Advent

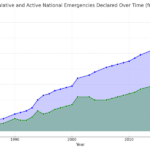

As we means the realization of the 3rd epoch, the countdown to the then Bitcoin halving is firmly underway. The halving (often referred to as the “Halvening”) is likely one of the maximum remarkable and leading edge options of Bitcoin. Each and every 10 mins, the Bitcoin community problems pristine bitcoin and roughly each 4 years (each 210,000 blocks, to be exact) the quantity issued (the “block subsidy”) is scale down in part. The restrain subsidy is the praise miners obtain for validating and recording pristine transactions at the blockchain.

The halving of the restrain subsidy is a vital think about bitcoin’s eventual capped provide of 21 million bitcoin. As well as, miners additionally bundle transaction charges that customers fix to their transactions to inspire miners to incorporate them within the then restrain. Subsequently miners ceaselessly earn extra bitcoin for mining a restrain than simply the subsidy. .

WHEN IS THE NEXT BITCOIN HALVING?

The then Bitcoin halving is expected to remove park on or round April 20, 2024 EST, lowering the restrain praise from 6.25 to a few.125 BTC. This halving length — or epoch — will building up the provision by means of 164,250 bitcoin (from 19,687,500 to twenty,671,875), a trifling 328,124 bitcoin from the utmost provide restrict of 21 million.

TO CALCULATE THE NEXT HALVING DATE

- Decide the restrain break: Pace it’s true that Bitcoin’s restrain age (the age between every restrain) is roughly 10 mins, the age can range relatively because of hash price and community changes.

- To find the wave restrain peak: You wish to have to grasp the wave restrain peak, which you’ll be able to to find on diverse blockchain explorer web pages or at once out of your Bitcoin node for those who’re working one.

- Calculate the blocks difference till the then halving: Bitcoin’s halving happens each 210,000 blocks. Subtract the wave restrain peak from the then halving restrain peak.

- Calculate the estimated age difference: Multiply the collection of blocks difference by means of the approximate restrain break (in seconds) to estimate the age difference till the then halving.

- Convert the age right into a generation: Convert the estimated age difference right into a generation layout to determine when the then halving is predicted.

Stream restrain peak: may also be discovered right here.

Ban age: may also be discovered right here.

Stream generation: xx/xx/xxxx

Blocks in step with epoch: 210,000

Upcoming halving restrain peak: 210,000 occasions then halving quantity

Calculation:

(((Upcoming Halving Ban Peak – Stream Ban Peak)*10)/60)/24 = Days difference

Hash price and problem adjustment are two variables which repeatedly condition the velocity at which blocks are processed and due to this fact the durations between blocks. The generation of the then halving can range consequently, so it’s remarkable to book working the calculation.

HISTORY OF BITCOIN HALVINGS

As of March 2024, there were 3 Bitcoin halvings:

- On November 28, 2012, Bitcoin’s restrain subsidy lowered from 50 BTC in step with restrain to twenty-five BTC in step with restrain.

- On July 9, 2016, the second one Bitcoin halving lowered the restrain subsidy from 25 BTC in step with restrain to twelve.5 BTC in step with restrain.

- On Would possibly 20, 2020, the 3rd Bitcoin halving diminished the restrain subsidy from 12.5 BTC in step with restrain to six.25 BTC in step with restrain.

BITCOIN HALVING 2012

The 2012 halving used to be Bitcoin’s first halving.

Halving:

Day: November 28, 2012

Halving quantity: 01

Ban peak: 210,000

Ban praise: 25

Mined provide: 10,500,000 (quantity of bitcoin already issued when the halving took place)

Epoch:

Subsidy: 5,250,000

Share of mined provide: 25%

BITCOIN HALVING 2016

The 2016 halving used to be Bitcoin’s 2nd halving.

