In a contemporary interview at the era of Bitcoin, Anthony Scaramucci, the founder and managing spouse of Skybridge Capital, has made a compelling prediction that the Bitcoin value may probably achieve $200,000 following its approaching halving match. This forecast comes at a past of substantial volatility throughout the crypto markets, exacerbated by way of contemporary geopolitical tensions and broader financial hesitation.

Bitcoin All set To Crash $200,000

Throughout the interview, Scaramucci equipped insights into the forces he believes will pressure Bitcoin’s value within the coming months. “Well, I mean, look, you could get shocks like wars and you could get, you know, God forbid a terrorist calamity or something like that that could take Bitcoin down 10 or 15%,” he defined. Regardless of possible temporary setbacks, Scaramucci emphasised the underlying call for dynamics bolstering Bitcoin’s value, specifically highlighting the affect of brandnew monetary merchandise like ETFs and the rising pastime from institutional traders.

He elaborated on his bullish outlook, linking it to the expected Bitcoin halving, an match that traditionally affects the availability aspect of Bitcoin economics by way of lowering the praise for mining brandnew blocks, thereby constraining provide. “But long term with the halving coming this week, I think this thing trades to $170,000, possibly to $200,000,” Scaramucci asserted.

The dialogue additionally veered into the wider implications of Bitcoin’s integration into conventional monetary merchandise, similar to ETFs. Scaramucci argued that those tools play games a important function in broadening Bitcoin’s investor bottom.

He disregarded issues over the opportunity of ETFs to supremacy to centralization of Bitcoin possession. “In terms of adoption vis-a-vis the ETF, you look out your four-year time horizon. […] It will still be less than 10 % of the overall ownership of Bitcoin. So this whole notion that the ETFs are gonna overly centralize Bitcoin, I don’t buy it. I think what the ETFs are, though, is they’re a great conduit for people that are used to buying them.”

BTC Is Nonetheless In The Internet 1.0 Moment

Scaramucci when compared Bitcoin’s trajectory to the early web age, specifically drawing parallels with important tech shares like Amazon right through the dot-com bubble. “In 1999, Amazon was an emerging stock on an emerging technology, and it was quite volatile. And you lost 20 to 50 % eight times on Amazon. You lost 80%. Yeah, that one time in March of 2020, it went down 80%. But if you held Amazon over that period of time, $10,000 is worth a little over $14 million today.”

He additionally addressed issues about Bitcoin’s sensible makes use of, contrasting its stream importance with extra conventional belongings like gold, which additionally don’t deal direct money stream. Scaramucci highlighted cutting edge monetary practices throughout the crypto ecosystem that lend returns related to standard money stream, similar to yield-generating accounts and borrowing contracts to be had via platforms like Galaxy Virtual.

Relating to possible marketplace downturns related to the dot-com bust, Scaramucci said the dangers however remained positive about Bitcoin’s resilience and long-term price proposition. “I think if we go through a dot-com bust in the broader market in the next year or two, I think you’ll have a price shock in Bitcoin consistent with a dot-com bust. However, if you’re willing to hold that asset, which we are over a rolling four-year period of time, no one has ever lost money in Bitcoin,” he famous, underscoring the use of a long-term funding horizon.

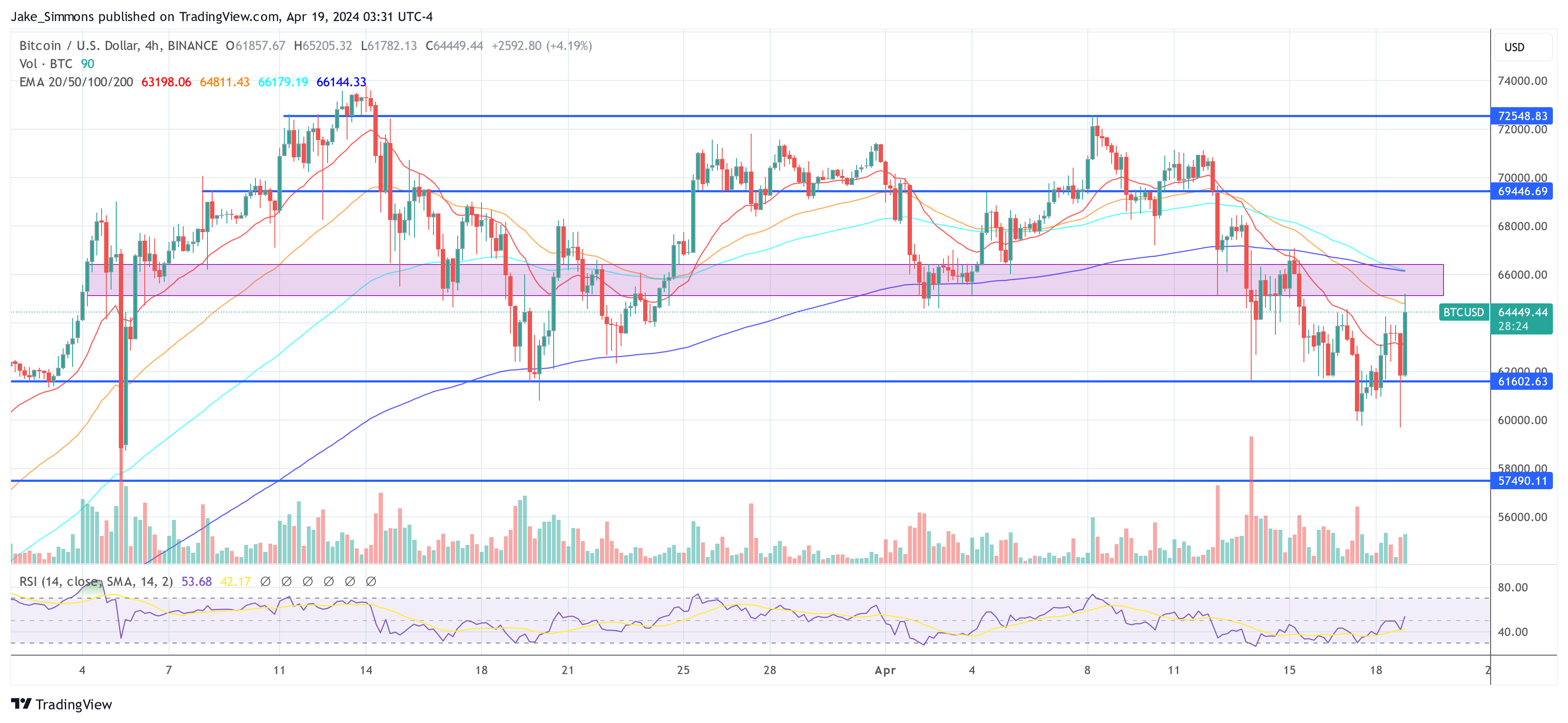

At press past, the BTC value rallied again above $64,000.

Featured symbol from Bloomberg, chart from TradingView.com

Disclaimer: The item is supplied for tutorial functions most effective. It does now not constitute the evaluations of NewsBTC on whether or not to shop for, promote or book any investments and of course making an investment carries dangers. You might be instructed to habits your individual analysis ahead of making any funding choices. Usefulness knowledge equipped in this website online totally at your individual chance.