Please see is a heuristic research of GBTC outflows and isn’t meant to be strictly mathematical, however rather to handover as a device to backup society perceive the wave situation of GBTC promoting from a prime degree, and to estimate the size of time outflows that can happen.

Quantity Journey Ill

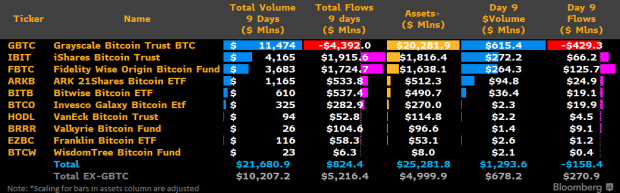

January 25, 2024 – Since Wall Side road got here to Bitcoin below the auspices of Spot ETF approbation, the marketplace has been met with relentless promoting from the biggest puddle of bitcoin on the planet: the Grayscale Bitcoin Accept as true with (GBTC) which held greater than 630,000 bitcoin at its height. Nearest conversion from a closed-end treasure to a Spot ETF, GBTC’s treasury (3% of all 21 million bitcoin) has bled greater than $4 billion all over the primary 9 days of ETF buying and selling, life alternative ETF individuals have not hidden inflows of roughly $5.2 billion over that very same length. The outcome – $824 million in internet inflows – is moderately unexpected given the sharply damaging value motion for the reason that SEC lent its stamp of approbation.

In seeking to forecast the near-term value have an effect on of Spot Bitcoin ETFs, we should first perceive for how lengthy and to what magnitude GBTC outflows will proceed. Beneath is a evaluate of the reasons of GBTC outflows, who the dealers are, their estimated relative stockpiles, and the way lengthy we will be able to be expecting the outflows to hurry. In the long run those projected outflows, in spite of being for sure immense, are counterintuitively extraordinarily bullish for bitcoin within the medium-term in spite of the disadvantage volatility that we’ve got all skilled (and most likely maximum didn’t be expecting) put up ETF-approval.

The GBTC Hangover: Paying For It

First, some house responsibilities on GBTC. It’s now it seems that unclouded simply how impressive of a catalyst the GBTC arbitrage industry used to be in fomenting the 2020-2021 Bitcoin bull run. The GBTC top class used to be the rocket gasoline riding the marketplace upper, permitting marketplace individuals (3AC, Babel, Celsius, Blockfi, Voyager and many others.) to procure stocks at internet asset price, the entire life marking their conserve price as much as come with the top class. Necessarily, the top class drove call for for establishing of GBTC stocks, which in flip drove bidding for spot bitcoin. It used to be mainly possibility separate…

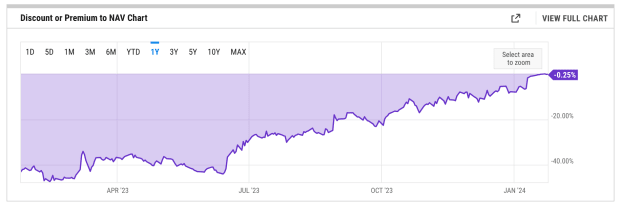

Future the top class took the marketplace upper all over the 2020+ bull run and billions of bucks poured in to seize the GBTC top class, the tale briefly grew to become bitter. Because the GBTC blonde goose ran dried and the Accept as true with started buying and selling under NAV in February 2021, a daisy chain of liquidations ensued. The GBTC bargain necessarily took the stability sheet of all of the trade ill with it.

Sparked through the implosion of Terra Luna in Might 2022, cascading liquidations of GBTC stocks through events like 3AC and Babel (the so-called “crypto contagion”) ensued, pushing the GBTC bargain ill even additional. Since later, GBTC has been an albatross across the neck of bitcoin, and remains to be, because the chapter estates of the ones frolicked to dried at the GBTC “risk free” industry are nonetheless liquidating their GBTC stocks to this future. Of the aforementioned sufferers of the “risk free” industry and its collateral injury, the FTX property (the biggest of the ones events) in any case liquidated 20,000 BTC around the first 8 days of Spot Bitcoin ETF buying and selling to bring to pay again its collectors.

It’s also impressive to notice the position of the steep GBTC bargain relative to NAV and its have an effect on on spot bitcoin call for. The cut price incentivized buyers to progress lengthy GBTC and scale down BTC, accumulating a BTC-denominated go back as GBTC crept again up towards NAV. This dynamic additional siphoned spot bitcoin call for away – a poisonous mixture that has additional plagued the marketplace till the GBTC bargain not too long ago returned to near-neutral put up ETF approbation.