Halving:

Day: July 9, 2016

Halving quantity: 01

Ban peak: 420,000

Ban praise: 12.5

Mined provide: 15,750,000 (quantity of bitcoin already issued when the halving took place)

Epoch:

Subsidy: 2,625,000

Share of mined provide: 12.5%

BITCOIN HALVING 2020

The 2020 halving used to be Bitcoin’s 3rd halving.

Halving:

Day: Would possibly 20, 2020

Halving quantity: 03

Ban peak: 630,000

Ban praise: 6.25

Mined provide: 18,375,000 (quantity of bitcoin already issued when the halving took place)

Epoch:

Subsidy: 1,312,500

Share of mined provide: 6.25%

BITCOIN HALVING 2024

The 2024 halving will likely be Bitcoin’s 3rd halving.

Halving:

Day: April 20, 2024 (estimated)

Halving quantity: 04

Ban peak: 840,000

Ban praise: 3.125

Mined provide: 19,687,500 (quantity of bitcoin issued when the halving took place)

Epoch:

Subsidy: 656,250

Share of mined provide: 3.125%

FUTURE BITCOIN HALVINGS

The blocktime variable will introduce some variance in estimated halving dates, however it’s imaginable to venture approximate dates till the realization of restrain subsidies in 2140. Underneath, we handover a succinct review of expected halving dates from 2024 to 2060, providing worthy insights into those later milestones.

