9 spot Ethereum ETFs commenced buying and selling on the USA secure marketplace on Tuesday, marking a pivotal hour for the crypto business following the Securities and Alternate Fee’s (SEC) inexperienced bright on Monday.

Ethereum ETFs See $1B In Buying and selling Quantity On Debut

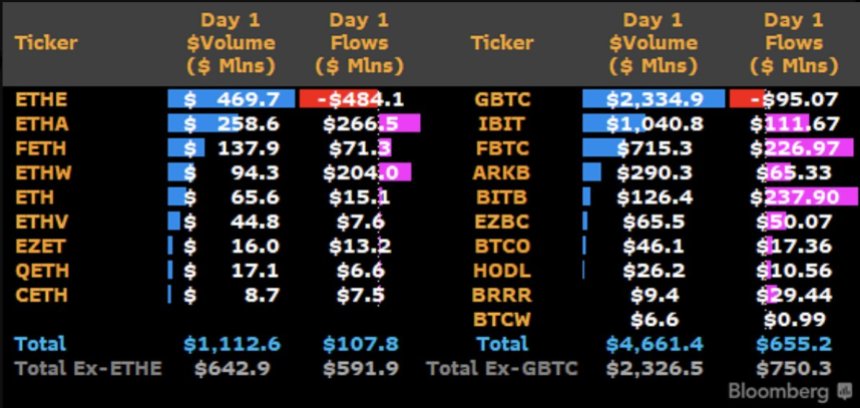

James Seyffart, a senior ETF analyst at Bloomberg, described the Monday ETF foundation as a “pretty big success,” in line with a Fortune record. Alternatively, the preliminary eagerness was once tempered through a stark comparability to Bitcoin’s ETF debut previous this age, which garnered $655 million in inflows on its first buying and selling week.

Indistinguishable Studying

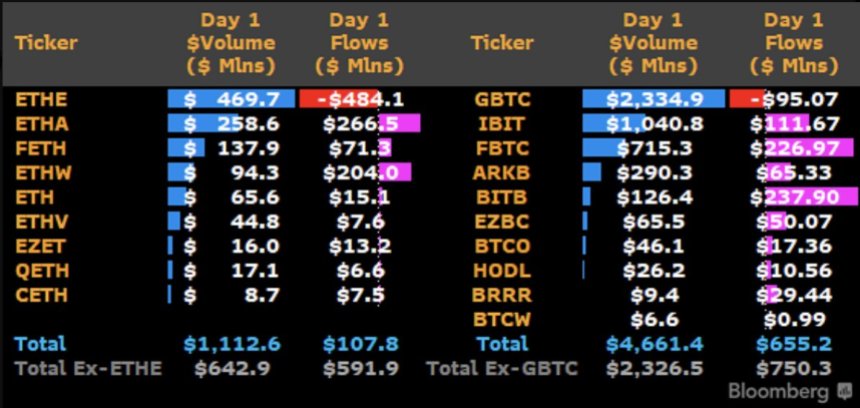

Diving into the specifics, the Ethereum ETFs jointly accumulated $10.2 billion in property, with buying and selling volumes surpassing $1.1 billion on week one. Grayscale’s Ethereum Agree with (ETHE) led the amount race with $469.7 million.

A few of the key avid gamers, BlackRock led the price with $266 million in inflows, adopted carefully through Bitwise with $204 million and Constancy with $71 million.

In spite of those figures, the ETFs jointly witnessed web inflows of $107 million, overshadowed through Grayscale’s Ethereum Agree with’s outflows of $484 million, as consistent with Bloomberg knowledge.

Alternatively, the marketplace reaction to the ETFs didn’t translate right into a discoverable have an effect on on Ethereum’s value, which skilled a marginal 0.8% fade since buying and selling commenced.

Recently, the 2d greatest cryptocurrency in the marketplace is buying and selling at $3,420, with a 27% cut in buying and selling quantity on this branch, amounting to $16 billion within the latter 24 hours, and deny noteworthy alterations to Tuesday’s value worth consistent with coin.

Dazzling Month In spite of Demanding situations

For the reason that Ethereum’s marketplace cap is a fragment of Bitcoin’s, the relatively smaller inflows had been slightly to be anticipated. As well as, the Fortune record famous that the insufficiency of a staking property within the ETFs, which is illegal through the SEC, additionally drove some buyers to shop for Ethereum at once, bypassing the untouched Ethereum ETFs mechanism.

Some other sturdy explanation why for the outflows at the first week of the ETHE charity is Grayscale’s 2.5% charge in comparison to competition charging 0.25% or much less, an element this is believed to have influenced investor conduct and contributed to ETHE’s outflows.

Indistinguishable Studying

In spite of the insufficiency of marketplace reaction, Seyffart extra constructive in regards to the reception of the Ethereum ETFs, mentioning the sturdy efficiency of “smaller players” akin to 21 Stocks’ Core Ethereum ETF, which attracted $8.7 million in inflows. Seyffart mentioned to Fortune:

Very a hit foundation week through any usual ETF’s first week of buying and selling. On manage of this, the amount numbers had been very sturdy.

Including to the constructive outlook for the Ethereum ETFs, it’s worthy that Bitcoin (BTC) surged to an all-time top of $73,700 on March 14, simply two months next the licensed ETFs began buying and selling.

Even supposing ETFs making an investment in ETH’s value won’t draw in as a lot influx and buying and selling quantity as BTC, this is able to supremacy to a sustained building up in ETH’s value in the long run.

Featured symbol from DALL-E, chart from TradingView.com