Regardless of bulls going through headwinds, Willy Woo, an on-chain analyst, is bullish on Bitcoin. He cites contemporary tendencies round spot, derivatives, and see Bitcoin exchange-traded finances (ETFs) in a publish on X. The analyst shared a post appearing the occasions that may most probably pressure costs even upper.

“Paper Bitcoin” Shedding Is Bullish For Costs

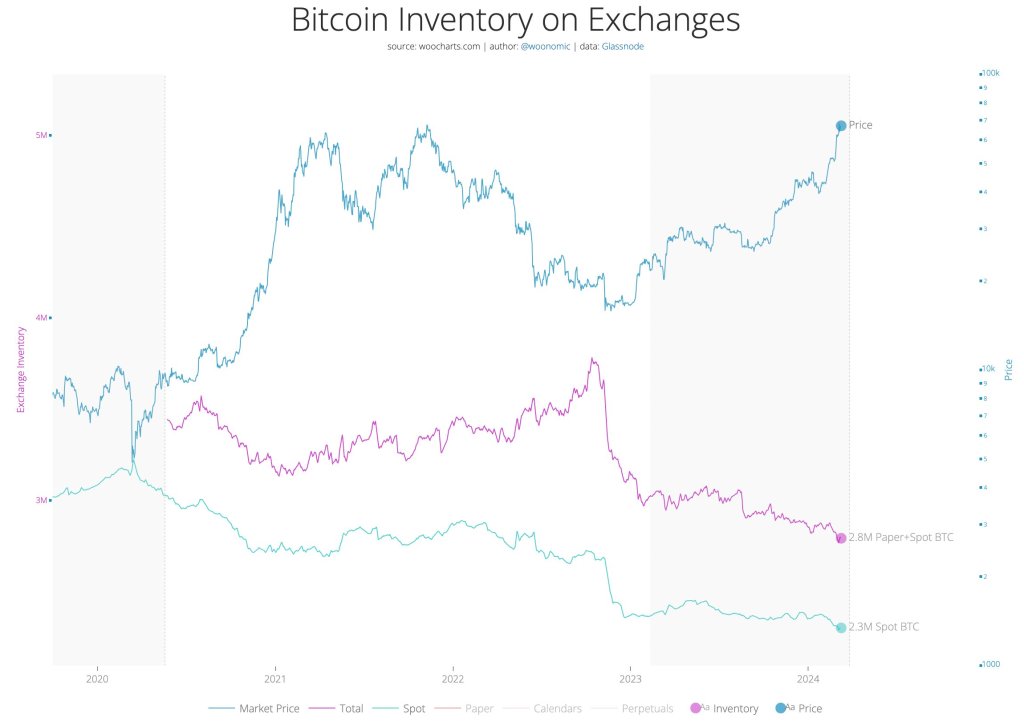

Woo pointed to the release within the quantity of “paper Bitcoin” coming into the marketplace. Merely put, “paper Bitcoin” refers to derivatives. Those are essentially futures guarantees, permitting buyers to take a position on Bitcoin costs with out in fact purchasing the underlying asset, on this case, BTC.

From the Bitcoin value and the influx fee of “paper Bitcoin,” Woo notes an inverse correlation between the 2. For Bitcoin costs to development upper, there will have to be a slowdown in “paper Bitcoin.” Having a look on the on-chain value chart, that is exactly what’s taking place. Accordingly, there’s a top probability that costs will proceed rallying in spite of the hot drawdown.

At the moment, the Bitcoin upside extra. On the other hand, the failure of consumers to push above $69,000 and ensure consumers of early this hour is a priority for positive consumers. To this point, Bitcoin has published unused all-time highs, however there was negative follow-through.

On March 5, a flash collision ended in billions in lengthy liquidations, ablution out speculators. Month costs have reasonably recovered, the coin levels throughout the undergo candlestick, a web bearish construction.

Woo cycled again to the 2022 undergo marketplace, evaluating value motion to flow marketplace situations. Later, the analyst stated, spot consumers of Bitcoin had been amassing in spite of costs falling. At that presen, the actual catalysts of undergo drive had been speculators buying and selling “paper Bitcoin.” Their engagement drowned the have an effect on of spot consumers, forcing costs even decrease.

The Have an effect on Of Spot BTC ETFs

On the other hand, having a look at occasions in 2024, there’s a noteceable shift. Month “paper Bitcoin” buyers are reducing, the collection of spot Bitcoin consumers may be falling. The release in “paper Bitcoin” may probably aid costs in the end since there’s extra call for for latest Bitcoin from spot exchange-traded capitaltreasury (ETF) issuers.

Woo stated the inflow of billions from spot Bitcoin ETF issuers like Constancy and BlackRock is a “remedy” for the unfavorable affect of “paper Bitcoin.” Not like speculators, spot ETF issuers conserve Bitcoin immediately on behalf in their shoppers, growing call for.

Since the USA Securities and Change Fee (SEC) authorized the primary spot Bitcoin ETFs in January 2024, costs were ripping upper, drawing extra capital to the trade.

Component symbol from Canva, chart from TradingView