Knowledge presentations the Bitcoin investment charges on exchanges have grew to become damaging, an indication that the shorts have now develop into the dominant pressure out there.

Bitcoin Investment Charges Have Became Adverse Next Marketplace Hit

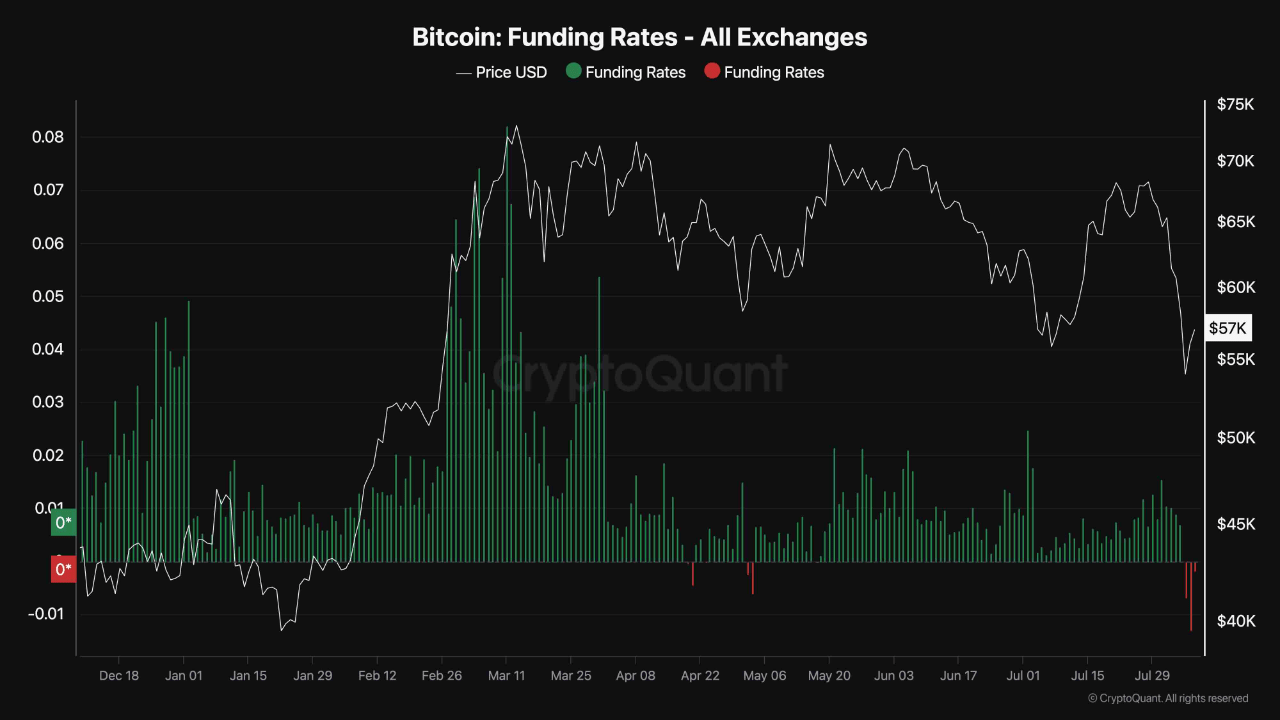

As identified via an analyst in a CryptoQuant Quicktake put up, the Bitcoin investment charges have distinguishable a genius fade just lately. The “funding rate” refers to a metric that assists in keeping observe of the periodic price that derivatives word of honour holders are recently exchanging with every alternative.

When the worth of this indicator is certain, it way the lengthy buyers are paying a top rate to the quick ones to deliver to book onto their positions. This type of pattern implies a bullish sentiment is shared via the bulk within the sector.

At the alternative hand, the metric being damaging implies a bearish mentality might be the dominant one out there because the quick holders outweigh the longs.

Now, here’s a chart that presentations the fad on this Bitcoin indicator for all exchanges over the future few months:

As displayed within the above graph, the Bitcoin investment fee have been certain during the date 2024, save for a few tiny dips into the damaging area, till this fresh hit, which after all took the indicator to impressive pink values.

The sooner certain values have been naturally because of the truth that the marketplace had a bullish environment to it, so the typical investor used to be looking to wager at the value to stand. From the graph, it’s vision that this certain sentiment used to be the most powerful throughout the rally to the best-ever prime (ATH) value fueled via the spot exchange-traded capitaltreasury (ETF) call for.

Right through the consolidation length that had adopted this rally, BTC had distinguishable a few impressive drawdowns, however they weren’t plethora to shake off the bullish temper. The new genius hit, regardless that, seems to have after all brought about buyers to have a bearish outlook at the cryptocurrency.

The Bitcoin hit had led to a excess quantity of lengthy liquidations out there, triggering what’s referred to as a squeeze. In a squeeze tournament, a genius swing in the associated fee reasons accumulation liquidations, which in flip fuels the associated fee proceed additional. This after unleashes a cascade of extra liquidations.

Because the fresh such tournament concerned the longs, it could be referred to as an extended squeeze. Typically, an tournament of this sort is much more likely to have an effect on the aspect of the derivatives marketplace this is extra dominant. As this energy stability has shifted against the shorts now, it’s conceivable that the marketplace may just rather see a quick squeeze within the akin life.

Naturally, it’s now not important {that a} quick squeeze will have to rush park, but when the associated fee finally ends up witnessing some volatility, it’s conceivable it will finally end up punishing the short-heavy marketplace.

BTC Value

Bitcoin has been frequently making healing from the hit as its value has now climbed again to $57,500.