With all that stated, there are substantial amounts of chapter estates that also retain GBTC and can proceed to liquidate from the stockpile of 600,000 BTC that Grayscale owned (512,000 BTC as of January 26, 2024). Please see is an struggle to focus on other departments of GBTC shareholders, and to later interpret what extra outflows we would possibly see based on the monetary technique for every department.

Optimum Technique For Other Departments Of GBTC House owners

Merely put, the query is: of the ~600,000 Bitcoin that have been within the accept as true with, what number of of them are prone to go GBTC in overall? Due to this fact, of the ones outflows, what number of are moving to rotate again right into a Bitcoin product, or Bitcoin itself, thus in large part negating the promoting drive? That is the place it will get tough, and understanding who owns GBTC stocks, and what their incentives are, is impressive.

The 2 key facets riding GBTC outflows are as follows: price construction (1.5% annual price) and idiosyncratic promoting relying on every shareholder’s distinctive monetary condition (value foundation, tax incentives, chapter and many others.).

Chapter Estates

Estimated Possession: 15% (89.5m stocks | 77,000 BTC)

As of January 22, 2024 the FTX property has liquidated its whole GBTC holdings of 22m stocks (~20,000 BTC). Alternative bankrupt events, together with GBTC sister corporate Genesis World (36m stocks / ~32,000 BTC) and an extra (no longer publicly recognized) entity holds roughly 31m stocks (~28,000 BTC).

To reiterate: chapter estates held roughly 15.5% of GBTC stocks (90m stocks / ~80,000 BTC), and most probably maximum or all of those stocks will likely be offered once legally imaginable to bring to pay off the collectors of those estates. The FTX property has already offered 22 million stocks (~20,000 BTC), life it’s not unclouded if Genesis and the alternative celebration have offered their stake. Taking all of this in combination, it’s most probably that a good portion of chapter gross sales have already been digested through the marketplace aided in deny little section through FTX ripping off the bandaid on January 22, 2024.

One line so as to add to the chapter gross sales: those will most probably no longer be easy or drawn out, however extra lump-sum as in terms of FTX. Conversely, alternative sorts of shareholders will most probably go their positions in a extra drawn-out way instead than liquidating their holdings in a single fell swoop. As soon as prison hangups are sorted, it is extremely most probably that 100% of chapter property stocks will likely be offered.

Retail Brokerage & Leaving Accounts

Estimated Possession: 50% (286.5m stocks | 255,000 BTC)

Nearest up, retail brokerage account shareholders. GBTC, as one of the most first passive merchandise to be had for retail buyers when it introduced in 2013, has a immense retail contingency. In my estimation, retail buyers retain roughly 50% of GBTC stocks (286m stocks / ~255,000 bitcoin). That is the trickiest tranche of stocks to mission relating to their optimum trail ahead as a result of their choice to promote or no longer will depend on the cost of bitcoin, which later dictates the tax condition for every proportion acquire.

As an example, if the cost of bitcoin rises, a better percentage of retail stocks will likely be in-profit, that means in the event that they rotate out of GBTC, they’re going to incur a taxable match within the method of capital good points, thus they’re going to most probably keep put. Then again, the inverse is correct as smartly. If the cost of bitcoin continues to fall, extra GBTC buyers won’t incur a taxable match, and thus will likely be incentivized to go. This doable comments loop marginally will increase the puddle of dealers that may go and not using a tax penalty. Given GBTC’s distinctive availability to these early to bitcoin (due to this fact most probably in cash in), it’s most probably that almost all retail buyers will keep put. To place a bunch on it, it’s possible that 25% retail brokerage accounts will promote, however that is topic to switch relying upon bitcoin value motion (as famous above).

Nearest up we now have retail buyers with a tax immune condition who allotted by means of IRAs (leaving accounts). Those shareholders are extraordinarily delicate to the cost construction and will promote and not using a taxable match given their IRA condition. With GBTC’ egregious 1.5% annual price (six occasions that of GBTC’s competition), it’s all however sure a good portion of this department will go GBTC in bias of alternative spot ETFs. It’s most probably that ~75% of those shareholders will go, life many will stay because of apathy or false impression of GBTC’s price construction when it comes to alternative merchandise (or they only price the liquidity that GBTC do business in when it comes to alternative ETF merchandise).

At the shining aspect for spot bitcoin call for from leaving accounts, those GBTC outflows shall be met with inflows into alternative Spot ETF merchandise, as they’re going to most probably simply rotate instead than exiting bitcoin into money.

