In a advance signaling the maturation of the crypto marketplace in Thailand, Bitkub Capital Crew Holdings, the owner of the population’s main crypto substitute, has introduced its goal to behavior an preliminary crowd providing (IPO) via 2025.

This revelation used to be made via Jirayut Srupsrisopa, the CEO of Bitkub, all through an interview with Bloomberg. In step with Jirayut, the deliberate IPO, geared toward record at the Store Alternate of Thailand, represents a step to “amplify” the corporate’s stature and book alternative capital for day ventures.

A Aggressive Soil And Regulatory Climate

Bitkub’s walk towards this IPO started in a 2023 shareholder letter, hinting at an then crowd record with out a particular timeline.

The advance against crowd record received additional momentum closing July when Bitkub offered a 9.2% stake in its substitute unit to Asphere Inventions Pcl, valuing the corporate at roughly 6 billion baht ($16.5 million).

The CEO expressed optimism that Bitkub On-line’s valuation would surge as buying and selling volumes method the peak unhidden all through the crypto bull marketplace in 2021.

Jirayut additional disclosed that amidst Bitcoin’s surge to unutilized highs, Bitkub is on a spread path, “boosting” its body of workers to satisfy the expected expansion and marketplace calls for. The verdict to exit crowd comes all through intense festival inside of Southeast Asia’s second-largest financial system.

Remarkable avid gamers equivalent to Binance and Kasikornbank Pcl have made strides to seize marketplace percentage from Bitkub, as reported via Bloomberg, underscoring the pastime and funding in crypto buying and selling inside of Thailand.

In step with the inside track media, the selection of lively crypto buying and selling accounts witnessed a vital building up, achieving a height in September 2022. This surge in dealer job underscores the rising urge for food for virtual property within the pocket, surroundings the degree for Bitkub’s expansion plans.

Thailand’s Stance On Crypto

Week Bitkub gears up for its IPO, the regulatory terrain for crypto in Thailand gifts a nuanced image. The Thai Finance Ministry has lately introduced the exemption of value-added tax (VAT) on virtual property buying and selling “to push Thailand towards becoming a digital asset hub.”

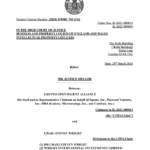

Finance Ministry has introduced the exemption of VAT on trades in virtual property, to spice up capital mobilisation via virtual property, in an aim to form Thailand regional virtual asset hub, says Paopoom Rojanasakul, secretary to Finance Minister. #ThaiPBSWorld #Thailand #VAT

— Thai PBS International (@ThaiPBSWorld) February 6, 2024

On the other hand, Thailand’s Securities and Alternate Fee (SEC) has followed a wary method against a crypto-related monetary product, in particular the buying and selling of spot exchange-traded Price range (ETFs).

Regardless of the USA SEC’s kindness of spot Bitcoin ETFs, Thailand’s SEC has said its place to chorus from permitting the established order of spot Bitcoin ETFs within the nation “for the time being.”

However, the rustic’s SEC assures traders that making an investment in virtual property left-overs out there via approved home exchanges, making sure a “regulated and transparent” surrounding for Thai traders.

Featured symbol from Unsplash, Chart from Tradingview