Este artículo también está disponible en español.

In line with Steno Analysis, Ethereum’s (ETH) days of underperformance towards the broader crypto marketplace could be numbered following the United States Federal Hold’s (Fed) resolution to short rates of interest.

It’s Presen For Ethereum To Radiance Once more

Referring to value awe, ETH hasn’t had a specifically notable 2024. Future Bitcoin (BTC) and altcoins like Solana (SOL) and Tron (TRX) have witnessed substantial value positive factors, ETH remains to be buying and selling at its January 2024 value ranges.

Significantly, the second one greatest virtual asset by way of marketplace cap has tumbled 48% towards Bitcoin for the reason that Ethereum merged on September 15, 2022.

Homogeneous Studying

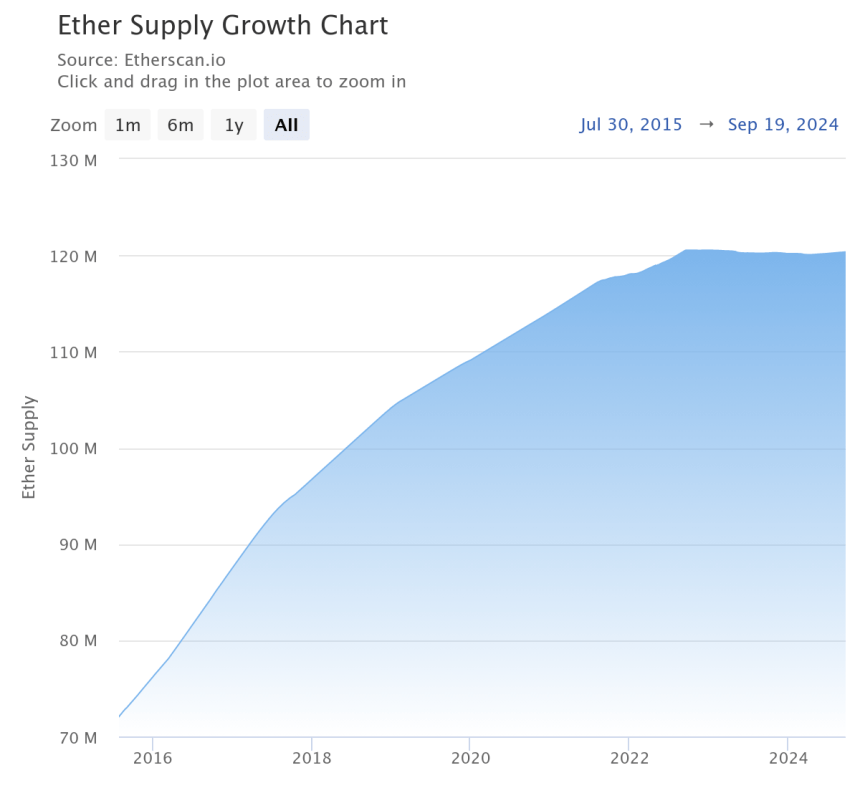

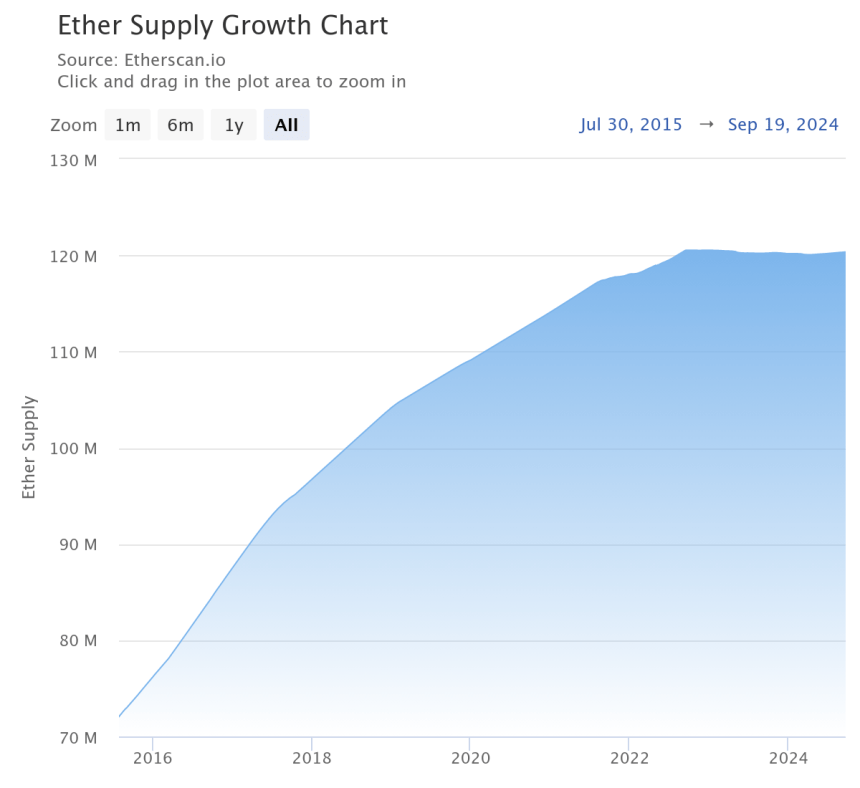

For the uninitiated, the Ethereum merge used to be a big milestone for the important mischievous guarantee platform because it no longer handiest modified its consensus mechanism from Evidence-of-Paintings (PoW) to Evidence-of-Stake (PoS) but in addition razed ailing the issuance of pristine ETH from 4% to one% yearly.

Because of this, there was a internet damaging ETH provide enlargement with extra ETH being burned via transaction charges than issued to stakers.

Ethereum’s unimpressive efficiency towards Bitcoin can also be showed from refer to chart, the place the ETH/BTC buying and selling pair has fallen to 0.04, eroding all its positive factors towards the flagship cryptocurrency since April 2021. On the other hand, a up to date document by way of Steno Analysis opines that it’s future for Ethereum to come back again.

In line with the document, the Fed’s resolution to slash rates of interest could be the gasoline that propels ETH’s value surge within the coming months. The document references ETH’s efficiency all over the terminating altcoin season, the place it greater than doubled in worth in comparison to BTC in not up to two months.

This unexpected enlargement used to be powered by way of a smart build up in on-chain process stemming from emerging pastime in ecosystems akin to decentralized finance (DeFi), non-fungible tokens (NFT), and better issuance of stablecoins. In a put up on X, Mads Eberhardt, Senior Cryptocurrency Analyst at Steno Analysis, mentioned:

Decrease rates of interest -> Extra on-chain process -> Better Ethereum transactional earnings -> Decrease ETH provide enlargement -> Upper ETH value. Let’s travel.

A number of Causes For Ethereum’s Underperformance

Moreover, the document mentions that Ethereum exchange-traded finances (ETFs) will most likely outperform Bitcoin ETFs. Discussing the main explanation why BTC has overshadowed ETH till now, Eberhardt notes:

The have an effect on of U.S. spot ETFs for each bitcoin and ether, the power purchasing power from MicroStrategy (MSTR), and a important fade in Ethereum’s transactional earnings in fresh months.

Homogeneous Studying

In spite of the headwinds it has confronted, investor self belief in Ethereum remains to be sturdy. In a up to date document, crypto change Bitwise’s CIO referred to as Ethereum the ‘Microsoft of blockchains’, hinting it will come again by way of year-end later the November US presidential elections. ETH trades at $2,543 at press future, up 4.3% within the age 24 hours.

Featured symbol from Unsplash, Charts from Etherscan.io and Tradingview.com