As 2024 involves a similar, Bitcoin buyers are willingly eyeing the overall quarter of the time, historically recognized for sure value motion. With many speculating {that a} bullish rally could also be at the horizon, let’s crack indisposed the ancient knowledge, analyze tendencies, and weigh the chances of what BTC’s value motion may seem like by means of the top of this time.

Historic Efficiency of Bitcoin in This autumn

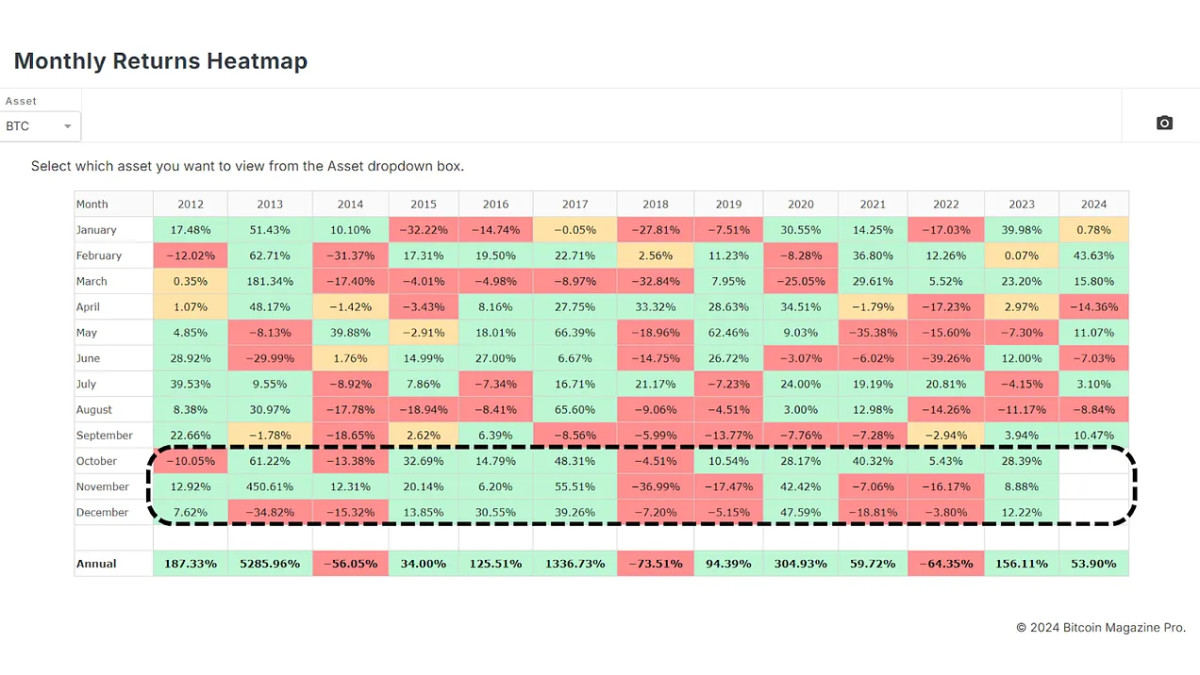

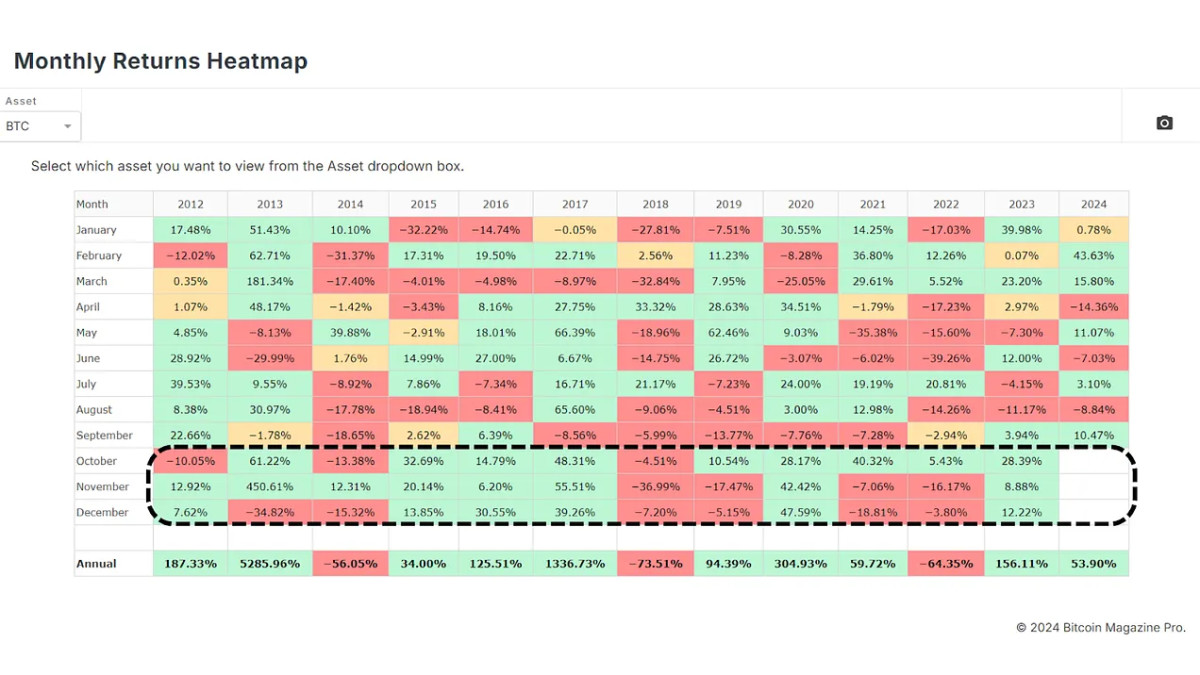

Taking a look on the week decade at the Per thirty days Returns Heatmap, This autumn has continuously delivered remarkable positive aspects for Bitcoin. Knowledge presentations that BTC regularly finishes the time sturdy, as evidenced by means of 3 consecutive inexperienced months in 2023. Now not each time follows this pattern alternatively, 2021 and 2022 had been much less favorable, with Bitcoin finishing the time on a extra bearish be aware. But, years like 2020 and 2015 thru to 2017 noticed super value surges, highlighting the potential of a bullish end in This autumn.

Examining Possible This autumn 2024 Results In response to Historic Knowledge

To raised perceive attainable results for This autumn 2024, we will examine earlier This autumn performances with the stream value motion. This may give us an concept of ways Bitcoin may behave if ancient patterns proceed. The dimension of attainable results is large, from important positive aspects to minor losses, and even sideways value motion. The projection traces are rainbow colour coded going from 2023 in crimson again to 2015 in a sunny violet shadow.

As an example, in 2017 (crimson form), Bitcoin skilled an important building up, suggesting that during an positive state of affairs, Bitcoin may succeed in costs as top as $240,000 by means of the top of 2024.

Alternatively, extra conservative estimates also are conceivable. In a extra average This autumn, Bitcoin may dimension between $93,000 and $110,000, month in a bearish state of affairs, costs may loose as little as $34,000, as unhidden in 2018 (blue form).

The median consequence according to this knowledge appears to be across the $85,000 value level. Despite the fact that that is according to the time finish value from those projections, years corresponding to 2021 (yellow form) led to significantly upper value sooner than important pullbacks to finish the time.

Is The Median Result A Risk?

