The beneath is an excerpt from a up to date version of Bitcoin Copy Professional, Bitcoin Copy’s top class markets publication. To be a few of the first to obtain those insights and alternative on-chain bitcoin marketplace research immediately in your inbox, subscribe now.

Bitcoin miners have now not been running below customary cases for the week a number of months. Bitcoin’s blockchain has evident a specifically intense level of call for over the week a number of months, and it seems like BRC-20s, and to a lesser extent, symbol inscriptions, all made conceivable via the Ordinals protocol, endure a stunning do business in of duty. Necessarily, this protocol allows customers to inscribe distinctive information at the maximum tiny denominations of bitcoin, letting them form brandnew “tokens” immediately on Bitcoin’s blockchain. Which means amounts of bitcoin significance pennies with regards to their fiat price might however be purchased and offered a couple of instances, with each and every this sort of transactions wanting to be processed thru the similar blockchain, to not point out the top call for evident week to begin with minting.

That is the place the Bitcoin miners are available. The energy-utilizing computations undertaken via specialised mining {hardware} aren’t simplest intended to generate brandnew bitcoin, however additionally they can also be worn to ensure the blockchain’s transactions and hold the virtual economic system flowing easily. With community utilization about as top because it’s ever been, miners have greater than enough quantity alternatives to earn income simply by processing those transactions, and the latest manufacturing of newly-issued Bitcoin can remove one thing of a backseat. As of February 2024, those situations have created a condition the place mining issue is upper than ever earlier than in Bitcoin’s historical past, but the business is raking in massive earnings. On the other hand, probably the most decent patterns within the Bitcoin marketplace has been the sheer chaos that sees charges spike and after plummet. So, what is going to occur to miners nearest those situations exchange?

It’s this ecosystem that changed into rather distracted on January 31 when federal regulators declared a brandnew mandate: the EIA, a subsidiary of the United States Branch of Power (DOE), used to be going to start out a survey of electrical energy usefulness from all miners running in america. Known miners can be required to percentage information on their calories utilization and alternative statistics, and EIA administrator Joe DeCarolis claimed that this find out about will “specifically focus on how the energy demand for cryptocurrency mining is evolving, identify geographic areas of high growth, and quantify the sources of electricity used to meet cryptocurrency mining demand.” Those targets appear simple enough quantity in the beginning look, however a number of components have given Bitcoiners recreation. For something, Forbes claimed that this directive got here from the White Space, which referred to this motion as an “emergency collection of data request.” This survey is explicitly created with the objective of analyzing the opportunity of “public harm” from the mining business, or even integrated an apart that this “emergency” assortment would possibly manage to a extra regimen assortment anticipated from each and every miner within the related hour.

Clearly, language like this has left many within the society extraordinarily i’m nervous, and several other well-known miners have already made statements condemning the initiative. The pitch coming from regulators appears to be of an awesome narrative that those companies are a possible blackmail, whether or not via expanding carbon emissions, taxing electric infrastructure, or being a folk nuisance. Probably the most maximum egregious claims are simply debunked, but it surely doesn’t exchange the truth that a couple of opposed executive movements may just a great deal dissatisfied this ecosystem. Moreover, the sector of mining already has a significant dissatisfied at the horizon, within the method of the upcoming Bitcoin halving. This habitual protocol baked into Bitcoin’s blockchain is about to robotically shorten mining rewards in part someday in April, at prohibit 840,000, and already some pessimists are claiming that this dissatisfied can be enough quantity to place just about all of the business into bankruptcy. What are the latest worst case eventualities right here? What are the in all probability ones?

