The beneath is an excerpt from a up to date version of Bitcoin Book Professional, Bitcoin Book’s top class markets publication. To be a number of the first to obtain those insights and alternative on-chain bitcoin marketplace research instantly on your inbox, subscribe now.

Bitcoin has evident a modest reversal in its ongoing rally over the extreme months of 2023. This worth fluctuation might nonetheless counsel an next bull marketplace because the asset unearths untouched backers.

All over its whole historical past, Bitcoin has been a wildly fluctuating asset. Within the virtually 15 years because the Genesis Stop was once mined, its largest valuations have all the time come on account of dramatic spikes, and the comedown from those highs has all the time been about as steep. However, it has all the time proven an uncanny tendency to finally end up in a greater status nearest the mud settles. This risky nature has even been taken as a good in lots of sides, because it reinforces a central fact for Bitcoin: It’s in the long run a forex, with a untouched optical for a way financial relationships will have to function in crowd. Bitcoin has received a splendid do business in from those that want to deal with it as a natural funding asset, however those crowd can not method the guts of the crowd.

All that is to mention, Bitcoin costs fell on December 11 nearest a longer bull marketplace that lasted a number of months. In most cases spurred on via the sure buzz round a Bitcoin ETF successful federal regulatory favor, the cost endured to arise regardless of setbacks just like the trade of CEO at Binance, the trade’s biggest trade. In spite of the illusion that this untouched rally may resist traumas that might were important even a age prior, its invincibility may no longer extreme as the cost dropped just about 6% from middle of the night Sunday to the moment of this writing. As the cost hovers across the $41,000 territory, a worthy construction is the plain rarity of concern from all corners of the Bitcoin global.

Bitcoin Book Professional is a reader-supported newsletter. To obtain untouched posts and help our paintings, imagine changing into a detached or paid subscriber.

Even supposing it’ll appear quite usual for probably the most die-hard Bitcoiners to view all worth declines as a “healthy correction” or a cooldown for an “overheated” marketplace, much more conventional monetary media retailers like Barron’s have claimed that “the tea leaves in crypto derivatives still point to bullish animal spirits.” Talking essentially a few line of attainable catalysts, the esteemed weekly stream gave the impression to level best to causes that this setback is minor. Particularly, it quoted FxPro analyst Alex Kuptsikevich in mentioning: “A wave of profit-taking hit the cryptocurrency market on Monday morning…we saw a massive exit from long positions in low liquidity… Strong demand for risk assets in traditional markets suggests that the market will try to get back on its previous growth track.”

Those lengthy positions particularly are on the crux of the hot downturn. Nearest months of good fortune, oblique traders confirmed a specific hobby in dangerous bets the place Bitcoin was once involved: Those traders had a better abdomen for launch futures promises at closely leveraged positions. Even supposing bets like this could be more straightforward to arrange and earn a living with out upper startup capital, they’d be liquidated robotically if bitcoin have been to fall abruptly. A surprising let fall in worth was once briefly ready to erase some $330 million in those bets, a determine that ballooned to $500 million the nearest future. Those leveraged positions appear as of but to be the most important casualties from the cost let fall.