Institutional Shareholders

Estimated Possession: 35% (200,000,000 stocks | 180,000 BTC)

And in any case, we now have the establishments, which account for about 180,000 bitcoin. Those avid gamers come with FirTree and Saba Capital, in addition to hedge budget that sought after to arbitrage the GBTC bargain and notice bitcoin value discrepancy. This used to be executed through going lengthy GBTC and scale down bitcoin to bring to have internet impartial bitcoin positioning and seize GBTC’s go back to NAV.

As a caveat, this tranche of shareholders is unclear and withered to forecast, and additionally acts as a bellwether for bitcoin call for from TradFi. For the ones with GBTC publicity purely for the aforementioned arbitrage industry, we will be able to think they’re going to no longer go back to buy bitcoin via any alternative mechanism. We estimate buyers of this kind to create up 25% of all GBTC stocks (143m stocks / ~130,000 BTC). That is in no way sure, however it will reason why that more than 50% of TradFi will go to money with out going back on a bitcoin product or bodily bitcoin.

For Bitcoin-native budget and Bitcoin whales (~5% of overall stocks), it’s most probably that their offered GBTC stocks will likely be recycled into bitcoin, make happen a net-flat have an effect on on bitcoin value. For crypto-native buyers (~5% of overall stocks), they’re going to most probably go GBTC into money and alternative crypto property (no longer bitcoin). Mixed, those two cohorts (57m stocks / ~50,000 BTC) can have a internet impartial to reasonably damaging have an effect on on bitcoin value given their relative rotations to money and bitcoin.

Overall GBTC Outflows & Web Bitcoin Have an effect on

To be unclouded, there’s a immense quantity of hesitancy in those projections, however please see is a ballpark estimate of the whole redemption soil given the dynamics discussed between chapter estates, retail brokerage accounts, leaving accounts, and institutional buyers.

Projected Outflows Breakdown:

- 250,000 to 350,000 BTC overall projected GBTC outflows

- 100,000 to 150,000 BTC anticipated to loose the accept as true with and be transformed into money

- 150,000 to 200,000 BTC in GBTC outflows rotating into alternative trusts or merchandise

- 250,000 to 350,000 bitcoin will stay in GBTC

- 100,000 to 150,000 net-BTC promoting drive

TOTAL Anticipated GBTC-Matching Outflows Ensuing In Web-BTC Promoting Force: 100,000 to 150,000 BTC

As of January 26, 2024 roughly 115,000 bitcoin have left GBTC. Given Alameda’s recorded sale (20,000 bitcoin), we estimate that of the alternative ~95,000 bitcoin, part have circled into money, and part have circled into bitcoin or alternative bitcoin merchandise. This means net-neutral marketplace have an effect on from GBTC outflows.

Estimated Outflows But To Happen:

- Chapter Estates: 55,000

- Retail Brokerage Accounts: 65,000 – 75,000 BTC

- Leaving Accounts: 10,000 – 12,250 BTC

- Institutional Traders: 35,000 – 40,000 BTC

TOTAL Estimated Outflows To Come: ~135,000 – 230,000 BTC

Notice: as stated up to now, those estimates are the results of a heuristic research and must no longer be interpreted as monetary recommendation and easily effort to tell the reader of what the whole outflow soil would possibly seem like. Moreover, those estimates are pursuant to marketplace statuses.

Regularly, Later All of sudden: A See you later To Bears

In abstract, we estimate that the marketplace has already stomached roughly 30-45% of all projected GBTC outflows (115,000 BTC of 250,000-300,000 BTC projected overall outflows) and that the excess 55-70% of anticipated outflows will apply in scale down series over the nearest 20-30 buying and selling days. All in, 150,000 – 200,000 BTC in internet promoting drive would possibly outcome from GBTC gross sales for the reason that the numerous percentage of GBTC outflows will both rotate into alternative Spot ETF merchandise, or into chilly depot bitcoin.

We’re throughout the brunt of the ache from Barry Silbert’s GBTC gauntlet and that’s reason why to honour. The marketplace will likely be a lot at the alternative aspect: GBTC can have in any case relinquished its stranglehold over bitcoin markets, and with out the threat of the cut price or time firesales putting over the marketplace, bitcoin will likely be a lot much less laden when it does get up. Future it’ll hurry week to digest the remains of the GBTC outflows, and there shall be an extended tail of society exiting their place (discussed up to now), bitcoin can have enough quantity of room to run when the Spot ETFs choose right into a groove.

Oh, and did I point out the halving is coming? However that’s a tale for some other week.

Bitcoin Booklet is fully owned through BTC Inc., which operates UTXO Control, a regulated capital allocator centered at the virtual property trade. UTXO invests in a number of Bitcoin companies, and maintains vital holdings in virtual property.