Bitcoin, the flagship cryptocurrency asset is lately within the limelight later experiencing a worth fix, enabling BTC to surpass the $61,000 threshold. Following the sure proceed, the coin has as soon as once more demonstrated its top within the cryptocurrency dimension and solidified its place because the lead reliable virtual asset, with its marketplace percentage achieving a top no longer perceivable in additional than 3 years.

The Marketplace Is Turning into Extra Ruled By means of Bitcoin

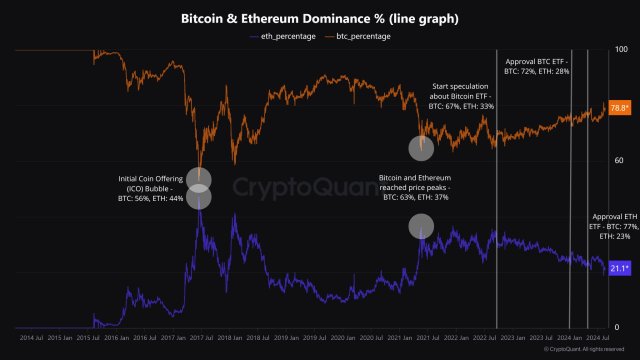

CryptoQuant, a eminent on-chain analytics platform shared the sure building at the X (previously Twitter) platform, which represents BTC’s expanding energy and tenacity within the ever-evolving and unstable global of cryptocurrencies. Bitcoin dominance has larger in spite of fresh marketplace fluctuations, attracting a larger percentage of the general marketplace capitalization of virtual property.

Consistent with the platform, compared to the marketplace cap of Ethereum, the second one biggest crypto asset, Bitcoin’s dominance has grown considerably, achieving a 40-month prime of about 78.5%. This stand in dominance means that crypto buyers are extra in call for for BTC, while Ethereum’s appeal has no longer been in a position to retain up.

The publish learn:

Within the chart beneath, you’ll be able to see how Bitcoin’s dominance has expanded relative to Ethereum’s marketplace cap, now hitting a 40-month top with a dominance of 78.5%. This means a more potent call for for Bitcoin amongst buyers, year Ethereum’s enchantment has no longer (but) matched up.

The on-chain platform perceivable that the dominance of BTC began to ascend in past due 2022 because of the mounting rumors shape a Spot Bitcoin Alternate-Traded Charity (ETF), which was once nearest licensed in January this time and has perceivable really extensive inflows ever since.

Regardless of a related state of affairs taking place with Ethereum, this development nonetheless has no longer modified. In particular, that is demonstrated by means of the low figures for the spot Ethereum ETF, which displays the limited call for for ETH.

For the reason that primary occasions just like the Preliminary Coin Providing (ICO) bubble and bubble top are in a position to vary this development as perceivable in 2021, CryptoQuant contends that ETH will want to revel in an similarly vital match to deliver to tamper with this development, and probably dominate the marketplace.

Since altcoins in finding it tough to maintain momentum, BTC’s expanding dominance highlights investor consider within the cryptocurrency’s long-term worth, underscoring its resilience and enchantment as a loyal bind of worth.

BTC Value Studies Bullish Efficiency

Lately, Bitcoin is exhibiting a good momentum later rebounding from the $58,000 help degree. With the rising optimism across the crypto asset, it’s most likely to draw extra positive aspects because the bulls appear to have taken keep an eye on of the marketplace as soon as once more.

Moreover, with the FOMC assembly arising in September, a number of analysts imagine that the development will handover as a catalyst for a worth surge as soon as the Federal Stock (FED) cuts ailing charges.

On the day of writing, Bitcoin had garnered positive aspects of over 3% within the while date and was once buying and selling at $61,155. Its marketplace cap and buying and selling quantity have additionally larger by means of greater than 3% and nil.67% respectively within the while date.

Featured symbol from Unsplash, chart from Tradingview.com