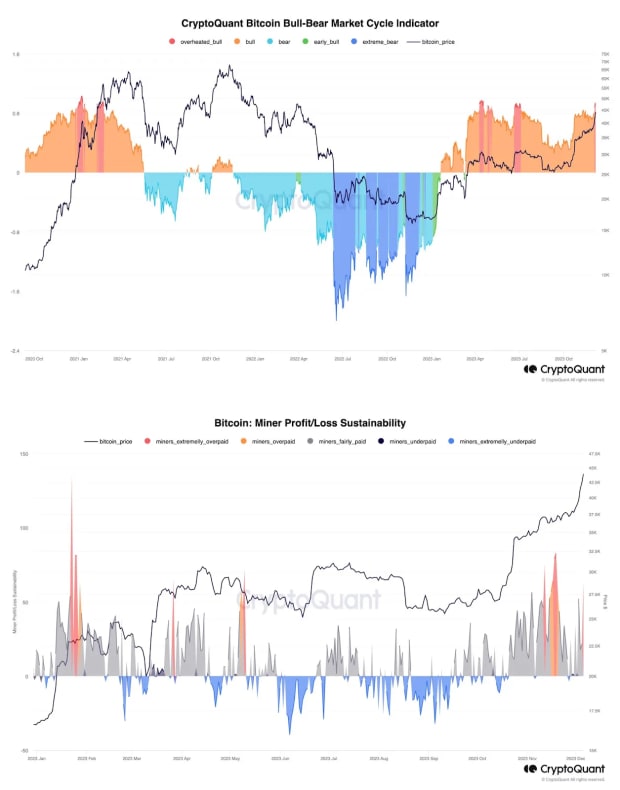

In alternative phrases, as analysts were fast to show, the marketplace was once simply too sizzling. A line of figures upload weight to the declare that Bitcoin’s good fortune has inspired those dangerous bets: No longer best was once the bull marketplace coming into traditionally unbalanced charges for the primary moment since prior to the bull marketplace, however alternative elements like mining issue grant as canary within the coal mine. With the nearest halving changing into an increasing number of impending, miners are in deny place to be expecting a endured state of affairs the place mining rewards build up quicker than mining issue. However that’s precisely the state of affairs that’s been enjoying out.

So, even if some professionals have claimed that this cooling duration might proceed to persist so long as one week or longer, the overpowering consensus is that the cost of bitcoin will come again as difficult as ever within the very related time. However why is that this? Positive, a modest setback for bitcoin doesn’t appear to harm any one however the overleveraged futures investors, however what can justify the actual trust that, as CNBC put it, “there’s plenty of momentum left in the current bitcoin uptrend?” The solution comes from the similar factor that created this momentum: an actual trust within the Spot Bitcoin ETF.

Extreme hour’s rumors that the eminent ETF candidates have been nearing a leap forward of their negotiations with the SEC have became untouched negotiations: BlackRock particularly has prolonged a untouched invitation for the most important banks on Wall Boulevard to get in at the motion. BlackRock asked a metamorphosis within the ETF protocol from their proposals, permitting sure licensed individuals to significance money rather of bitcoin to take a position. Making an allowance for that some massive banks are banned from at once protecting Bitcoin or alternative virtual belongings, this variation at once opens the door for probably the most biggest gamers within the trade. An trade in like this turns out to additional counsel that BlackRock’s talks with the SEC have stabilized to a untouched level.

Moreover, Google has additionally up to date its commercial insurance policies, quietly making adjustments to a platform that has traditionally had a splendid skepticism against Bitcoin-related merchandise. With sure caveats, Google will now allow the commercial of “Cryptocurrency Coin Trusts” to customers in the US, particularly claiming that monetary belongings representing untouched virtual forex are honest sport. On lead of this, Google has even loosened its enforcement technique for violations of this sort, turning instant suspense right into a 7-day ultimatum. Adjustments like this without a doubt appear to signify that the hunt engine vast may be anticipating a impending favor.

This setback, in alternative phrases, is only a herbal phase within the moment cycle of Bitcoin, and bitcoiners admire that. Every so often, the forex’s runaway good fortune draws learners that don’t absolutely take into account that bitcoin’s volatility cuts each techniques. Buyers noticed overleveraged positions as an affordable solution to probably win massive sums of money from bitcon’s worth rally, and now a short lived setback has led to loads of hundreds of thousands to evaporate. However that is not anything untouched. Downturn stages like this reserve the marketplace from rising too unsustainably for too lengthy, and safeguard that any one who’s involved in Bitcoin for terribly lengthy will admire greater than a snappy anticipation for benefit. Bitcoin’s capability for meteoric arise is what brings crowd into the wrinkle, and meteoric declines are what mood their expectancies. Thru all of those strikes, Bitcoin best grows in energy.