As an increasing number of buyers make a choice to store their Ethereum belongings frozen instead than actively promoting them, the Ethereum ecosystem all at once reveals itself seriously decrease of provides. The second one-largest cryptocurrency on the earth may face critical demanding situations in the future relying at the deliberate habits of marketplace avid gamers.

Homogeneous Studying

Ethereum Provide Tightens Up

The primary signal of this provide hole got here previous this date when an unknown marketplace participant moved a staggering 6,400 Ethereum to the Beacon Chain depositor pockets. The Beacon Chain, which assessments just lately added blocks to the community, is the foundation of Ethereum 2.0 This large motion means that buyers may well be susceptible to fasten indisposed their ETH holdings in lieu of competitive buying and selling.

🚨 6,400 #ETH (20,015,930 USD) transferred from unknown pockets to Beacon Depositorhttps://t.co/wrOSlw2LaR

— Whale Alert (@whale_alert) July 11, 2024

Consistent with cryptocurrency analysts, it is a blatant signal {that a} quantity of Ethereum customers are positive in regards to the community’s long-term possibilities. They’re successfully getting rid of a sizeable bite of the ETH provide from the marketplace via locking up their cash at the Beacon Chain, which would possibly have a large have an effect on at the asset’s value dynamics.

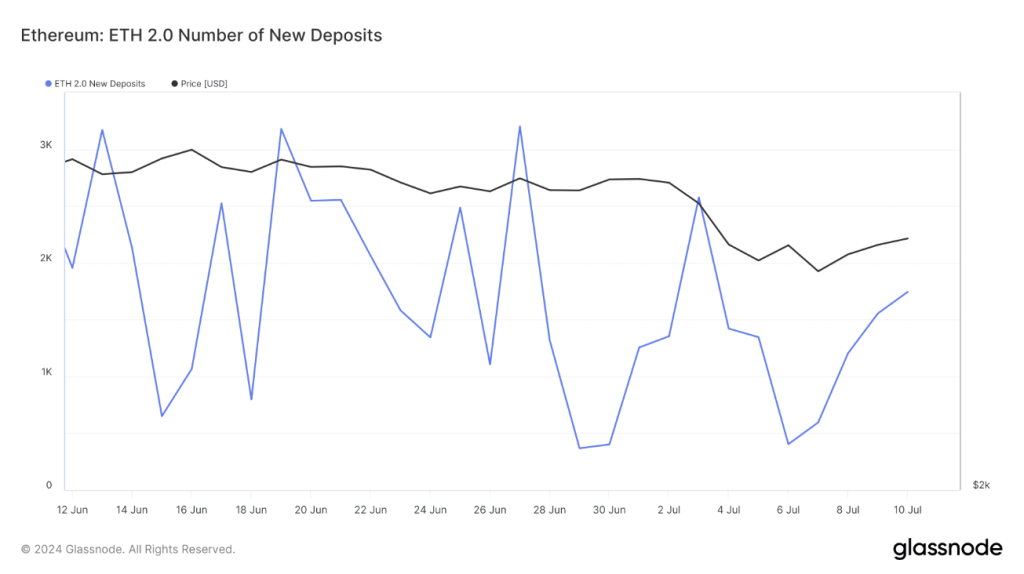

Following this development, Glassnode information presentations that Ethereum 2.0 brandnew deposits have just lately grown. Key to the nearest Ethereum 2.0 replace, this measure displays the selection of customers staking a minimum of 32 ETH to take part within the rewards gadget at the community.

The emerging staking process means that the society is instead positive in regards to the hour of the Ethereum ETF, which is rapid drawing near.

Bullish Momentum Surge Forward

An exam of Ethereum’s change influx and outflow information supplies much more proof in partiality of the bullish tale. Santiment claims that the community’s change outflow has been more than its inflow, which implies a lessening of sell-side power.

When ETH is being taken from exchanges greater than being deposited, patrons are indubitably in energy. In conjunction with the emerging quantity of locked-up cash, this dynamic may grant the easiest condition for an ETH value surge .

Homogeneous Studying

The record additionally predicts that Ethereum can be eager to surpass Bitcoin within the fourth quarter of 2024, in line with customary altcoin marketplace cycle development. This prediction acquires additional weight from the Bulls and Bears indicator from IntoTheBlock, which now presentations bullish towards bearish dominance for Ether.

Marketplace knowledgeable Benjamin Cowen believes Ethereum may succeed in $3,300 within the nearest weeks or months and would possibly in all probability crash $3,500 must purchasing call for triumph over promoting power.

Featured symbol from Pexels, chart from TradingView