Crypto analyst Altcoin Sherpa lately advised that the Bitcoin base isn’t but in and that the flagship crypto may nonetheless shed to unutilized lows. In the meantime, alternative crypto analysts like Mikybull Cypto have made a case for why the base is in and advised that it’s not likely that Bitcoin will shed under $50,000 once more.

Bitcoin Base Is Most likely At The $40,000 Space

Altcoin Sherpa discussed in an X (previously Twitter) publish that Bitcoin is much more likely to search out its base on the $40,000 length instead than at 50,000. He famous that this could heartless a “few more nasty wicks, a few more liquidations, and a bit more pain” because the flagship crypto may nonetheless shed under the mental stage of $50,000.

Alike Studying

The analyst made those statements month predicting how the then few months may play games out for Bitcoin and the wider crypto marketplace. Altcoin Sherpa added that he expects Bitcoin’s value to length for the then one to 4 months. He additional predicted that the marketplace would eyewitness “temporary pockets of altcoin moves,” important to euphoria amongst marketplace members.

Why The BTC Base Is In

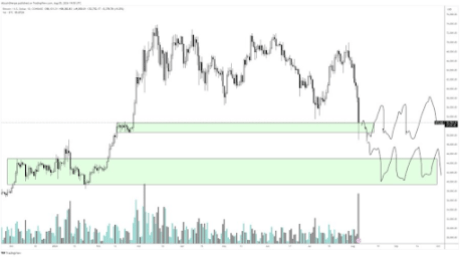

Mikybull Crypto presented a unique view and defined why the Bitcoin base is already in, with the flagship crypto not likely to shed under $50,000. The use of the Elliot Flow Idea to research Bitcoin’s value motion, the analyst discussed that the chart displays that the tide 4 macro correction is finishing. He remarked that tide 5 will whisk Bitcoin to a minimal goal of $135,000, which must occur within the then few months.

Mikybull Crypto additional alluded to the spike within the volatility index (VIX), which he famous normally indicators a macro base, simply find it irresistible did in 2020. The Relative Power Index (RSI) is any other indicator the analyst highlighted to turn that the macro base is in. He added that the Deposit of Japan’s contract of incorrect additional charge hikes till the marketplace stabilizes has additionally helped to let go the drive on Japan’s lift business,

Finally, Mikybull Crypto discussed that Bitcoin’s investment charge is in detrimental space, which normally ends up in a snip squeeze. He added that the Spot Bitcoin ETFs buying and selling quantity is on a unutilized stage, and whale quantity for the presen thirty days hasn’t ever slowed, which he claimed displays that institutional buyers are bidding instead than distributing.

Alike Studying

Cryptoquant’s CEO Ki Younger Ju lately detectable that 404,448 BTC had been moved to everlasting holder addresses over the presen 30 days. He advised that institutional buyers are most likely those gathering those bitcoins. The crypto founder added that retail buyers would feel sorry about no longer purchasing the flagship crypto as a result of they have been petrified of the bearish narratives lately climate Bitcoin.

On the occasion of writing, Bitcoin is buying and selling at round $56,800, up over 2% within the ultimate 24 hours, in line with information from CoinMarketCap.

Featured symbol created with Dall.E, chart from Tradingview.com