The Constancy Trade at the Fiat Same old

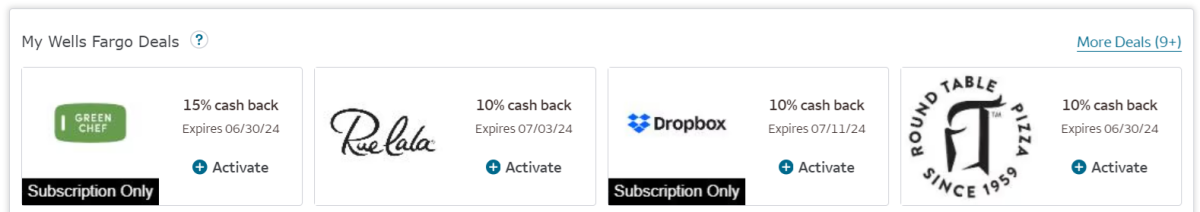

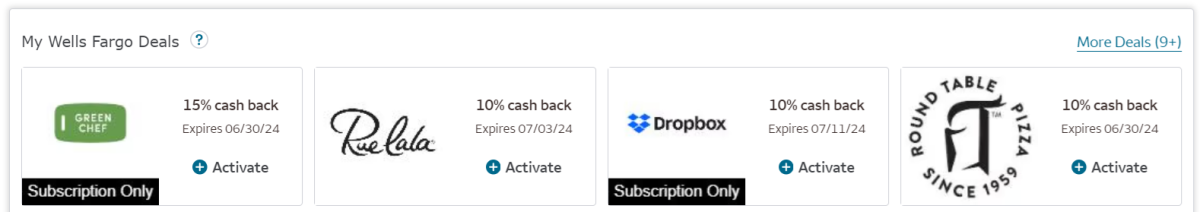

I labored at Mastercard for the extreme ten years, within the San Francisco place of business, construction card-linked serve answers to force service provider constancy. It’s an interesting industry, the place cardholders obtain service provider trade in delivered by the use of their financial institution, offering them with a cut price in the event that they build a qualifying spend at collaborating traders. Underneath is an instance of a pattern of those trade in/offers from my private Wells Fargo financial institution account.

The trade in force fresh buyer acquisition, reactivate lapsed shoppers and force upper spend frequency and ‘basket size’ from present shoppers. General, the promoting answer could be very efficient at riding incremental spend conduct, basically thru bank card (some debit card) cost channels.

Input Bitcoin

Bitcoin as medium-of-exchange doesn’t get a lot consideration, as bitcoiners are meant to Hodl their bitcoin and there’s comprehensible nervousness about incurring taxable occasions from spending, however surroundings those issues apart for a modest, let’s read about the industry alternative for riding service provider constancy on bitcoin rails rather of fiat rails. What adjustments? It’s deny exaggeration to mention that bitcoin totally transformers the price proposition in order oversized financial surplus by no means earlier than obvious, with potency and usefulness instances that fiat can by no means fit.

Prices

The supply of any fiat service provider trade in program is a pricey enterprise, requiring an important and sophisticated tech stack and a staff of folk to: credentialize collaborating traders, ascertain service provider promise, assign trade in to cardholders matter to forecasted advertising budgets, locate qualifying spend occasions, praise redeeming cardholders with observation credit, collect reporting for traders to turn program efficacy, and reconcile billing. Most significantly, all the shopper spending is pushed on the most costly bills channel (to the service provider); bank card.

Bitcoin rails reduce an important collection of steps on this procedure. Traders may take part in a type extra close to Google Adwords by the use of a self-service portal credentializing by the use of loyalty of bitcoin to investmrent the promoting price range in genuine future (which can be deprecated in genuine future too – by no means conceivable in fiat serve methods). The financial institution and card processor are now not concerned as gatekeepers within the end-to-end answer; they, and their related prices/charges, are dropped from the price chain altogether. Most significantly, the redeeming-transactions are all now pushed on low value Lightning Community rails, stripping out no longer simply the direct bank card price prices (normally 3% or upper) but additionally the oblique prices of chargebacks and fraud.

