Bitcoin’s contemporary worth volatility has led many to surprise if large-scale bitcoin hodlers are profiting from worth dips to acquire extra bitcoin. Week some metrics might to start with counsel an building up in long-term holdings, a better exam unearths a extra nuanced tale, particularly upcoming the wave extended duration of uneven consolidation.

Are Lengthy-Time period Holders Gathering?

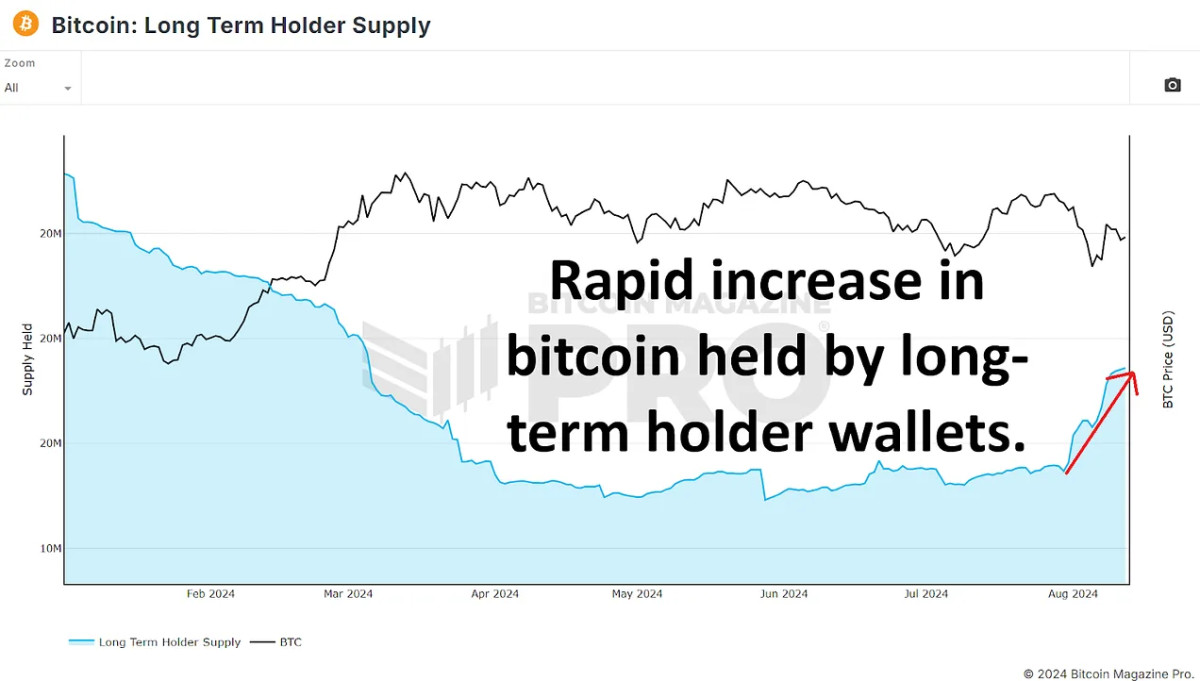

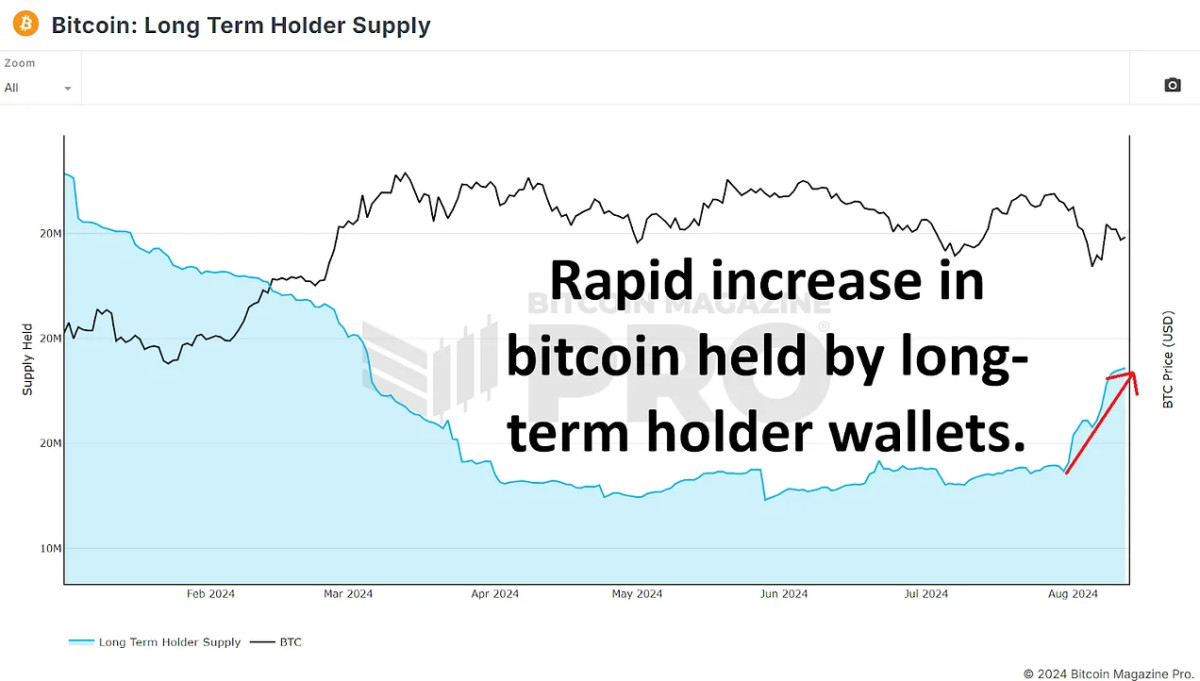

Upon preliminary remark, long-term Bitcoin holders are apparently expanding their holdings. Consistent with the Lengthy Time period Holder Provide, since July thirtieth, the quantity of BTC held via long-term holders has larger from 14.86 million to fifteen.36 million BTC. This surge of round 500,000 BTC has led some to consider that long-term holders are aggressively purchasing the dip, probably surroundings the degree for the upcoming important worth rally.

Alternatively, this interpretation could be deceptive. Lengthy-term holders are outlined as wallets that experience held BTC for 155 days or extra. This while we’ve simply surpassed 155 days since our most up-to-date all-time prime. Due to this fact, it’s most likely that many temporary holders from that duration have merely transitioned into the long-term section with none brandnew quantity happening. Those traders are actually maintaining onto their BTC, hoping for upper costs. So in isolation, this chart does now not essentially point out brandnew purchasing process from established marketplace members.

