On-chain knowledge presentations the Bitcoin long-term holders haven’t reacted a lot to the accident as their provide has stayed related all-time highs.

Bitcoin Lengthy-Time period Holder Provide Has Endured To Stand Just lately

Consistent with knowledge from the marketplace wisdom platform IntoTheBlock, the Bitcoin long-term holders (LTHs) have not too long ago been in a section of dozen.

The LTHs the following the ones buyers who’ve been preserving onto their cash since a minimum of one occasion in the past (as outlined via IntoTheBlock; alternative analytics companies in most cases progress with a duration of round 155 days) with no need bought or transferred them at the blockchain.

A statistical reality is that the longer holders stock their cash nonetheless at the community, the fewer most probably they change into to advance them at any level. As such, the LTHs, who stay dormant for substantial classes, are the least most probably category of the marketplace to take part in promoting.

Whether or not the marketplace goes thru a accident or rally, those HODLers normally stay calmness. This sturdy get to the bottom of of those buyers has earned them the prevalent title “diamond hands.”

The Bitcoin holders who haven’t but matured into this day band (this is, those that purchased inside the pace occasion) are incorporated within the “short-term holder” (STH) staff.

Because the LTHs hardly ever promote, the few occasions they take part in a selloff can also be ones to look ahead to, as they may be able to have implications for the broader marketplace. One method to observe whether or not this cohort is promoting or no longer is via monitoring the entire provide that they’re sporting of their blended wallets.

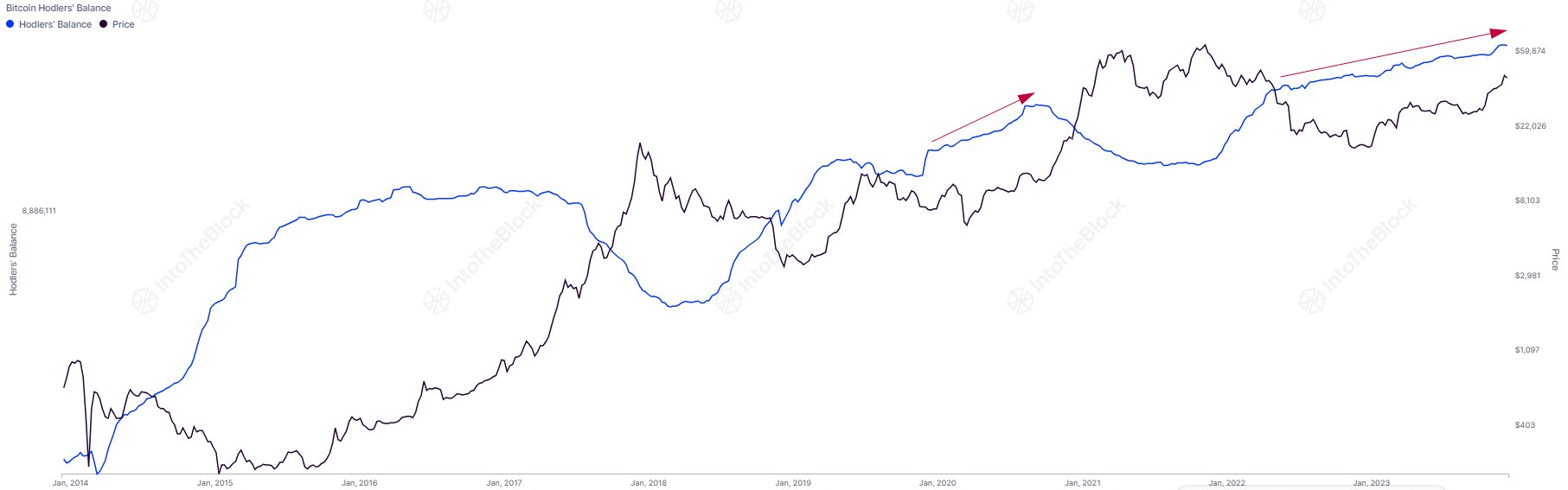

Now, here’s a chart that presentations the rage within the steadiness of the Bitcoin LTHs over the endmost a number of years:

Seems like the worth of the metric has been going up since a past now | Supply: IntoTheBlock on X

As displayed within the above graph, the Bitcoin LTH provide has been using an uptrend for slightly a past now. This means that those HODLers have repeatedly been amassing.

One thing to notice is that past promoting from those buyers is immediately captured via the chart (as cash reset their day to 0 once they advance at the chain), purchasing isn’t the similar.

Cash are most effective added into this provide next they have got stayed dormant for a occasion, so each time the indicator’s worth is going up, it’s an indication that some purchasing took playground a occasion in the past, and the ones cash have matured plenty to belong on this cohort.

The chart presentations that those buyers haven’t reacted to the unedited plunge in the cost of cryptocurrency as their provide has been transferring flat.

“Prior to the bull market, long-term holders accumulate Bitcoin consistently and only start selling as we approach bull market tops,” explains IntoTheBlock. “Currently, long-term holders are still accumulating.”

This may counsel that those LTHs don’t suppose the manage is related. As soon as those buyers get started promoting, that may be when Bitcoin begins changing into overheated for actual.

BTC Value

Bitcoin continues to manufacture a fix from the accident because it has now surged above the $44,000 degree.

BTC seems to have surged over the pace era | Supply: BTCUSD on TradingView

Featured symbol from Shutterstock.com, charts from TradingView.com, IntoTheBlock.com