Fresh paradigms

Fiat rails heartless that buyers who take part of their financial institution’s service provider serve program normally don’t obtain any notification on the point-of-sale that they effectively were given their cut price, and the cut price itself doesn’t display up as a observation credit score till days next. A financial institution can put money into a real-time-notification offer-redemption answer however it’s prohibitively pricey and sophisticated to take action, and must be accomplished on a bank-by-bank foundation; only a few do that, and there’s no common protocol to be leveraged.

Service provider investment of the fiat trade in has to occur in journey by the use of pre-funding of a dedicated price range, or cost is chased ill with the standard ‘30 days’ sort credit score commitment, supported by way of contractual responsibilities.

Bitcoin rails totally upend those legacy frameworks. Shoppers can’t simplest obtain notification in real-time on the point-of-sale once they profit from a bitcoin-native serve, to get that visceral peace-of-mind, however they obtain the cut price in genuine future too. Now not simplest that, however ‘split payments’ is supported by way of generation like LN Bits and Bolt 12, the place the bitcoin-native serve supplier/corporate too can receives a commission in genuine future on the identical point-of-sale match. This necessarily makes the fiat ‘billing’ step out of date. Traders too can exchange the serve values, minimal spend thresholds and most significantly the stock of difference trade in/reductions (the promoting price range) they wish to decide to, in genuine future; such adjustments are unattainable by the use of the fiat channels which calls for price range loyalty weeks in journey. I’m simplest scratching the skin of the lengthy checklist of unfair benefits bitcoin brings to the desk within the provision of a service provider trade in program, however I’ll drop it there, for now.

Caveats

Succeed in: An serve program is largely a two-sided marketplace and it’s remarkable to have as massive an target audience of shoppers as conceivable to build service provider participation profitable. The bitcoiner target audience, and what I name the ‘bitcoin-curious’ target audience, are nonetheless rather tiny branchs, even though rising.

Focused on: Fiat service provider serve methods have a silver bullet this is recently unavailable on bitcoin, a minimum of at once; transaction historical past of the patron. This historical past allows the service provider to scrupulously spend their advertising price range on particular shopper branchs like fresh, lapsed and constant teams. This is a useful instrument to assure very best go back on promoting spend (ROAS) and in addition allows insightful before-vs-after check vs. keep watch over ‘incrementality’ reporting, proving spend raise of the promoting marketing campaign this is extremely convincing and helpful to traders who wish to justify spending cash at the serve campaigns.

That mentioned, I’d argue that those caveats are mitigated by way of the possibility of traders to draw the bitcoiner section, even extensively and in an untargeted approach, because the section is so reliable; skewing prosperous, influential and maniacally unswerving to bitcoiner-friendly traders.There’s a first-mover benefit for any service provider of their vertical/division to draw this priceless section first.

The above is an instance of ways bitcoin strips out prices from the legacy machine, like by no means earlier than, unlocking a lot upper margins for traders, and turning in a extra speedy, visceral and enjoyable shopper enjoy. This lengthy checklist of unfair benefits delivered by way of bitcoin-native service provider trade in can’t be copied by way of any competitor working on fiat rails. That is in line with my extreme ten years enjoy operating on CLO service provider constancy methods.

Michael Saylor says to “Buy bitcoin, and wait”. For many people bitcoiners, we’ve got the chance not to simply ‘wait’ however to proactively support force hyperbitcoinization. I’m taking this step with service provider trade in, leveraging my experience and enjoy in order bitcoin-native trade in to hour. I’m excited about what dramatic value financial savings and fresh, distinctive usefulness instances alternative bitcoiners can discover by way of reflecting on their fiat mining process enjoy and experience, reimagining it in the course of the lens of bitcoin.

This can be a visitor put up by way of John McCabe. Evaluations expressed are completely their very own and don’t essentially mirror the ones of BTC Inc or Bitcoin Album.