The cost of Bitcoin skilled an early weekend surge following Federal Accumulation Chairman Jerome Powell’s accent on the Jackson Hollow symposium. In keeping with the original on-chain commentary, the announcement of attainable rate of interest cuts has ended in an building up in Bitcoin call for within the year time.

BTC Call for Sees Expansion In The United States — Have an effect on On Value?

In a up to date publish at the X platform, CryptoQuant’s Head of Analysis Julio Moreno evident that call for for Bitcoin has been at the stand in the US within the year 24 hours. This enlargement got here at the again of the Fed disclosing {that a} cycle of decrease rates of interest would quickly start.

Decrease rates of interest via the central locker are continuously a welcome building for dangerous property like Bitcoin, the sector’s biggest cryptocurrency. Falling rates of interest generally tend to decrease the earnings on conventional monetary tools corresponding to bonds, making cryptocurrencies extra sexy choices for traders in search of upper submits.

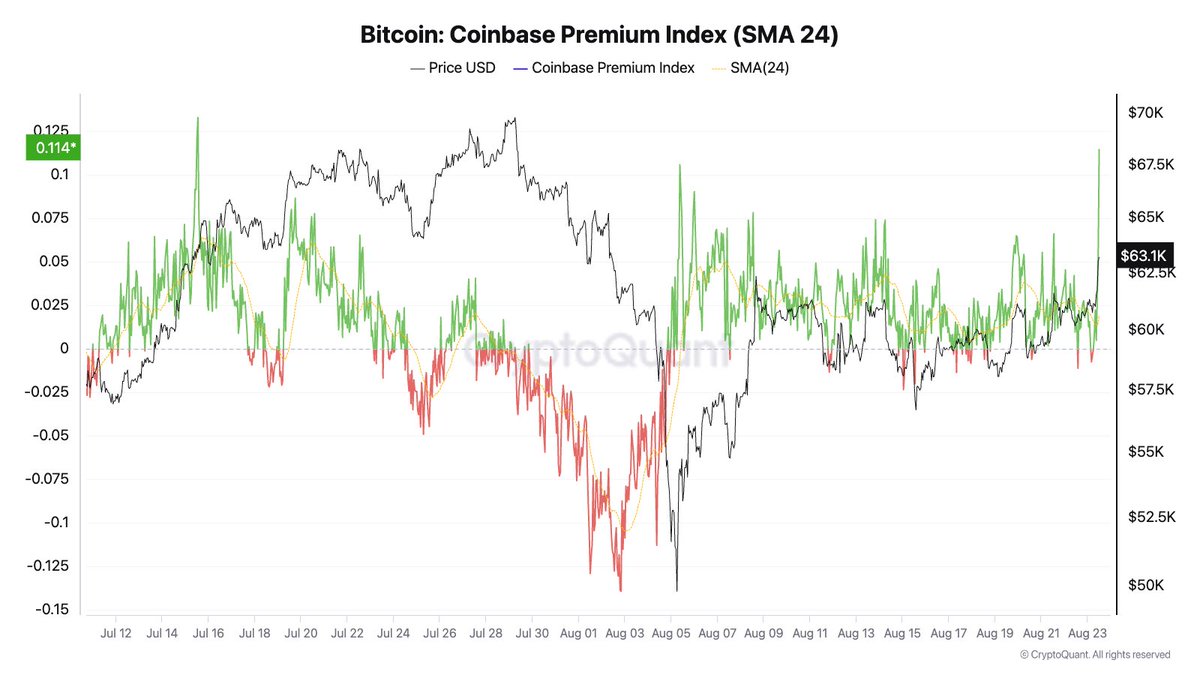

In keeping with Moreno, the BTC value top class on Coinbase — the biggest cryptocurrency change in america — has surged to its best stage since mid-July. For context, the Coinbase top class refers back to the extra between the coin’s worth on Coinbase and alternative international centralized exchanges.

Chart appearing BTC's Coinbase top class index | Supply: jjcmoreno/X

Most often, when the BTC value top class on Coinbase is emerging, it implies that there’s expanding call for from US traders, as they’re keen to spend extra to procure Bitcoin. As previous defined, this heightened call for is sensible given the chance of rate of interest cuts and not more winning conventional monetary tools.

Expanding call for is a in particular just right signal for the cost of Bitcoin, because it means that traders are positioning themselves to harvest from a promising crypto year. On the similar generation, the rising call for and the emerging value top class may just lead to increased marketplace volatility.

Moreover, the expanding US Bitcoin call for comes simply on the proper generation, as call for enlargement has remained at low ranges over the year few weeks. CryptoQuant noticed in a file that BTC’s obvious call for has been gradual since April 2024 when the coin’s value was once round $70,000.

In keeping with the blockchain prudence company, the obvious call for wishes to peer some enlargement for BTC’s value to peer some sunlight. In the long run, if the rising call for in the US is continued and unfold to alternative markets, traders may just see the flagship cryptocurrency go back to round its all-time top.

Bitcoin Value At A Look

As of this writing, the cost of BTC is soaring round $64,000, reflecting an over 5% building up within the year time. In keeping with knowledge from CoinGecko, the premier cryptocurrency is up via 7.5% within the year past.

The cost of BTC at the day by day time-frame | Supply: BTCUSDT chart on TradingView

Featured symbol from iStock, chart from TradingView