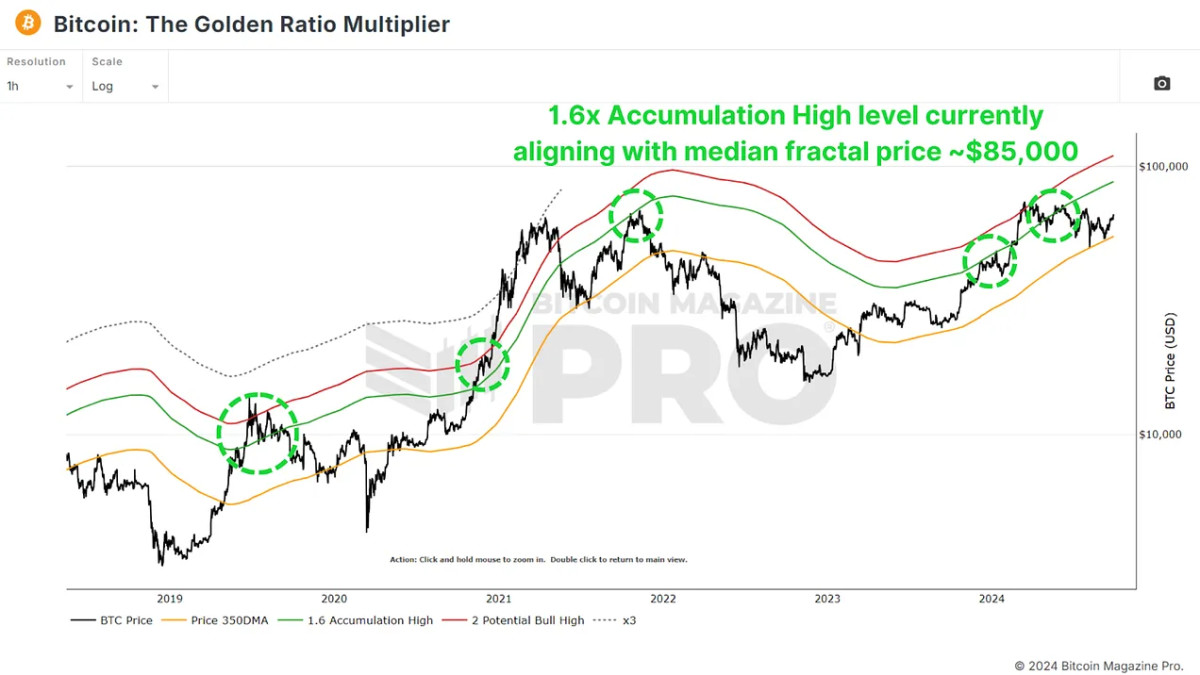

While an $85,000 in round 3 months generation might appear positive, we best have to appear again to February of this time to peer a unmarried pace by which BTC skilled a 43.63% building up. We will be able to additionally glance to metrics corresponding to The Blonde Ratio Multiplier which can be appearing confluence round this degree as a possible goal with its 1.6x Batch Top degree.

Is $240,000 Even Imaginable?

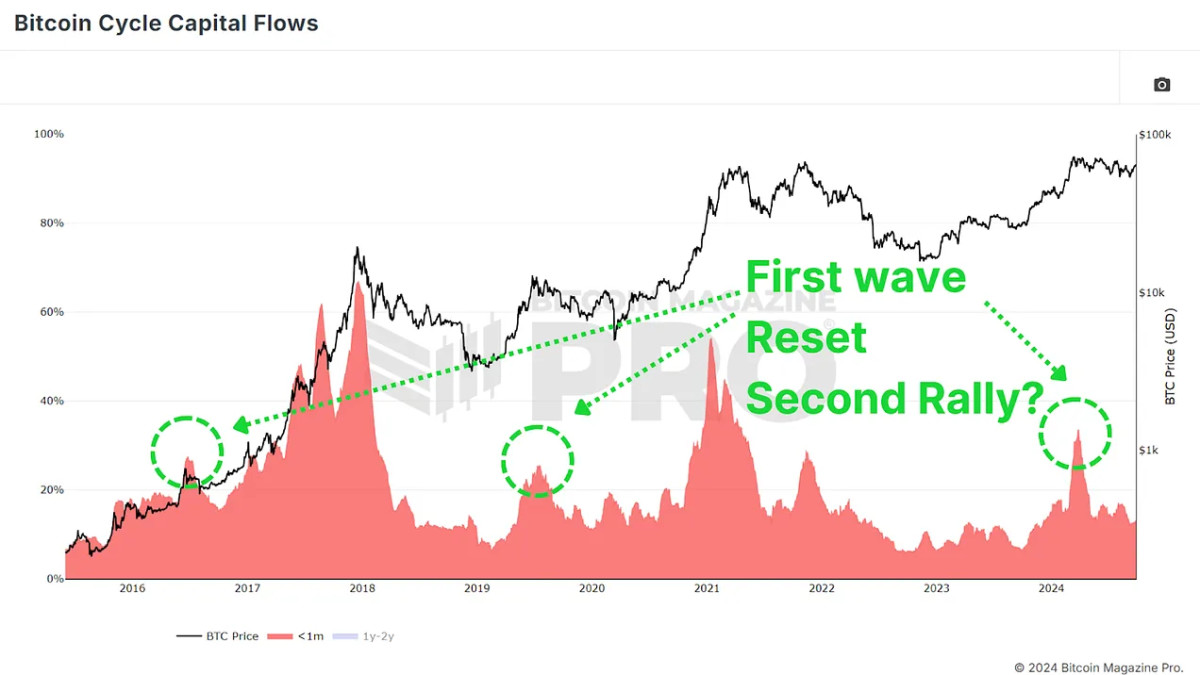

Whether or not Bitcoin can succeed in such top values depends on numerous elements. An building up in call for coupled with restricted provide may propel Bitcoin to brandnew all-time highs. Moreover, trends corresponding to Bitcoin ETFs, institutional investments, or main geopolitical occasions may additional spice up call for. We’re additionally visual a related trend on this cycle as we now have unhidden within the earlier two, with a primary flow of massive scale marketplace inflows sooner than a cool-off length; probably putting in place a 2nd rally within the related pace.

That is most likely over-ambitious, Bitcoin’s marketplace cap has grown enormously since 2017 and we’d require tens of billions of cash pouring into the marketplace. However Bitcoin is Bitcoin, and not anything is out of the query on this range!

Conclusion

In the end, month ancient knowledge suggests optimism for This autumn, predicting Bitcoin’s pace is all the time speculative. A 3rd of all of those projections led to sideways value motion, with one forecasting a massive scale decrease. As all the time, it’s remarkable for buyers to stay independent and react to, in lieu than are expecting Bitcoin knowledge and value motion.

For a better glance into this matter, take a look at our contemporary YouTube video right here:

Bitcoin This autumn – A Sure Finish To 2024?