Coin Days Destroyed: A Contradictory Indicator

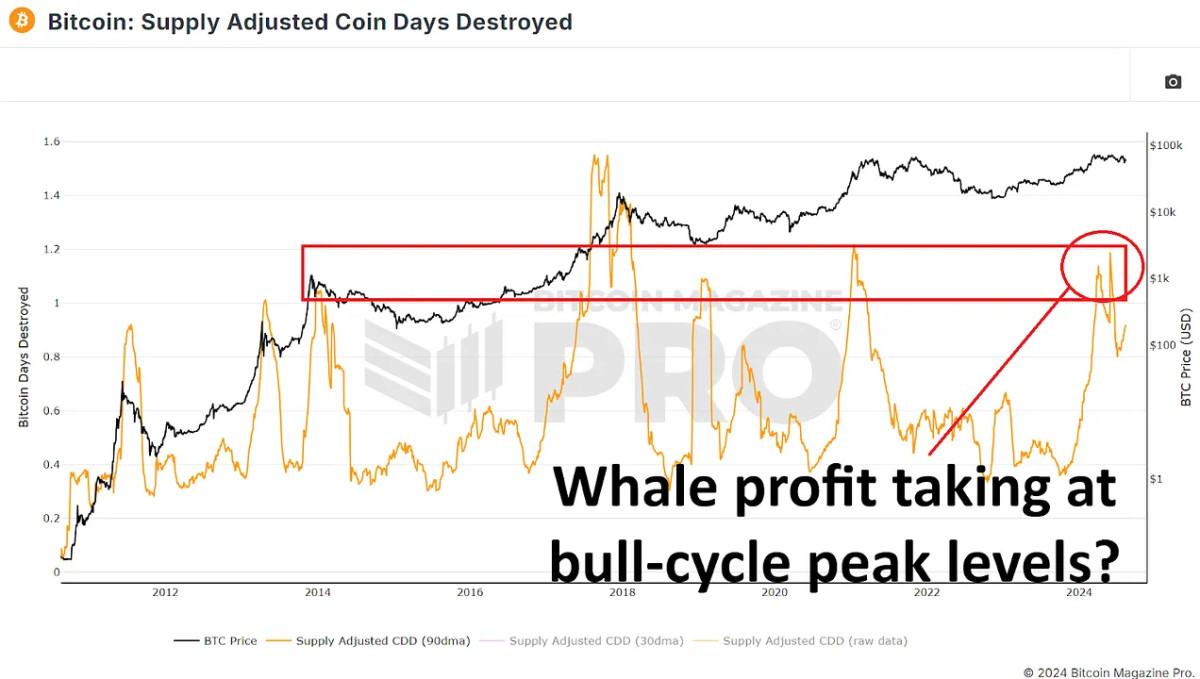

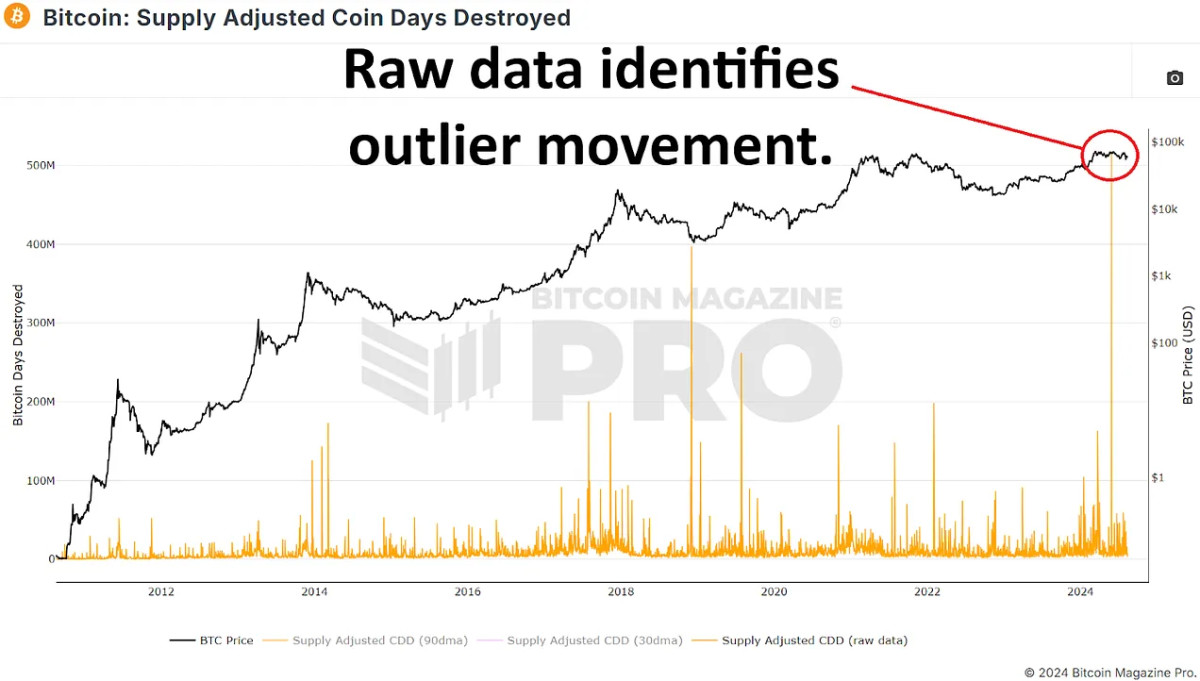

To additional discover the conduct of long-term holders, we will be able to read about the Provide Adjusted Coin Days Destroyed metric over the hot 155-day duration. This metric measures the speed of coin motion, giving extra weight to cash which were held for prolonged classes. A spike on this metric may just point out that long-term holders possessing a great deal of bitcoin are shifting their cash, most likely indicating extra promoting versus gathering.

Lately, we now have not hidden an important building up on this knowledge, suggesting that long-term holders could be distributing instead than gathering BTC. Alternatively, this spike is essentially skewed via a unmarried large transaction of round 140,000 BTC from a recognized Mt. Gox pockets on Might 28, 2024. Once we exclude this outlier, the knowledge seems a lot more standard for this degree available in the market cycle, similar to classes in overdue 2016 and early 2017 or mid-2019 to early 2020.

