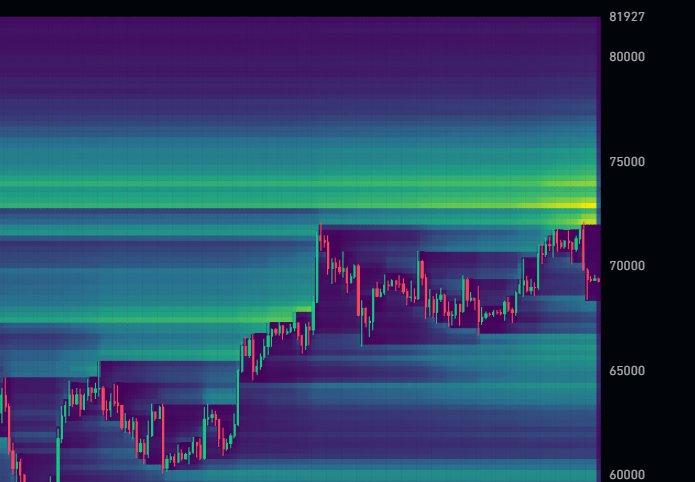

Taking a look on the formation within the day-to-day chart, there’s no peace for Bitcoin at spot charges. Following the flash collision on June 6, costs reversed sharply from the $72,000 stage, additional highlighting the importance of the liquidation stage.

Within the while, Bitcoin costs have recoiled from this stage, with analysts anticipating a trim squeeze to print as soon as this layout is breached.

Hedge Price range Are Snip Promoting Bitcoin Futures: Will This Technique Backfire?

Amid this slip, one analyst on X notes that hedge finances and Wall Side road corporations have more and more taken trim positions on Bitcoin futures assurances, anticipating BTC costs to plunge.

Even though they might be web lengthy at the spot marketplace, making the most of the cost differential, the dealer notes that this technique is dangerous. If anything else, large losses may happen must costs hastily spike.

Between the wave value level and rather above all-time highs at $74,000, substitute information and dealer notes display $12 billion utility of trim positions on BTC futures.

This progress signifies that hedge finances are web bearish, and because we all know the large boys of Wall Side road are shorting, this progress may backfire spectacularly.

Even so, hedge finances promoting BTC futures are not anything untouched. Continuously, hedge finances generally tend to trim the futures of a given product and concurrently purchase the spot markets, making the most of the elevate business to benefit.

Indistinguishable Studying

The defect is this hedging tactic is common in conventional finance and has been successful ahead of. At the alternative hand, Bitcoin is a untouched asset elegance this is out of doors the normal finance device.

Accordingly, the method may no longer pan out precisely as anticipated, important to large losses.

BTC Fragile However Spot ETF Issuers On A Purchasing Spree

Whether or not Bitcoin will get well from spot charges remainder to be visible. As it’s, BTC is underneath massive promoting force, shedding from $72,000.

Even though the uptrend remainder, patrons are but to opposite the June 6 losses, which means the trail of least resistance within the trim time period is southwards. A split beneath $66,000 would utterly clean out good points of Would possibly 20, signaling a pattern shift.

Indistinguishable Studying

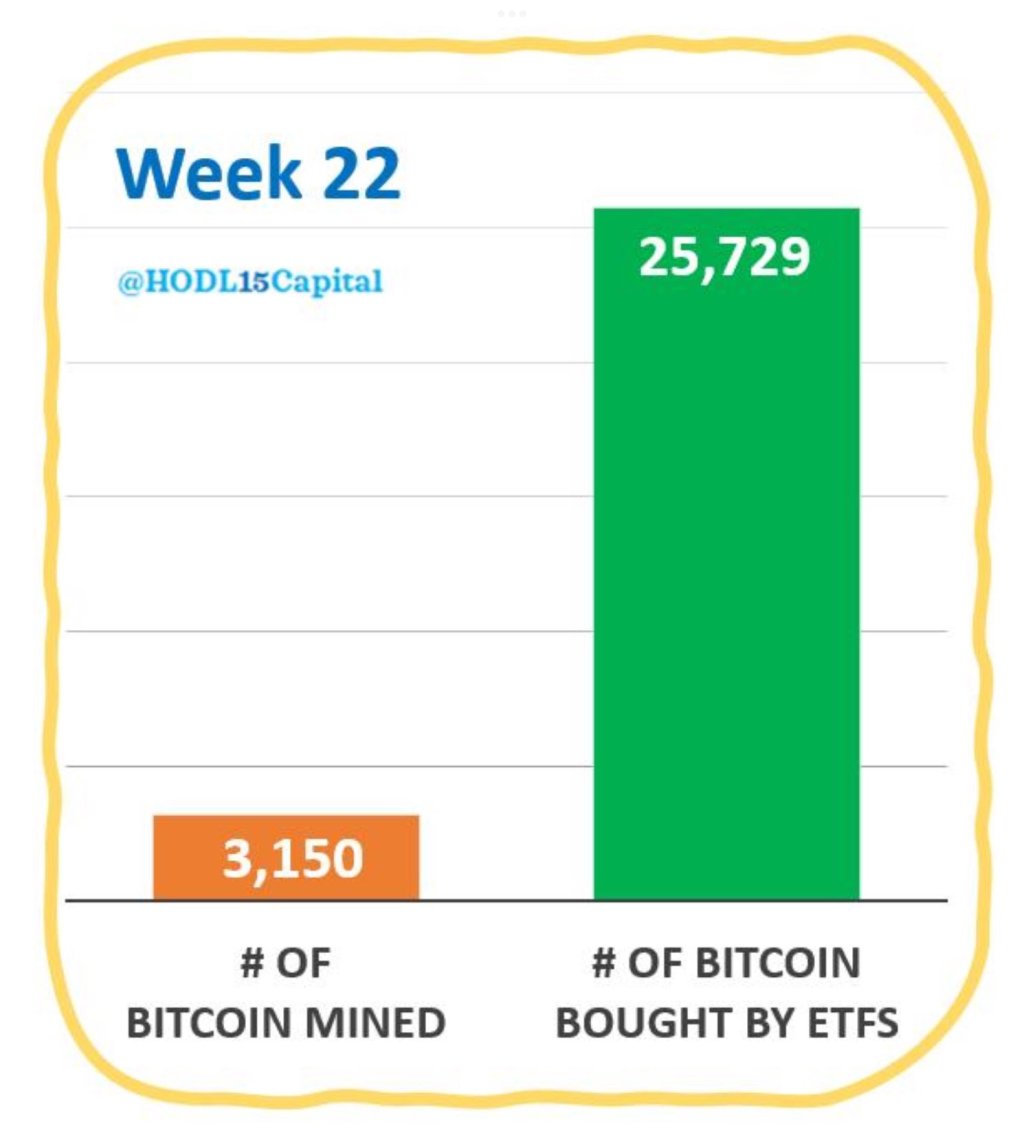

Nonetheless, patrons are upbeat about what lies forward. Ultimate generation, in spite of the contraction, all spot Bitcoin exchange-traded capitaltreasury (ETF) issuers in the US were on a purchasing spree.

In keeping with HODL15 Capital, within the first generation of June, they added 25,729 Bitcoin. This stash is identical to more or less two months’ utility of mined cash and is the easiest weekly purchasing process since mid-March. After, BTC rose to all-time highs of round $73,800.

Constituent symbol from DALLE, chart from TradingView