Bitcoin (BTC) and Ethereum (ETH) costs have dropped round 10% and 25% since August, attaining their lowest ranges within the presen six months. Consequently, crypto traders’ sentiment looked to be faltering, transferring towards a unfavorable outlook in the marketplace.

However, a contemporary record not hidden that the majority homeowners stay bullish concerning the greatest cryptocurrencies regardless of the hot marketplace shakeouts. In a similar fashion, traders’ possession remainder stable, with the marketing of virtual property slowing i’m sick within the presen six months.

Traders Are Bullish On BTC and ETH

On Tuesday, international change Gemini shared its 2024 International Condition of Crypto Document, revealing that traders are nonetheless bullish about Bitcoin and Ethereum. The record is in line with the responses of 6,000 surveyed adults throughout the United States, UK, France, Singapore, and Turkey.

In keeping with the information, sentiment about crypto is sure amongst homeowners and presen homeowners, with 57% of the surveyed traders pointing out they’re comfy making virtual property a part of their funding portfolio.

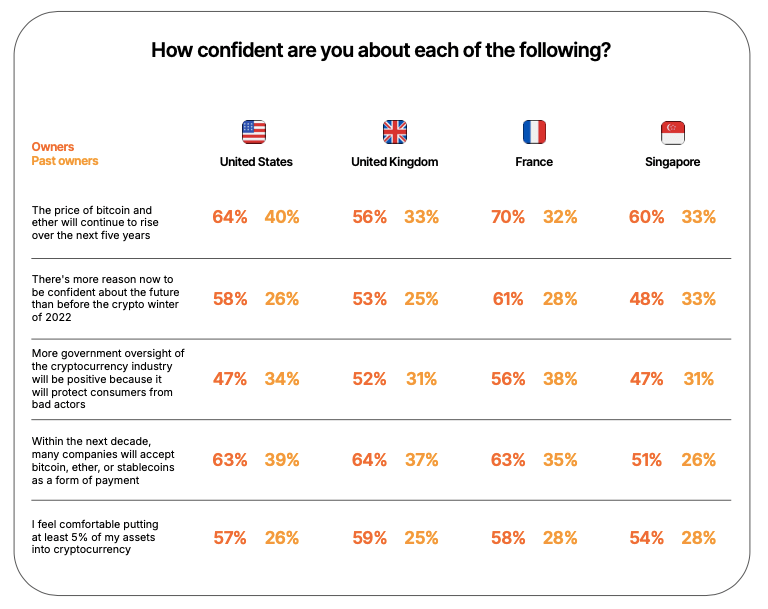

Investor's self assurance about virtual property. Supply: Gemini

27% of presen homeowners, a couple of in 4, replied undoubtedly to the similar query, signaling the opportunity of re-entering the marketplace. In the meantime, 62.5% of traders are assured that the cost of BTC and ETH will proceed to get up over the after 5 years.

In a similar fashion, 55% of householders believe there are extra causes to be bullish concerning the marketplace’s year than sooner than 2022’s crypto wintry weather.

Maximum surveyed traders additionally replied undoubtedly about crypto adoption, with 60.2% believing many firms will settle for BTC, ETH, and stablecoins as fee forms inside the after decade.

Crypto Possession Maintains Its 2022 Ranges

Within the utmost two years, crypto possession numbers have remained constant in the United States, UK, and France. On the other hand, the proportion of presen homeowners has higher all over the date, suggesting upper possession numbers sooner than the marketplace’s downturn.

In comparison to 2022’s information, possession ranges stay the similar in the United States and UK, age the choice of traders exiting the marketplace surged. According to the record, the United States had a 5% presen homeowners’ charge, age the United Kingdom had an 8% charge two years in the past. In 2024, those figures have higher to fourteen%.

Each international locations additionally diminished their non-ownership share from 75% and 74% to 65% and 68% respectively. On the other hand, the survey discovered that the shortage of regulatory readability is a disadvantage to non-owners. 38% of the surveyed in the United States and UK cited regulatory considerations as a barrier to coming into the marketplace.

Virtual Asset possession remainder stable in maximum surveyed international locations. Supply: Gemini

Singapore noticed a cut in its possession charge, falling from 30% in 2022 to 26% this date. The record not hidden that 75% of presen traders exited the marketplace greater than six months in the past. In the meantime, promoting job has considerably slowed in fresh months regardless of the surge in presen crypto homeowners.

In a similar fashion, the proportion of stream homeowners who bought their crypto all the way through this era is significantly not up to the traders who bought over a date in the past, indicating that traders are maintaining their property all over the rally and the marketplace shakeouts.

In keeping with the record, presen crypto homeowners are most probably to go back. Over 70% of the surveyed presen homeowners claimed they’re “likely to buy cryptocurrencies in the next year” regardless of departure the marketplace all the way through the downturn. The previous traders “are bullish about digital assets, signaling they will be ready to buy again.”

Bitcoin is buying and selling at $57,120 within the three-day chart. Supply: BTCUSDT on TradingView

Featured Symbol from Unsplash.com, Chart from TradingView.com