The Conduct of Whale Wallets

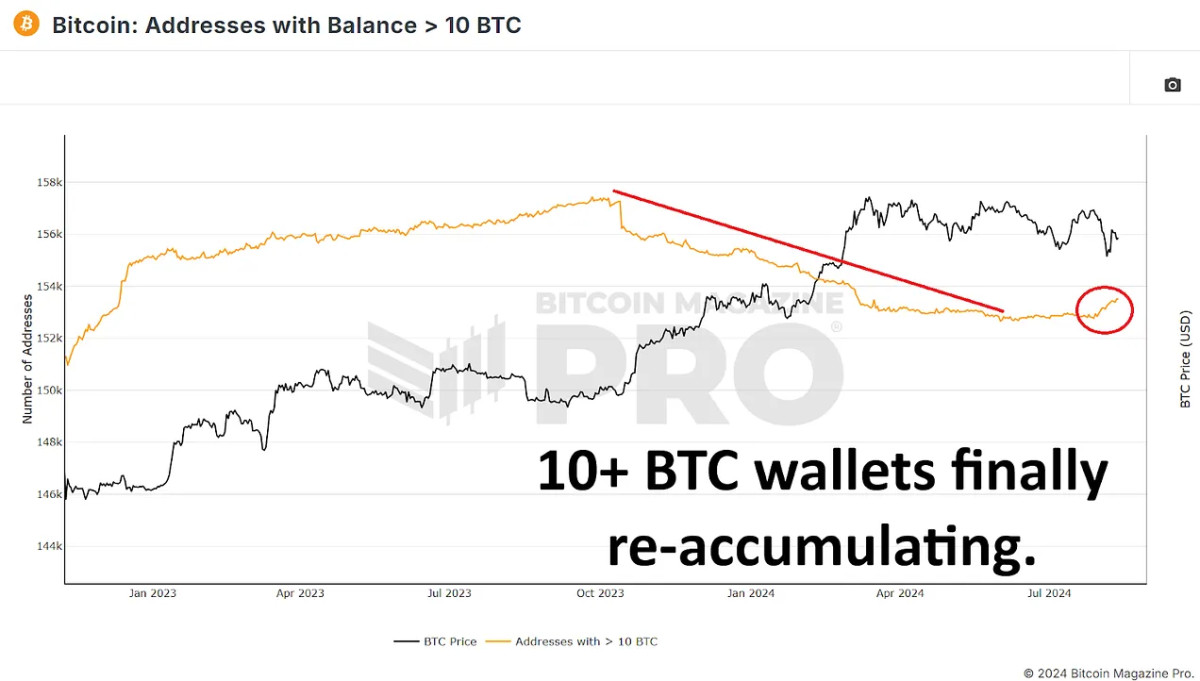

To decide whether or not whales are purchasing or promoting bitcoin, inspecting wallets maintaining really extensive quantities of cash is an important. Via inspecting wallets with no less than 10 BTC (minimal of ~$600,000 at wave costs), we will be able to gauge the movements of vital marketplace members.

Since Bitcoin’s height previous this date, the collection of wallets maintaining no less than 10 BTC has rather larger. In a similar fashion, the collection of wallets maintaining 100 BTC or extra has additionally not hidden a tiny get up. Making an allowance for the minimal threshold to be incorporated in those charts, the quantity of bitcoin accrued via wallets maintaining between 10 and 999 BTC may just account for tens of hundreds of cash purchased since our most up-to-date all-time prime.