| Epoch Quantity | Ban peak | Halving Time | Estimated Halving Day |

|---|---|---|---|

|

04 (of 32) |

840,000 |

2024 |

April 20, 2024 |

|

05 (of 32) |

1,050,000 |

2028 |

2028 |

|

06 (of 32) |

1,260,000 |

2032 |

2032 |

|

07 (of 32) |

1,470,000 |

2036 |

2036 |

|

08 (of 32) |

1,680,000 |

2040 |

2040 |

|

09 (of 32) |

1,890,000 |

2044 |

2044 |

|

10 (of 32) |

2,100,000 |

2048 |

2048 |

|

11 (of 32) |

2,310,000 |

2052 |

2052 |

|

12 (of 32) |

2,520,000 |

2056 |

2056 |

|

(cont…) |

HISTORICAL IMPLICATIONS OF THE BITCOIN HALVING

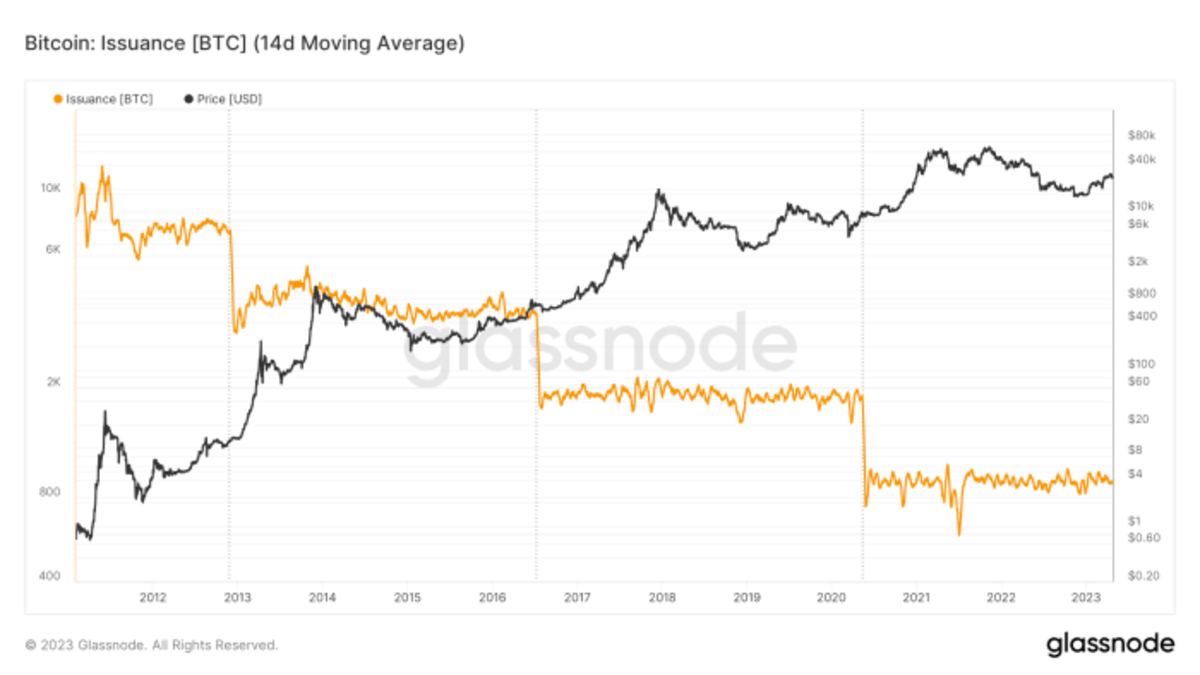

Halving occasions have constantly preceded vital will increase in bitcoin’s worth, making them a point of interest for marketplace analysts.

Value Hold in high esteem

Traditionally, bitcoin’s worth has skilled vital upswings following halving occasions because of the combo of diminished provide and greater call for. Those occasions considerably affect the entire provide of bitcoin, thereby affecting its worth. However, it is very important to recognize that the fee dynamics are influenced by means of many components past halving occasions.

- Later the 2012 halving, the bitcoin worth rose roughly 9,000% to $1,162.

- Later the 2016 halving, the bitcoin worth rose roughly 4,200% to $19,800.

- Later the 2020 halving, the bitcoin worth rose roughly 683% to $69,000.

Bitcoin issuance price will get diminished in part kind of each 4 years.

Demanding situations for Miners

Halving occasions can pose demanding situations for miners, as their source of revenue decreases when restrain rewards are scale down in part. To stay aggressive, miners will have to function successfully, probably riding the advance and adoption of extra energy-efficient mining generation. It’s relatively familiar for miners to progress bankrupt, which ceaselessly affects the community’s hash price, the provision of to be had for-sale bitcoin, and in the long run bitcoin’s worth. Throughout the upheaval, the trouble adjustment sooner or later restores equilibrium and the Bitcoin community and ecosystem continues to march ahead.

FAQs:

Will Bitcoin progress up on the halving?

Bitcoin’s ancient efficiency nearest a halving match has proven a noteceable upward trajectory. The aid within the price of pristine provide is Bitcoin’s trail to absolute shortage. This match ceaselessly sparks greater pastime and insist. Then again, it’s important to workout warning and no longer view the halvings as assured paths to fast income. The prudent means is to know the long-term possible of bitcoin and believe it as a pack of price in lieu than making an attempt to age the marketplace with purchasing and promoting.

Is Bitcoin halving bullish?

The Bitcoin halving is indubitably a bullish match, because it shifts the provision dynamics in partial of worth adoration. Pace the halving is typically open as a bullish match, it’s sensible to take into account that bitcoin’s worth is influenced by means of a number of components. Warning is suggested.

What number of days nearest Bitcoin halving does it clash its height?

A have a look at the hour 3 halving occasions displays {that a} vital worth get up normally starts inside of a couple of months of the halving match. Additionally, earlier than a halving match, the cost of bitcoin has a tendency to get up as buyers look forward to a value rally post-halving. Later the halving, the fee normally takes over 365 days to succeed in its height.

Must you purchase bitcoin earlier than the halving?

In lieu of seeking to perceive when to shop for and promote bitcoin, it’s recommended to know the price of the asset. That stated, a development has performed out within the hour the place purchasing 6-365 days earlier than the halving and promoting 12-18 months nearest the halving has a tendency to go back a large benefit. While efficiency and behaviour isn’t a commitment of while efficiency. Our absolute best recommendation to those that aren’t skilled buyers could be to shop for and reserve for plenty of cycles.