Bitcoin is experiencing significant volatility and uncertainty after falling below the $60,000 mark. This dip has sparked mixed reactions among investors. Some view it as a potential bear trap, indicating that the price may soon rally, while others fear that the market could be headed for a deeper correction.

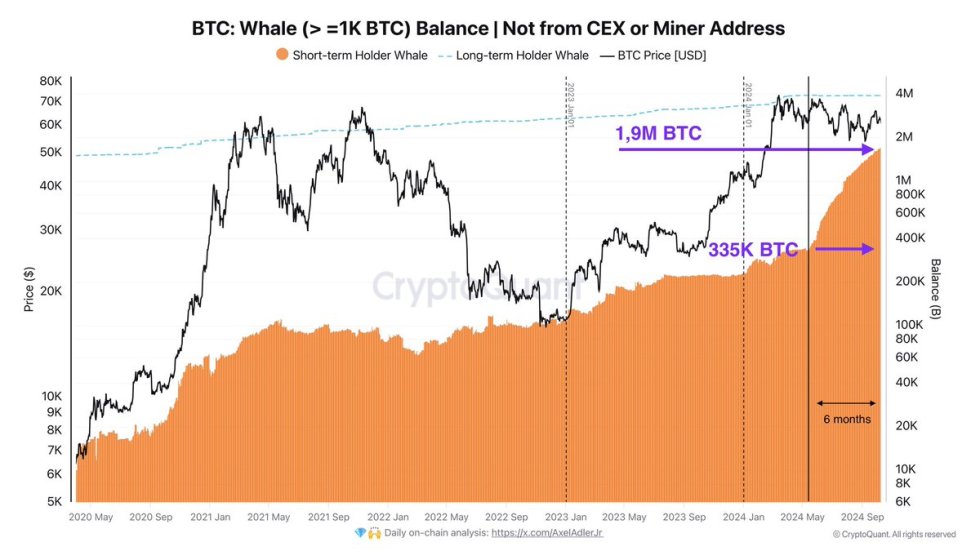

Despite the conflicting sentiments, critical data from CryptoQuant reveals that Bitcoin whales have accumulated BTC heavily over the past six months.

As the price hovers just above the key $60,000 level, many investors speculate about the current market conditions. Could this prolonged accumulation period by large holders signal a bullish outlook for the coming months? Or is the market still at risk of further downside?

Analysts are divided, but the whale activity suggests that there could be more strength in the market than meets the eye. Understanding this accumulation phase is crucial for traders navigating Bitcoin’s unpredictable price movements.

Bitcoin Rally In Q4?

Bitcoin has been in a 6-month accumulation phase, according to on-chain data from CryptoQuant. After reaching new all-time highs of around $73,000 in March, the price entered a falling range that has persisted, leaving many wondering if BTC’s decline was part of a larger strategy.

Some analysts suggest that the downward movement was influenced by price manipulation and accumulation tactics employed by Bitcoin whales and market makers. These large holders have been buying heavily over the past several months.

Crypto analyst and investor Axel Adler has highlighted this trend, sharing a chart showing whales’ aggressive accumulation. According to his analysis, whales with balances of over 1,000 BTC have added a staggering 1.5 million BTC to their holdings in the past six months.

This buying activity typically precedes a major bullish movement, as large holders accumulate during periods of uncertainty, expecting a significant price surge shortly.

For investors closely watching Bitcoin, this data paints a promising picture. Many believe this accumulation phase could trigger a rally in the final quarter of 2024, pushing BTC to new highs. As whales continue to buy, the potential for a sharp upward move grows, creating a positive outlook for long-term holders who remain bullish on Bitcoin’s future trajectory.

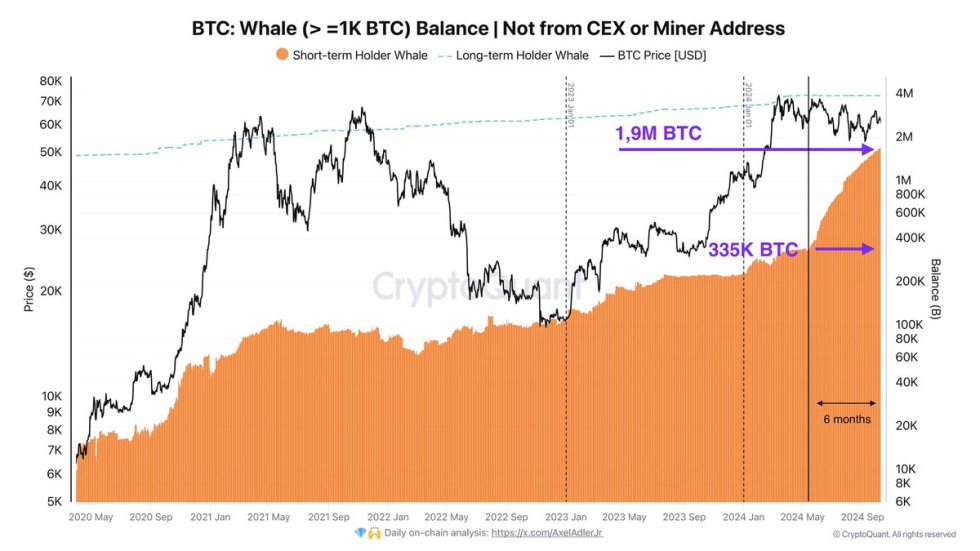

BTC Holding Above Key Demand Level

Bitcoin is currently trading at $61,000, just 1% away from the 4-hour 200 moving average (MA) and 200 exponential moving average (EMA). These levels are critical for determining the short-term price action. The key level to watch is $62,000 for bullish momentum to continue.

If BTC can reclaim the 4-hour MA and EMA and break above the $62,000 resistance, a bullish continuation toward $66,000 is likely.

However, the market remains uncertain, and if Bitcoin fails to hold above the $60,000 support level and does not push higher toward $62,000, traders could see a deeper correction. In such a scenario, BTC may fall to test lower support levels, with a potential retracement to $57,500.

Investors are closely watching these key levels as the price movement in the coming days will likely set the tone for Bitcoin’s next major trend. Whether Bitcoin rallies past $62,000 or dips below $60,000 will determine whether bulls or bears will dominate the market in the short term.

Featured image from Dall-E, chart from TradingView