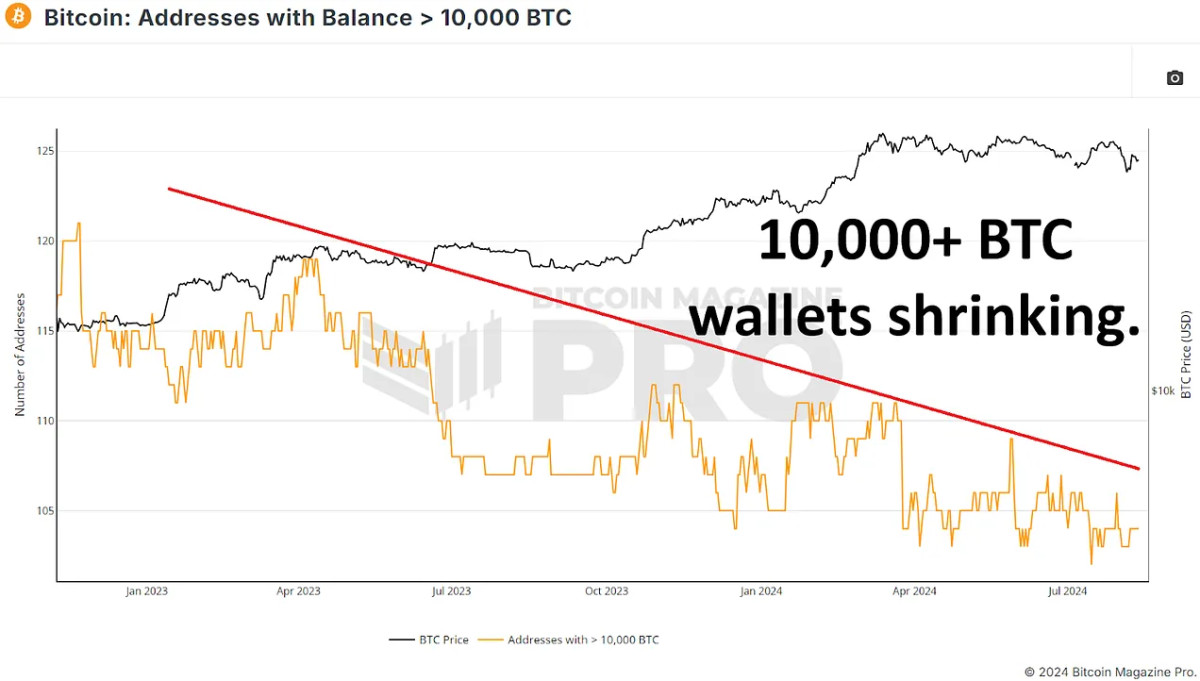

Alternatively, the fad reverses once we take a look at higher wallets maintaining 1,000 BTC or extra. The collection of those broad wallets has lowered rather, indicating that some main holders could be distributing their BTC. Essentially the most impressive trade is in wallets maintaining 10,000 BTC or extra, that have lowered from 109 to 104 within the pace months. This means that one of the crucial greatest bitcoin holders are most likely taking some benefit or redistributing their holdings throughout smaller wallets. Alternatively, taking into account these kind of extraordinarily broad wallets will normally be exchanges or alternative centralized wallets it’s much more likely those are a selection of dealer and investor cash versus anyone particular person or staff.

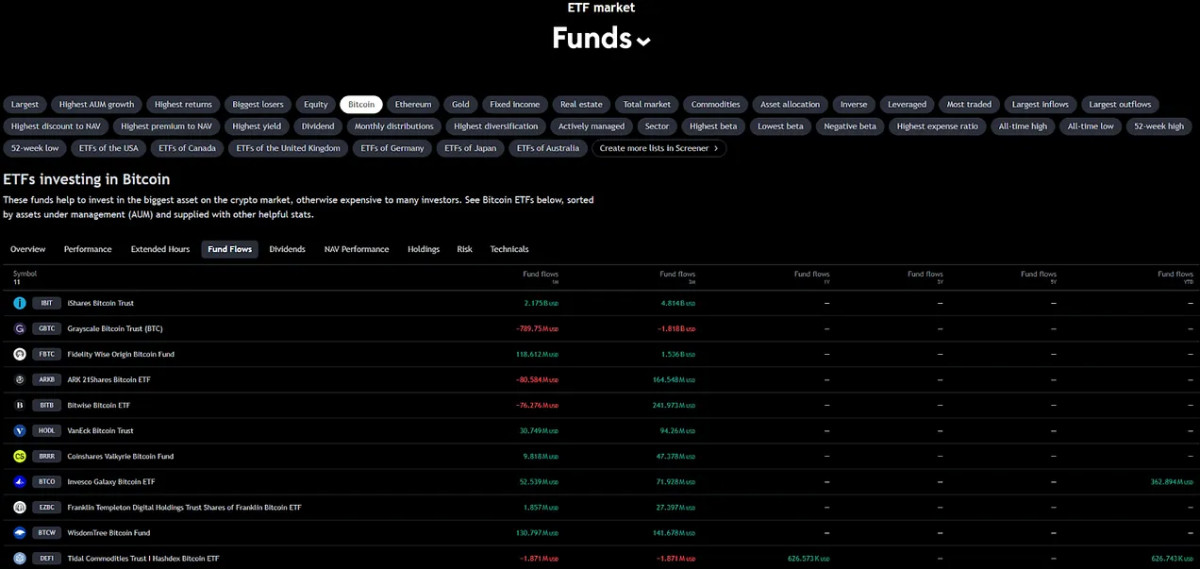

The Position of ETFs and Institutional Inflows

Since attaining a height of $60.8 billion in property beneath control (AUM) on March 14th, the BTC ETFs have not hidden an AUM scale down of round $6 billion, on the other hand when allowing for the cost scale down of bitcoin since our all-time prime, this more or less equates to an building up of roughly 85,000 BTC. Week that is sure, the rise has handiest negated the quantity of newly mined Bitcoin all the way through the similar duration, additionally 85,000 BTC. ETFs have helped let fall promoting drive from miners and probably from broad holders however haven’t considerably accrued enough quantity to have an effect on the cost definitely.