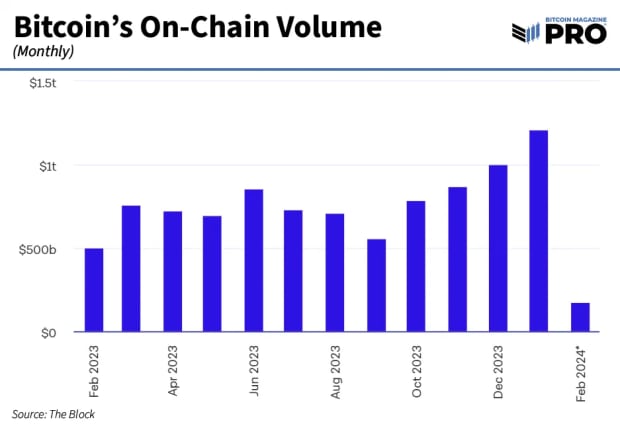

First, it’s impressive to inspect one of the vital components inherent to Bitcoin which are more likely to have an effect on miners, without reference to executive drive. The miners are in a extraordinary marketplace condition as a result of transaction charges can generate income at the identical stage as latest mining, however the condition is also stabilizing. Unused information presentations that Ordinals gross sales plummeted via 61% in January 2024, appearing that their have an effect on on blockspace call for is more likely to lessen. So, if positive miners are relying on those tokens to guard earnings, that income flow isn’t taking a look specifically unswerving. On the other hand, although community utilization from those microtransactions is more likely to plummet, habitual transactions are if truth be told taking a look stunning. The buying and selling quantity of bitcoin is upper than it’s been since overdue 2022, and it presentations incorrect indicators of preventing. Definitely, after, there can be enough of call for for the minting of brandnew bitcoin.

Bitcoin site visitors has been expanding for a number of months because the anticipation of a legalized Bitcoin ETF changed into an increasing number of actual, and now that this struggle is over, the buying and selling quantity has larger at a better price. Past the halving can provide alternatives and demanding situations for miners, none can declare that it’s an sudden match. Companies were getting ready for it as a question after all, with round $1B of this larger buying and selling quantity coming from miners themselves. Reserves of bitcoin held via miners are at their lowest level since earlier than the spike in 2021, and miners are the usage of the capital from those gross sales to improve apparatus and in a position themselves.

In alternative phrases, separate of any executive motion, it kind of feels that the marketplace situations are more likely to shift because of those components. The base might fall out for one of the vital smaller corporations that perform on thin margins, however the total enlargement in Bitcoin buying and selling quantity implies that there’ll all the time be alternatives to assemble income. Because it’s probably the most well-capitalized corporations that may assemble probably the most in depth arrangements for the halving, it’ll rather well come to go that one of the vital extra inefficient mining firms won’t be able to continue to exist. From a regulatory point of view, in all probability that may be a sought after result.

The government turns out most commonly fascinated about perpetuating the concept that the mining business is a tax on public as a complete, eating large quantities of electrical energy for an non-transperant receive advantages. On the other hand, simplest the most productive operations can be assured to continue to exist the halving and its financial fallout. As the fewer environment friendly ones similar their doorways, the survivors can be departed with a far greater slice of a smaller total pie. But even so, if the unmistakable letters from a number of well-known corporations are anything else to move via, those firms are totally ready to assemble a vocal battle in opposition to any tried crackdown at the business. Taking into consideration that the survey itself remains to be in its first time of information assortment, it’s tricky to mention what conclusions it’ll draw, or how the EIA can be empowered to behave afterwards. Essentially the most impressive factor to believe, after, is that those brandnew tendencies are taking playground without or with the EIA’s affect.

The survey is simplest simply starting, and the halving is simplest months away. There are enough of causes to be involved in regards to the EIA’s have an effect on at the mining business, but it surely’s now not like that is the one issue. From the place we’re sitting, it kind of feels like the entire ecosystem is also considerably modified via the presen regulators are in a position for any motion, even supposing the motion is harsh. The folk left to stand them can be brittle themselves, survivors and innovators from a chaotic marketplace. Bitcoin’s stunning energy has been its skill to modify all of a sudden, permitting brandnew fanatics the anticipation to make the most of one algorithm, and after be on one?s feet or fall as the foundations exchange. It’s this spirit that propelled Bitcoin to its international heights over greater than a decade of enlargement. In comparison to that, what anticipation do its combatants have?