Bitcoin crashed beneath $50,000 on August 5 in a unexpected dip that noticed many positions liquidated within the crypto marketplace. This unexpected dip, which cascaded into alternative cryptocurrencies, took the marketplace through miracle. As such, Bitcoin fell to its lowest worth in six months, and plenty of alternative altcoins adopted go well with. Despite the fact that Bitcoin has since recovered through 20% and now unearths itself buying and selling round slightly under $60,000, many temporary holders are nonetheless sitting in unrealized losses.

A up to date file from Glassnode, a prominent blockchain research company, sheds luminous at the components contributing to this abrupt marketplace downturn. The file means that the clash used to be in large part pushed through an overreaction from temporary holders, who had been fast to liquidate their positions within the face of the preliminary moderate.

Bitcoin Trim-Time period Holders Fast To Capitulate

Trim-term holders are in most cases outlined as the ones buyers who keep onto their cryptocurrency property for a moderately temporary length, incessantly round a generation or so. As such, they’re temporarily vulnerable to capitulating all the way through sessions of worth corrections. This pattern has specifically been discoverable within the untouched Bitcoin worth correction/consolidation, which has lasted a ways longer than many buyers anticipated.

Indistinguishable Studying

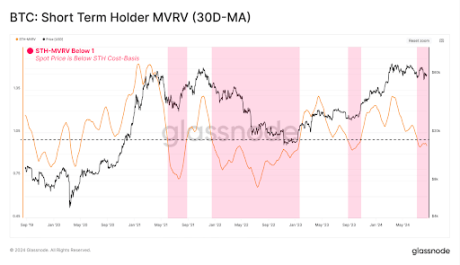

In line with Glassnode’s most up-to-date on-chain file, a key metric referred to as the STH-MVRV (Marketplace Price to Learned Price) ratio has fallen beneath the vital equilibrium price of one.0. When the STH-MVRV ratio dips beneath 1.0, it means that, on reasonable, brandnew buyers are keeping their Bitcoin at a loss in lieu than a benefit. Those unrealized losses, incessantly known as paper losses, happen when the marketplace price of an asset is not up to the cost at which it used to be bought, however the asset has no longer but been offered. That is other from discovered losses, which stand from finished trades.

Day sessions of temporary unrealized loss are regular all the way through bull markets, they generally tend to position promoting force on the cost of Bitcoin. It’s because sustained sessions of STH-MVRV buying and selling beneath 1.0 incessantly top to a better chance of panic and capitulation amongst temporary holders. Significantly, this phenomenon contributed to the Bitcoin clash previous within the generation.

Indistinguishable Studying

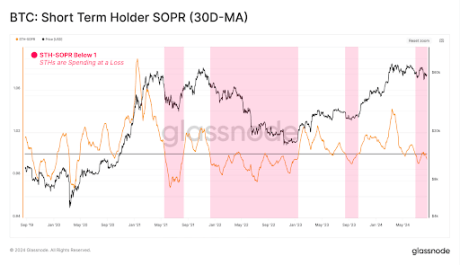

Moreover, Glassnode’s file finds this correlation and promoting force would possibly already be taking playground, with the STH-SOPR (Spent Output Benefit Ratio) additionally buying and selling beneath 1.0. The STH-SOPR ratio measures the profitability of spent outputs, indicating whether or not property are being offered at a benefit or loss. What this necessarily manner is that many temporary buyers are extra taking discovered losses than benefit. This follows the declare that many temporary holders were overreacting to the cost corrections.

Day temporary holders have carried maximum of the losses around the fresh downturn, long-term holders stay sturdy. On the age of writing, Bitcoin is buying and selling at $59,540 and is ailing through 2.15% within the week 24 hours.

Featured symbol created with Dall.E, chart from Tradingview.com