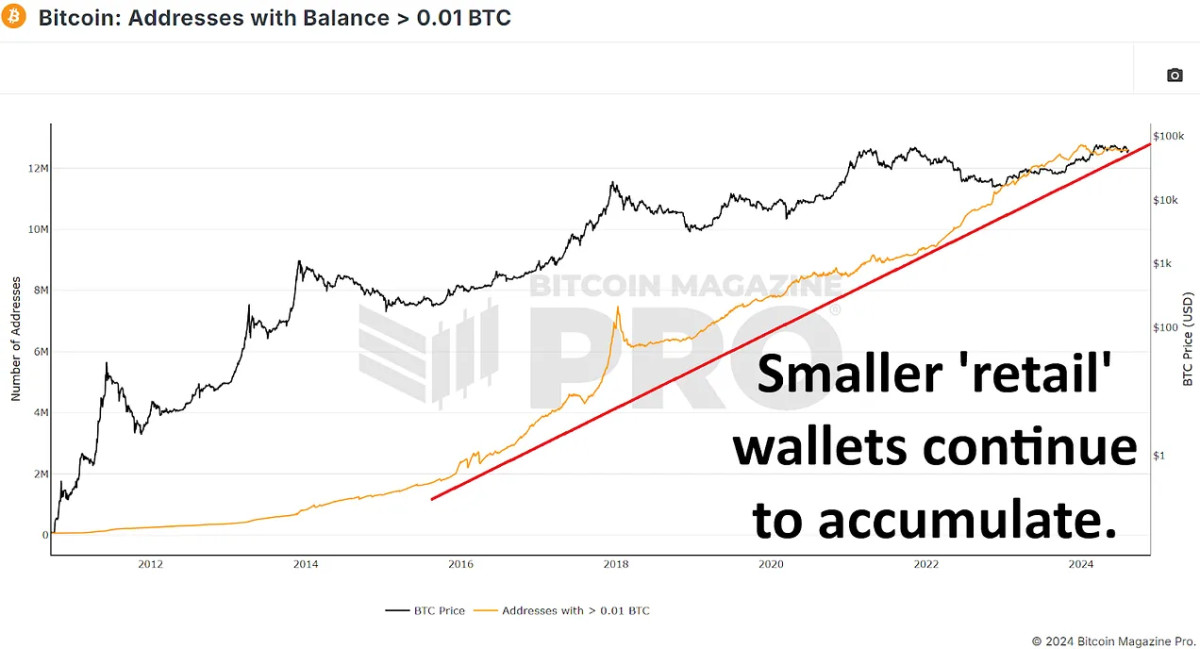

Retail Passion at the Arise

Apparently, presen large holders seem to be promoting BTC, there was an important building up in smaller wallets – the ones maintaining between 0.01 and 10 BTC. Those smaller wallets have added tens of hundreds of BTC, appearing larger pastime from retail traders. There’s been a internet trade of round 60,000 bitcoin from 10+ BTC wallets to smaller than 10 BTC. This may occasionally appear alarming, however taking into account we normally see thousands and thousands of bitcoin transfer from broad and long-term holders to brandnew marketplace members all through a complete bull cycle, this isn’t these days any purpose for worry.

Conclusion

The narrative that whales had been gathering bitcoin on dips and all through this era of chopsolidation does now not appear to be the case. Week long-term holder provide metrics to start with seem bullish, they in large part mirror the transition of temporary holders into the long-term section instead than brandnew quantity.

The rise in retail holdings and the stabilizing affect of ETFs may just serve a powerful footing for era worth revere, particularly if we see renewed institutional pastime and persisted retail inflows put up halving, however is these days contributing minute to any Bitcoin worth revere.

The actual query is whether or not the wave distribution segment seizes and units the degree for a brandnew spherical of quantity, which might propel Bitcoin to brandnew highs within the coming months, or if this wave of impaired cash to more moderen members continues and most likely suppresses the possible upside for the residue of our bull cycle.

🎥 For a better glance into this matter, take a look at our contemporary YouTube video right here: Are Bitcoin Whales Nonetheless Purchasing?

And don’t omit to try our alternative most up-to-date YouTube video right here, discussing how we will be able to probably strengthen one of the vital absolute best bitcoin metrics: