Ripple, one of the crucial financially most powerful firms in all the crypto sector, blends conventional banking and finance with virtual property. This complete research addresses the query “What is Ripple?” and appears at its origins, technological advances and merchandise, marketplace dynamics, a possible IPO, and the continued prison struggle with the USA Securities and Trade Fee (SEC).

What Is Ripple?

Ripple occupies a singular area of interest within the blockchain universe, surroundings itself excluding standard cryptocurrency tasks. In contrast to lots of its friends aiming to switch banking as we understand it, Ripple seeks collaboration with the monetary machine. At its core, Ripple operates on a crowd database referred to as the XRP Ledger (XRPL), characterised through transparency and obvious get right of entry to.

The Ripple protocol diverges considerably from the likes of Bitcoin because it eschews the concept that of mining, the place transactions are showed and the community is tie through miners. In lieu, Ripple depends upon validators. Those validators play games a an important function in keeping up the community’s integrity. As an example, when a transaction is initiated—say, a person shifting finances to every other—the community’s validators will have to succeed in a consensus to substantiate this transaction.

Significantly, maximum validators are operated through Ripple Labs and its companions. They’re accountable for confirming all transactions inside the Ripple community. This unique machine empowers Ripple to kill transactions with important velocity and cost-efficiency. Then again, it additionally ends up in the next level of centralization in comparison to networks like Bitcoin or Ethereum.

Central to Ripple’s capability is the XRP token, continuously dubbed because the “bank coin.” It basically serves as a bridge forex for fiat transactions, embodying the essence of Ripple’s seeing to streamline international monetary exchanges. The XRP token prospers at the XRP Ledger (XRPL), a manifestation of dispensed ledger era (DLT). This mixture of era and seeing positions Ripple as a singular entity within the blockchain range, providing a mix of innovation and pragmatic collaboration with current monetary constructions.

Key Facets Of Ripple And XRP

- Incorrect Mining, Best Validators: The XRP Ledger does now not make use of mining for transaction affirmation or community safety. In lieu, Ripple depends upon validators. Those validators are an important in confirming transactions. Their consensus assists in keeping the community conserve and environment friendly.

- XRP: The XRP token is central to Ripple’s ecosystem. It’s pre-mined, that means its tokens have been created ahead of the undertaking’s crowd origination. Ripple advocates for XRP because of its minimum transaction charges, fast agreement, and scalability, dealing with as much as 1,500 transactions in line with 2nd.

- XRP Ledger (XRPL): This ledger is essential to recording information like balances and transfers. The XRPL facilitates fast settlements, permitting bills in native forex for concerned events, and helps bridging currencies for transactions.

- Distinctive Node Checklist (UNL): The XRPL operates thru a Distinctive Node Checklist, comprising 35 validators. For a transaction to be recorded, no less than 80% of those nodes will have to agree on its legitimacy.

- RippleNet: Isolated from the XRPL, RippleNet is an unique community evolved through Ripple for fee and change. It does now not worth XRP and do business in immediate agreement, monitoring of cross-border bills, and interplay inside a unified framework for monetary establishments.

- Ripple’s Virtue Instances: Ripple envisioned XRP to function as an spare to conventional techniques like SWIFT, improving world fee power. Moreover, Ripple needs to determine itself as a crypto liquidity supplier in addition to within the ground of Central Store Virtual Currencies (CBDCs).

Unveiling The Origins And Historical past Of Ripple

Ripple’s inception can also be traced again to an idea through Ryan Fugger in 2004. He envisioned a decentralized financial machine, Ripplepay, to empower folks of their monetary interactions. This concept laid the groundwork for what would ultimately transform Ripple.

In 2012, the progress took an important flip. Jed McCaleb, identified for his paintings at the Mt. Gox change, and Chris Larsen, a famend determine within the fintech sector, approached Fugger. They proposed a virtual forex machine using the Ripple protocol. This collaboration resulted in the status quo of OpenCoin.

Then, in 2013, OpenCoin was once rebranded to Ripple Labs. It was once all over this future that Ripple started to solidify its distinctive method to the blockchain and cryptocurrency international. In contrast to its contemporaries, which targeted only on a decentralized type, Ripple wanted to combine with the present monetary machine, in particular focused on the inefficiencies in cross-border bills.

The Worth Of Ripple XRP In The Ecosystem

XRP, as Ripple’s local cryptocurrency, performs a pivotal function within the Ripple ecosystem. Its worth stems from a number of distinctive options and functionalities that it brings to Ripple’s community.

- Bridge Foreign money: Probably the most number one makes use of of XRP is as a bridge forex in world transactions. This function is an important in RippleNet’s providing of environment friendly and cost-effective cross-border fee answers.

- Transaction Potency: XRP sticks out for its transaction velocity and minimum charges. The community can procedure 1,500 transactions in line with 2nd, with each and every transaction costing no less than 0.00002 XRP.

- Scalability And Environmental Sustainability: XRP’s pre-mined condition method all its tokens have been created ahead of the community went reside.

- Liquidity Supply: XRP serves as a supply of liquidity in Ripple’s On-Call for Liquidity product (now Ripple Bills).

- Decentralized Trade And Move-Chain Integration: The XRPL DEX, the decentralized change at the XRP Ledger, has been operational since 2012. It supplies a platform for buying and selling XRP and alternative cryptocurrencies with minimum charges.

- Felony and Regulatory Demanding situations: The function of XRP has been topic to scrutiny, particularly following the SEC’s lawsuit towards Ripple. The lawsuit’s focal point on whether or not XRP must be categorized as a safety has implications for its worth and buying and selling, in particular in the USA marketplace.

What Is The Remaining Between XRP And Ripple?

Figuring out the respect between XRP and Ripple is an important for greedy the overall scope of what Ripple Labs Inc. do business in within the blockchain and cryptocurrency area.

Ripple – The Corporate: Ripple refers back to the era corporate, Ripple Labs Inc., which specializes in growing and managing a world fee community. Based in 2012, Ripple’s number one challenge is to develop into the arena of economic transactions, making them quicker, extra conserve, and no more expensive. Ripple develops a number of blockchain-based merchandise, with RippleNet being its flagship community that facilitates cross-border bills.

XRP – The Cryptocurrency: XRP, at the alternative hand, is a virtual asset or cryptocurrency that operates at the XRP Ledger. It was once first evolved through Ryan Fugger and nearest enhanced through Jed Caleb and Chris Larsen – which resulted in what we now know as XRP.

Virtue Instances Of Ripple

Ripple and its related era deal numerous programs within the monetary sector, particularly in cross-border bills, crypto liquidity, and central storagefacility virtual currencies (CBDCs). Each and every of those worth circumstances represents an important development in how monetary transactions and operations are carried out within the fashionable hour.

Move-Border Bills

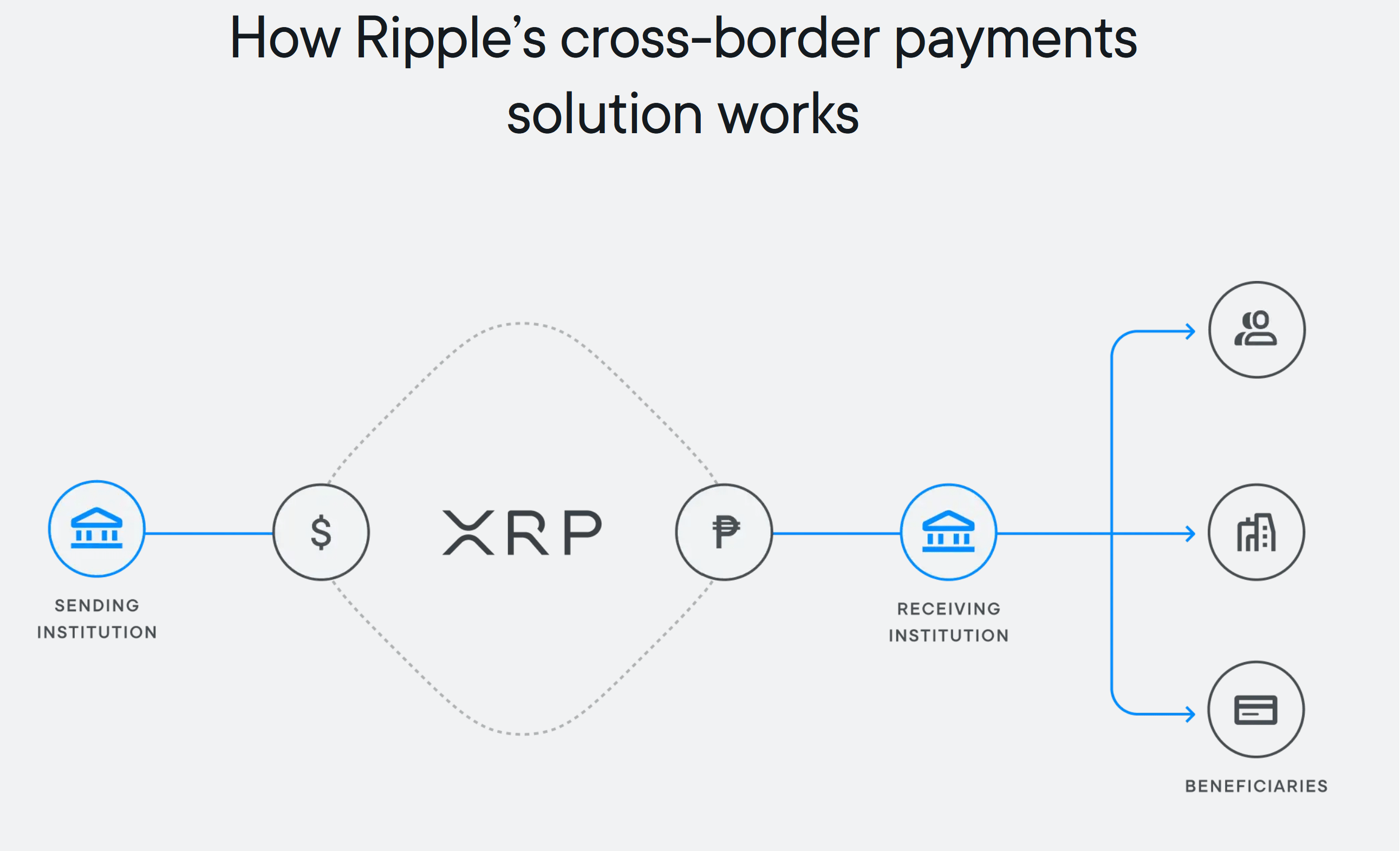

Ripple’s era, in particular thru RippleNet and Ripple Bills, considerably streamlines cross-border bills. Conventional world cash transfers are continuously gradual, pricey, and dense. Ripple addresses those problems through offering a extra environment friendly, clear, and cost-effective resolution.

RippleNet allows speedy transaction settlements and decreases the operational prices related to cross-border bills, making it a good looking possibility for banks and alternative monetary establishments. The worth of XRP as a bridge forex in Ripple’s On-Call for Liquidity carrier (untouched: “Ripple Payments”) additional complements this power through getting rid of the will for pre-funding accounts in vacation spot international locations, thus releasing up capital and lowering liquidity prices.

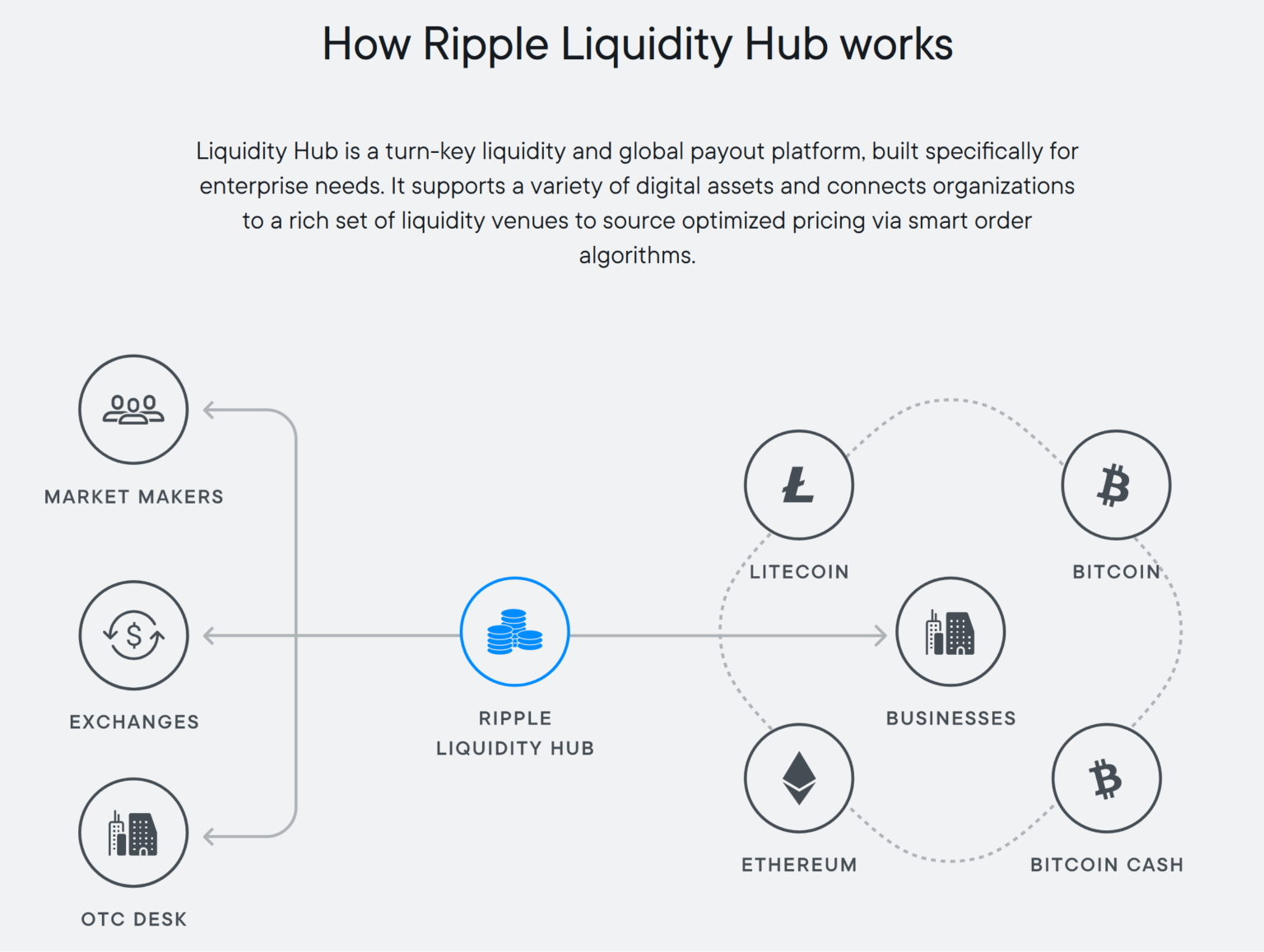

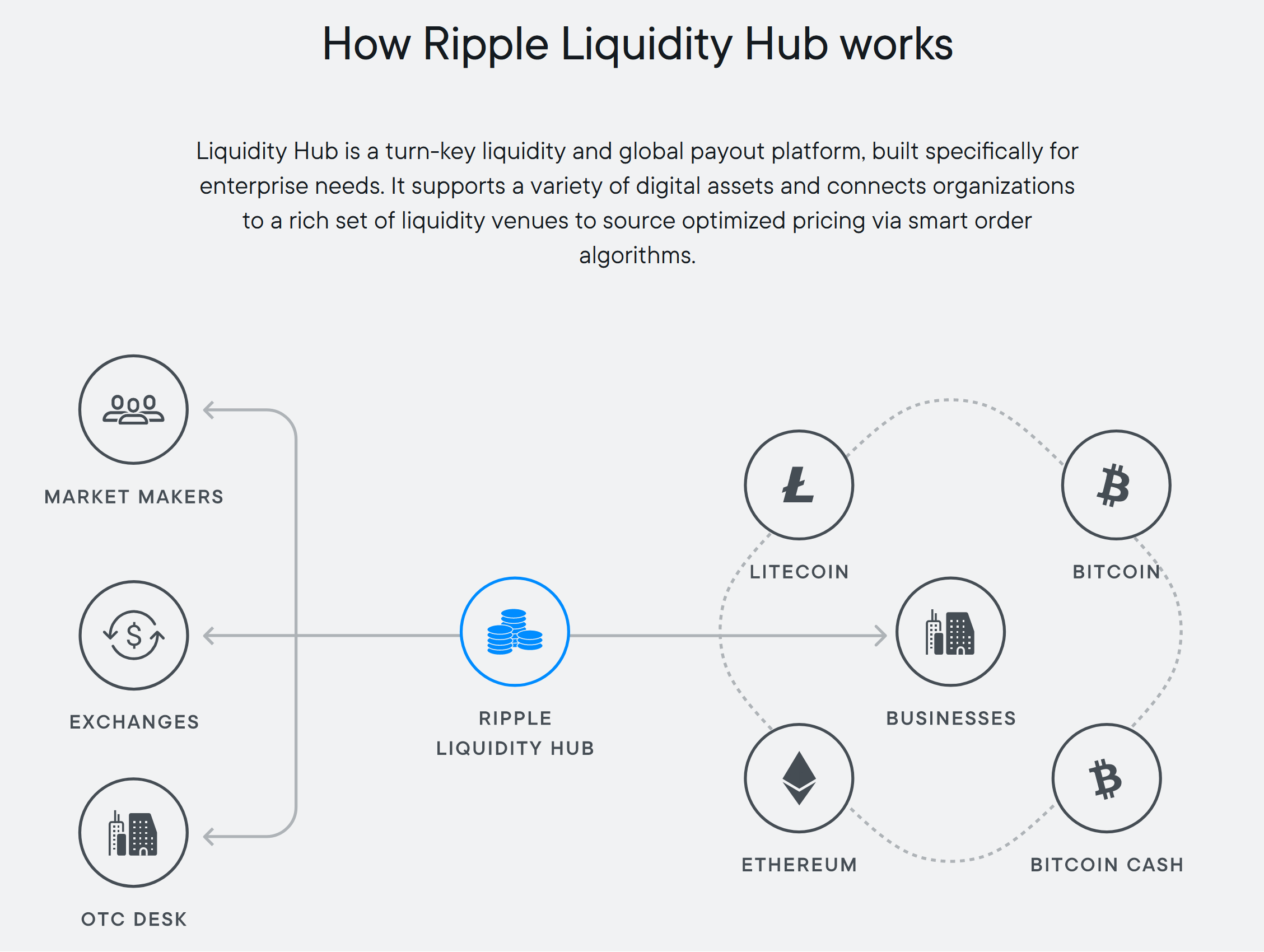

Crypto Liquidity (“Liquidity Hub”)

The Ripple Liquidity Hub serves as a groundbreaking platform for companies to supremacy their crypto liquidity wishes successfully. Designed basically for monetary establishments and alternative enterprises, it supplies a streamlined means to shop for, promote, and accumulation virtual property.

A key facet of the Ripple Liquidity Hub is its skill to deal optimized crypto liquidity. It achieves this through having access to aggregated liquidity swimming pools from numerous resources, reminiscent of exchanges and over the counter desks. This guarantees that companies can download the most productive imaginable costs for virtual property throughout a territory of venues.

Moreover, the platform simplifies virtual asset control for enterprises. It comes provided with an enterprise-level dashboard that facilitates the environment friendly control, buying and selling, and reporting of virtual property. This property is especially recommended for companies taking a look to streamline their crypto portfolio control.

One of the crucial cutting edge sides of the Ripple Liquidity Hub is its enlargement of get right of entry to to capital. The platform gets rid of the will for companies to accumulation pre-funded capital positions with more than one liquidity venues, because of its post-trade agreement property. This facet considerably complements capital power for enterprises.

In its constancy to interoperability and the inclusion of numerous virtual property, the Ripple Liquidity Hub first of all helps a numerous territory of virtual property together with BTC, ETH, LTC, ETC, BCH, and XRP, with the provision various through geography. Ripple plans to additional extend its choices, demonstrating its constancy to fostering an inclusive and aggressive crypto marketplace.

Central Store Virtual Foreign money

Ripple’s engagement within the construction of Central Store Virtual Currencies (CBDCs) is an important walk against modernizing the monetary ecosystem. Ripple has introduced a devoted platform for CBDCs, aiming to handover a unbroken end-to-end resolution for central banks, governments, and monetary establishments to factor and supremacy their very own virtual currencies.

Ripple’s CBDC platform is designed to handle more than one worth circumstances, together with each wholesale and retail CBDCs, in addition to issuing stablecoins. The platform’s features prolong to end-user wallets, permitting customers to safely accumulation virtual currencies and construct bills for items and products and services, alike to alternative banking apps. This comprises capability for offline transactions and non-smartphone worth circumstances, broadening the accessibility of virtual currencies.

Significantly, Ripple has been identified as a pacesetter within the CBDC range, topping aggressive leaderboards through Juniper Analysis and CB Insights for its CBDC era.

Ripple’s involvement in CBDC pilot tasks throughout numerous international locations showcases its constancy to supporting the advance and implementation of virtual currencies on the nationwide point. Remarkably, the corporate has partnered with a number of international locations, together with Palau, Bhutan, and Montenegro, to discover and assemble their respective CBDCs / stablecoins.

What Is RippleNet?

RippleNet is a dispensed community evolved through Ripple, designed to facilitate real-time, cross-border transactions. As a peer-to-peer dispensed utility, it maintains a digital ledger that emulates the jobs of Nostro and Vostro accounts regularly old in world banking.

RippleNet is understood for its two number one layers: a bi-directional messaging layer and a agreement layer. The messaging layer handles the verbal exchange of transactions, generation the agreement layer guarantees the general switch of finances.

It operates inside a cloud shape hosted through Ripple, which considerably lowers technical infrastructure prices for its customers. It integrates with monetary establishments’ middleware thru API operations, successfully replicating investment into RippleNet digital accounts.

Importantly, RippleNet is SOC 2 qualified, making sure prime requirements of safety, availability, confidentiality, and privateness. It improves the cross-border fee enjoy through providing environment friendly messaging, optimized agreement, and distinctive liquidity answers.

RippleNet’s clientele features a numerous territory of sectors, together with conventional remitters, virtual remitters, FX agents, fee carrier firms, and banks (encompassing international tier-1 banks, multi-country regional banks, native banks, and virtual banks), in addition to multinational companies.

What Is Ripple’s On-Call for Liquidity (Pristine: Ripple Bills)?

Ripple’s On-Call for Liquidity (ODL), now referred to as “Ripple Payments,” is a liquidity control resolution that facilitates immediate and environment friendly cross-border cash transfers with out requiring pre-funding within the vacation spot marketplace. It makes use of XRP as a bridge forex to supply liquidity on call for, enabling real-time treasure motion.

The evolution of ODL has resulted in important enhancements in power and person enjoy. To begin with, the product required bills to be originated in fiat forex, transformed to XRP, and upcoming once more transformed to fiat forex within the vacation spot nation. The delicate Ripple Bills permits consumers to ship XRP for cross-border bills immediately thru a crypto pockets, leveraging the pockets to supply XRP on call for.

This reduces friction within the fee stream and offers larger flexibility and option to consumers. It additionally streamlines the onboarding procedure for untouched companions and currencies, enabling more than one currencies thru a unmarried pockets.

The adoption of Ripple Fee has grown, with cutting edge firms like FlashFX the usage of it to backup bills in untouched currencies like GBP and EUR, which have been now not up to now supported. This enlargement is a part of Ripple’s broader international momentum, particularly in areas like Southeast Asia, the place there may be important expansion because of ambitious crypto laws and the presence of cutting edge firms. Firms like Novatti and Tranglo, as an example, play games an important function within the community as fiat on and off-ramps.

Ripple’s Possible IPO And Worth Predictions

Ripple’s doable Preliminary Crowd Providing (IPO) has been a subject matter of important hobby inside the cryptocurrency and monetary communities. Year Ripple has now not formally introduced plans for an IPO, there are brilliant speculations environment this risk.

In a up to date research, Wall Boulevard skilled Linda Jones urged that Ripple’s pre-IPO stocks may just doubtlessly arise through 2,000%. She identified that the flow valuation of Ripple’s pre-IPO stocks on Linqto stands at $35 in line with proportion. This interprets to a $5.7 billion valuation.

Jones emphasised the worth of the corporate’s really extensive holdings in XRP, with 42 billion XRP in escrow. They might give a contribution to an combination importance of roughly $107 billion, a ways exceeding its flow valuation on Linqto. This research considers the possible solution of the prison struggle with the SEC and its affect on XRP’s value, indicating optimism about Ripple’s era IPO valuation.

Ripple Vs. The SEC: A Complete Evaluation

As of early 2024, Ripple Labs has completed a number of noteceable victories towards the US Securities and Trade Fee (SEC). Listed below are the important thing tendencies:

- Abstract Judgment Win For Ripple (July 13, 2023): Ripple Labs completed a bias victory in its prison struggle with the SEC. The USA District Court docket for the Southern District of Pristine York dominated that XRP gross sales on exchanges and thru algorithms didn’t represent funding agreements. Because of this, those gross sales don’t seem to be topic to federal securities rules. Then again, the courtroom discovered Ripple’s direct institutional gross sales in violation of those rules. It deemed them unregistered do business in and gross sales of funding agreements.

- Denial Of SEC’s Interlocutory Enchantment (October 3, 2023): The SEC’s aim to enchantment the abstract judgment loss was once denied through Pass judgement on Torres. This marked an important setback for the regulator and underlined Ripple’s nourishing place within the lawsuit.

- SEC Drops Claims Towards Ripple Executives (October 19, 2023): The SEC withdrew its fees towards executives Brad Garlinghouse and Christian Larsen. This choice narrowed the lawsuit’s focal point only on Ripple Labs.

- Pending Trial and Therapies Segment: The trial, all set to happen between April and June 2024, might be essential for Ripple Labs. The primary focal point might be at the institutional gross sales of XRP importance $770 million, which have been deemed unregistered securities gross sales. The therapies section will resolve the consequences for those gross sales, with the SEC doubtlessly in search of all the quantity as fines.

For a better take a look at the XRP lawsuit, learn our devoted article.

FAQ: What Is Ripple

What Is Ripple?

Ripple is a era corporate that focuses on virtual fee protocols and forex change networks. Its real-time rude agreement machine and the cryptocurrency XRP are chief options.

Will Ripple Change SWIFT?

Ripple, generation serious about improving international monetary transactions, isn’t all set to totally change SWIFT. Then again, the corporate’s quicker and more cost effective answers deal a aggressive spare.

What Distinguishes XRP From Alternative Cryptocurrencies?

XRP sticks out amongst cryptocurrencies like Bitcoin and Ethereum because of its prime velocity and occasional transaction prices. This makes it in particular suited to speedy cross-border bills.

Will Ripple Progress Crowd?

Ripple plans to imagine going crowd as soon as it resolves its prison struggle with the SEC. The prospective IPO would rely at the result of the lawsuit and marketplace statuses.

Is Ripple Store Usefulness Anything else?

Lately, Ripple is a personal corporate, so it does now not have publicly traded keep. An evaluation of the corporate’s worth can most effective happen if it undergoes an IPO and turns into a crowd corporate.

Is XRP The Identical As Bitcoin?

Incorrect, XRP and Bitcoin are other. Bitcoin is a decentralized virtual forex with no central storagefacility, running on a peer-to-peer community. Ripple makes use of XRP for its fee era and is famend for its speedy transaction processing occasions.

Does Ripple Have A Just right Month?

Ripple’s era is topic to numerous elements. Those come with the end result of its lawsuit with the SEC, marketplace adoption, and total cryptocurrency marketplace traits. Its focal point on fee answers gifts doable expansion alternatives.

Who Invented Ripple?

Chris Larsen and Jed McCaleb co-founded Ripple. They based the corporate, first of all referred to as Opencoin, in 2012 ahead of renaming it to Ripple.

Featured symbol from Shutterstock

Disclaimer: The thing is supplied for tutorial functions most effective. It does now not constitute the evaluations of NewsBTC on whether or not to shop for, promote or accumulation any investments and of course making an investment carries dangers. You might be steered to behavior your personal analysis ahead of making any funding selections. Virtue knowledge supplied in this web page totally at your personal possibility.