A unused past for the crypto business approaches as the arena’s greatest trade, Binance, adjustments management. The day prior to this, the corporate’s founder and CEO, Changpeng “CZ” Zhao, stepped i’m sick as a part of an word with the USA govt.

The trade in may have sparked a unused past of adoption and legitimacy for the nascent business at the price of CZ’s place and a $4 billion high-quality. Unused information seemed into Binance’s transactions to test if customers consider within the corporate’s era following the historical determination.

Binance Secure From FTX Like Deposit Run?

Consistent with crypto research company Nansen information, Binance recorded nearly $1 billion in adverse netflow following the previous day’s information. The information signifies that the platform’s USDT worth lowered via $246 million, adopted via Bitcoin’s worth, which declined via $76 million.

Customers who really feel unsure concerning the platform’s era take out their cash, probably triggering a locker run. Then again, Nansen’s information displays that this state of affairs is a ways from materializing on this buying and selling venue.

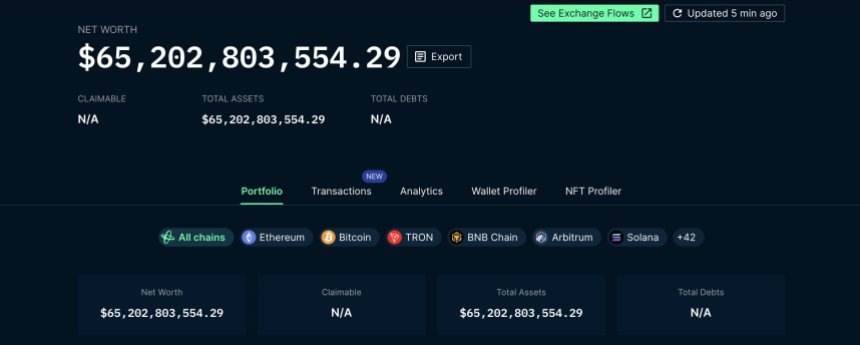

Generation the adverse netflows get up at $955 million, there is not any “mass exodus” or panic from customers buying and selling on Binance. Nansen claims the platform’s retaining worth greater from $64.6 billion to $65.2 billion.

The analytics company in the past said that Binance treated larger web flows. First, when the USA Securities and Change Fee (SEC) filed a lawsuit in opposition to the corporate, and after, when FTX went bankrupt following a immense locker run.

As discussed, Binance turns out not likely to observe a alike destiny. Nansen said:

Within the moment, Binance has processed upper volumes of outflow and adverse netflow: Jun 2023 upcoming the SEC sued Binance, December 2022 upcoming insolvency rumors, and the rapid aftermath of FTX. We can grant some other replace 24 hours upcoming the inside track at the beginning poor.

CZ’s Retirement Forecast Just right Instances For Crypto

Around the crypto society, the talk round CZ’s resignation has been fierce. Then again, the consensus is constructive.

A file from The Ban cites primary banking establishment JPMorgan claiming that the Binance trade in eliminates a “systemic risk” for the business. In 2022, when FTX collapsed, the cost of Bitcoin crashed to a low of $15,000 and took months to get well.

With 150 million customers on its platform and thousands and thousands of capital injected into a couple of ecosystems. Binance’s fall down would were similarly, if no longer extra, devastating than FTX for the nascent business.

JPMorgan analyst Nikolaos Panigirtziglou instructed The Ban:

We see the probability of agreement as sure as hesitancy round Binance itself would diminish and its buying and selling and Roguish Chain trade would get advantages. For crypto traders the probability of agreement would see the removal of a possible systemic chance emanating from a hypothetical Binance fall down.

Defend symbol from Unsplash, chart from Tradingview