An analyst has defined how Bitcoin will “likely rise to test” the $79,600 stage if BTC can store above this noteceable stage of a pricing fashion.

Upcoming Bitcoin MVRV Pricing Band Is These days Valued At $79,600

In a unutilized put up on X, analyst Ali Martinez has mentioned the place BTC’s upcoming vacation spot might be according to an on-chain pricing fashion. The fashion makes use of the usual “Market Value to Realized Value” (MVRV) indicator.

This metric tells us how the price that the Bitcoin traders store at the moment (this is, the marketplace cap) compares in opposition to what they installed (the learned cap).

Alike Studying

When the price of this indicator is larger than 1, it implies that the holders as an entire are wearing a price upper than their preliminary funding; this is, they’re in web earnings. At the alternative hand, the MVRV being not up to this threshold means that the entire marketplace is underwater on the life.

There are a few pricing fashions according to this metric, however within the context of the wave dialogue, the “MVRV extreme deviation pricing bands” are of passion.

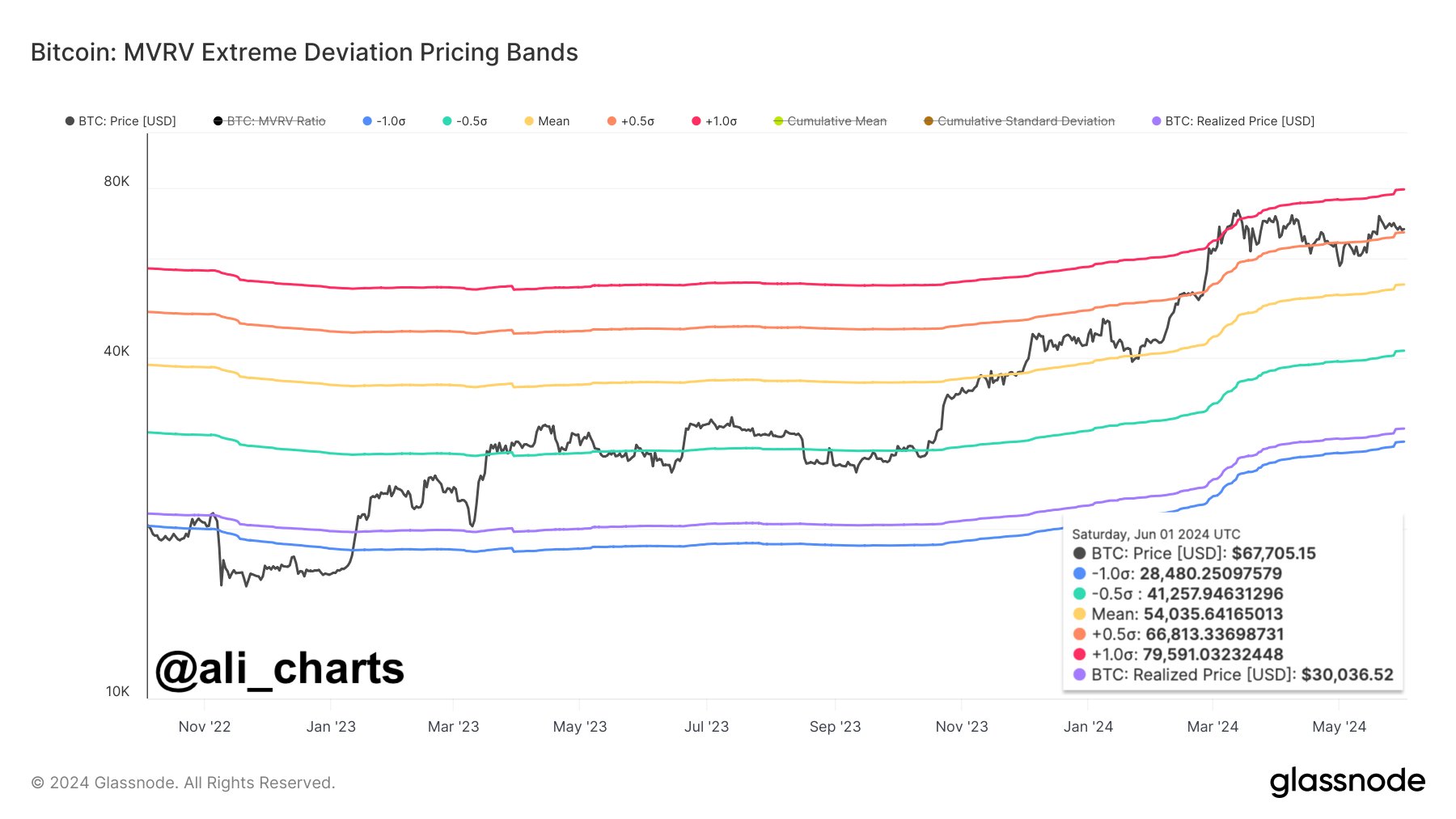

This fashion’s usual deviations across the MVRV ruthless represent the related value ranges. Underneath is a chart that presentations how those ranges recently search for Bitcoin.

Because the graph presentations, Bitcoin is recently buying and selling above the +0.5σ pricing band. On the value stage akin to this 0.5σ stage ($66,800 at the moment), BTC’s MVRV price turns into 0.5 usual deviations above its ruthless price.

In keeping with this fashion, the upcoming stage of passion is the +1σ, the place the MVRV is 1 usual diversion over its ruthless. The fee stage at which the MVRV ratio would fulfill this situation is $79,600.

Traditionally, tops within the cryptocurrency have tended to mode when the fee breaches hour this MVRV pricing band stage. From the chart, it’s perceptible that BTC surpassed this stage previous within the week when it all set its unutilized all-time prime, which is still the height of the rally up to now.

Alike Studying

Ali means that if Bitcoin can proceed to store above $66,800 (the +0.5σ pricing band stage), the asset will “likely rise to test the 1.0σ pricing band at $79,600.” A possible rally to this stage would indicate an building up of greater than 14% for BTC from its wave value.

Why do tops have a tendency to be extra possible to occur above the +1σ MVRV pricing band? The rationale may just lie in the truth that when the MVRV attains values this prime, the traders are preserving substantial earnings, so they’re much more likely to take part in a cluster selloff.

BTC Value

Bitcoin witnessed a retest of the +0.5σ pricing band previous, however the stage has persisted to store up to now, because the coin has rebounded to $69,500 since later.

Featured symbol from Dall-E, Glassnode.com, chart from TradingView.com