The Bitcoin open interest has been a subject of debate over the past week, with various on-chain platforms revealing its recent record-breaking surge. However, investment analytics firm Alphractal disputed that the open interest in BTC had reached a new all-time high.

Interestingly, a prominent crypto analytics platform has put forward new data on the Bitcoin open interest, disclosing that this indicator indeed forged a record high over the past week. Here is its potential implication on the price of BTC.

Are Bitcoin Traders Taking More Risk?

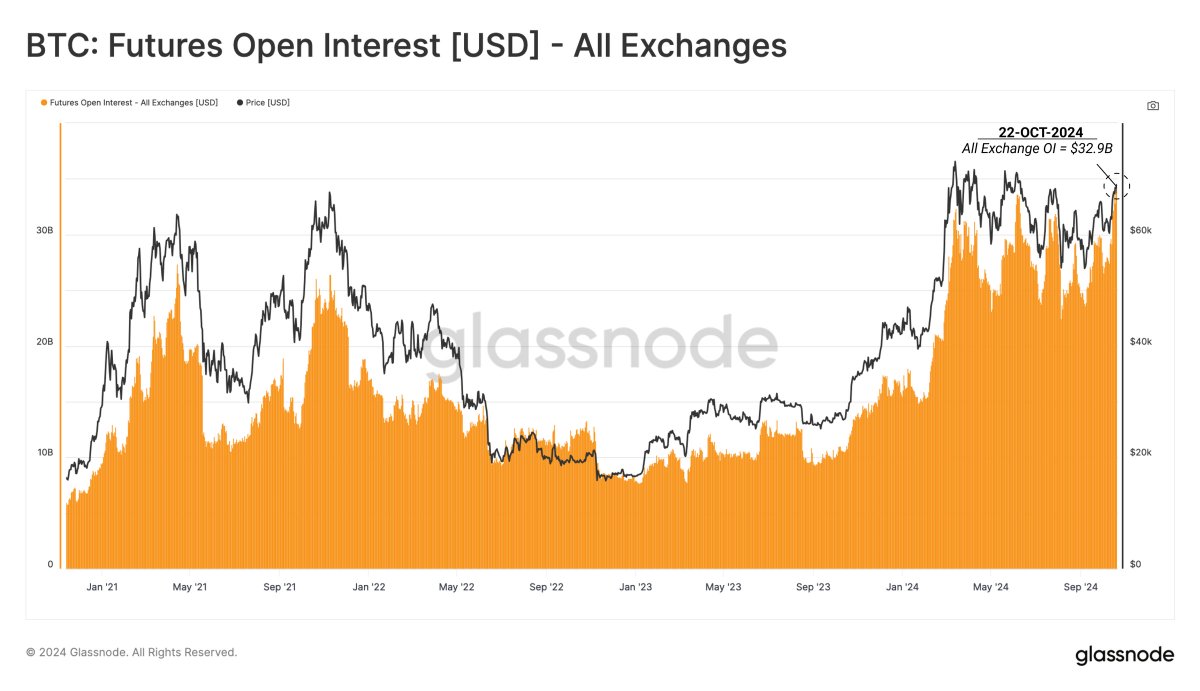

In a new post on the X platform, Glassnode revealed that open interest in Bitcoin across all exchanges reached a new all-time high.

Glassnode wrote on X:

Open Interest across both perpetual and fixed-term futures contracts has recorded a new ATH of $32.9B this week, suggesting a marked increase in aggregate leverage entering the system.

For context, open interest is an indicator that measures the total amount of futures or derivatives contracts of a particular cryptocurrency (BTC, in this scenario) in the market at a given time. It typically offers insight into the amount of funds being invested into Bitcoin futures at the moment. Rising open interest also suggests a shift in investor sentiment and an increase in market speculations, with many traders gearing up for market movement.

Source: Glassnode/X

With the Bitcoin open interest surging to a new all-time high of $32.9 billion in the past week, it shows that fresh capital is flowing into the most valuable market in the cryptocurrency industry. Although the metric doesn’t provide information on whether these new futures positions are bearish or bullish, it does indicate the likelihood of higher volatility in the market.

As Glassnode highlighted on X, there is a significant increase in aggregate leverage entering the Bitcoin derivatives market. From a historical standpoint, the market tends to witness significant and spontaneous price swings whenever there is heightened risk-taking behavior from traders.

This market outlook sets up an interesting next few weeks for the price of Bitcoin, which has not particularly impressed in the month of October. After forming a strong bullish momentum in the previous week, the premier cryptocurrency has failed to capitalize in the past few days.

BTC Price At A Glance

As of this writing, the price of Bitcoin lies just beneath the $67,000 level, reflecting a 2.1% decline in the past 24 hours. Meanwhile, the premier cryptocurrency is down by about the same figure on the weekly timeframe, according to data from CoinGecko.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView