On the contemporary MicroStrategy’s Bitcoin For Firms match, Neel Maitra, a spouse at Dechert and a seasoned former fintech and crypto specialist on the SEC, presented a deep dive into the judicial complexities these days entangling crypto rules, with a unique center of attention at the ongoing Ripple litigation. His insights are specifically great given his in depth background in each regulatory our bodies and personal criminal follow, together with his hour at Sullivan & Cromwell.

Will Ripple Vs. SEC ‘Inevitably’ Proceed To The 2nd Circuit?

Right through the Prison & Regulatory Panel, Maitra mentioned the deviant judicial reviews on how secondary buying and selling of cryptocurrencies like XRP must be legally categorised. He emphasised that this disparity in judicial opinion, particularly inside the Southern District of Unutilized York, illustrates the unsureness and complexity of flow crypto rules. “It’s funny because three of the judges relevant here were in the Southern District of New York. So in a single federal district the judges can’t agree on how these secondary trading of crypto should be treated,” Maitra noticed.

The main factor to hand, as defined via Maitra, revolves round whether or not transactions carried out on cryptocurrency exchanges represent securities transactions below US legislation. Pass judgement on Analisa Torres, overseeing the Ripple case, differentiated between number one and secondary transactions. In number one transactions, shoppers purchase immediately from Ripple and depend on Ripple’s efforts for doable income, obviously categorizing such transactions as securities below the Howey Take a look at.

On the other hand, Pass judgement on Torres argued that secondary transactions, which take place anonymously on exchanges, don’t robotically qualify as securities transactions. She termed those as “blind transactions,” the place the consumers are continuously basic buyers ignorant of whom they’re purchasing from or the intricacies of the underlying industry operations of Ripple.

By contrast, Pass judgement on Jed Rakoff and Pass judgement on Katherine Polk Failla in free instances (Terra Luna and Coinbase, respectively) followed a broader view. They posited that the competitive advertising and marketing methods hired via crypto corporations may affect each number one and secondary marketplace transactions, thereby doubtlessly categorizing even secondary transactions as securities.

“The differing opinions among these judges underscore the nuances and the evolving nature of cryptocurrency regulation,” Maitra defined. He predicted, “It’s inevitable that this [the Ripple vs SEC case] is going to the second circuit and maybe even further, who knows, but there’s a lot left to go in this particular decision just like with Coinbase.” His commentary highlights the continuing debate and the most probably development of the case throughout the upper judicial echelons.

Maitra additionally let go sunny at the SEC’s interpretation of the results of those instances. In spite of the setbacks in some rulings, the SEC does no longer view those as a repudiation of its general stance on cryptocurrencies as securities. “The SEC doesn’t necessarily see the Ripple case as being a failure of its theory that secondary trading of crypto is securities trading. They just see it as maybe we couldn’t put forward the evidence sufficiently well to convince the court and we’ll fix that at the second circuit level,” he said.

🚨⚖️ 🚨𝗦𝗘𝗖 𝘃𝘀. 𝗥𝗶𝗽𝗽𝗹𝗲 🚨⚖️🚨

👤 Neel Maitra, Spouse at Dechert / Former Fintech and Crypto Specialist on the @SECGov / Previously at Sullivan & Cromwell

⚠️ “𝘛𝘩𝘦 𝘚𝘌𝘊 𝘥𝘰𝘦𝘴𝘯’𝘵 𝘯𝘦𝘤𝘦𝘴𝘴𝘢𝘳𝘪𝘭𝘺 𝘴𝘦𝘦 𝘵𝘩𝘦 𝘙𝘪𝘱𝘱𝘭𝘦 𝘤𝘢𝘴𝘦 𝘢𝘴 𝘣𝘦𝘪𝘯𝘨 𝘢… %.twitter.com/DL4lksMoF6

— Subjective Perspectives (@subjectiveviews) May 5, 2024

This viewpoint means that the SEC is getting ready to refine its arguments and proof in probability of additional judicial critiques. This ongoing litigation no longer handiest impacts Ripple and alternative particular person corporations but in addition units vital precedents that would surrounding the regulatory terrain for all of the cryptocurrency marketplace in america.

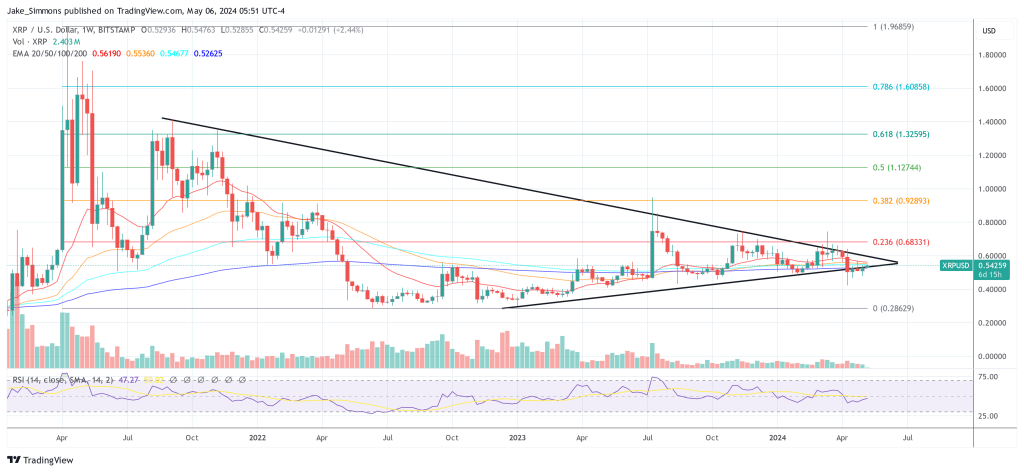

At press hour, XRP traded at $0.54259.

Featured symbol from YouTube / Bitcoin Novel, chart from TradingView.com