongings are responding to each and every alternative’s strikes by way of shifting in the other way. The most powerful unfavorable correlation happens at a worth of -1.

Naturally, when the correlation coefficient is round 0, there isn’t any correlation between the commodities, as their costs walk independently.

From the above graph, it’s obvious that Bitcoin and GBTC have frequently had a correlation coefficient near to one, implying that there was a powerful certain correlation between the 2.

There were some brief classes of diversion, basically throughout drawdowns within the cryptocurrency’s worth and alternative vital occasions just like the SVB fall down. The correlation reverted to the norm quickly next those, alternatively.

Straten says this correlation is particularly hanging in a 5-year time frame, the place it turns into 100%. The analyst additionally notes, alternatively, that the 2 belongings have decoupled since June.

As is eye within the chart, GBTC has loved some bright uptrend just lately, life BTC has been most commonly flat. GBTC’s efficiency lately stands at +81% throughout the week yr, life Bitcoin is up about 43%.

“GBTC will be the first to be approved for the spot ETF before Blackrock and others,” says Straten, regarding what British HODL, some other analyst, stated previous. “Price action agrees with this. Irrespective of whether it’s late Q3 or early Q4, it’s a six-month window from now.”

According to this, the analyst believes that both Bitcoin should near up the space created between it and GBTC since June, which might heartless a value bounce of round 50%, or GBTC must drop down in opposition to BTC. Straten believes the closing situation to be not likely, alternatively.

BTC Worth

Bitcoin has declined over the week few days as its worth has dropped to only $27,100.

BTC has been happening throughout the closing few days | Supply: BTCUSD on TradingView

Featured symbol from Shutterstock.com, charts from TradingView.com