Bitcoin can’t appear to loose the $60,000 worth degree because it continues to do business in hesitation. On Saturday, August 3, the cryptocurrency skilled any other genius subside, in short dipping underneath the $60,000 mark.

Despite the fact that this let go lasted just a few mins, it used to be relatively important, particularly for the reason that Bitcoin had traded above $62,000 previous the similar pace. This fluctuation has significantly impacted marketplace individuals, chief to the liquidation of various lengthy positions.

Matching Studying

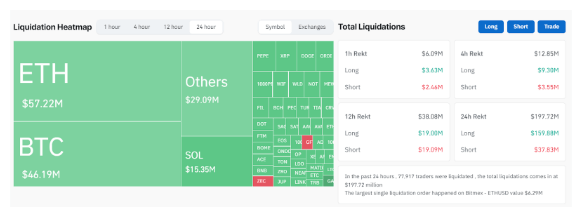

On the year of writing, over $197 million usefulness of leveraged positions were liquidated within the pace 24 hours. Significantly, this determine soared to up to $288 million right through the height of the marketing force.

Bitcoin And Marketplace Liquidations

The chronic incapacity of Bitcoin to uphold a solid place above $60,000 highlights the hesitation and speculative nature of the cryptocurrency marketplace. Investors and buyers stay wary, carefully tracking its worth actions.

This wary manner has most probably been amplified by way of fresh stories of repayments initiated by way of the bankrupt crypto lender Genesis International Capital, which flooded the marketplace with backup virtual belongings, essentially Bitcoin and Ethereum.

Bearing in mind Bitcoin and Ethereum’s dominance over the marketplace, this wary manner has inadvertently resulted in a lingering bearish sentiment environment alternative cryptocurrencies. Despite the fact that Bitcoin and Ethereum skilled the absolute best liquidated positions, the have an effect on has spilt over into alternative virtual belongings.

In step with Coinglass information proven underneath, Ethereum led the marketplace with $57.22 million usefulness of leveraged positions liquidated. Bitcoin adopted carefully with $46.19 million in liquidations and Solana with $15.35 million.

The overall liquidation quantity reached $197.72 million, with the bulk ($159.88 million) in lengthy positions. These types of liquidations passed off on Binance, OKX, and Bybit, with $85.88 million, $65.83 million, and $16.47 million in liquidations, respectively, every showing an 80% lengthy liquidation charge.

Customery Bearishness

The crypto business isn’t any stranger to sporadic liquidations of such profusion quantities. Bearing in mind the popular temporary bearish sentiment, a majority of these liquidations have again and again been on lengthy positions. On June 24, the marketplace witnessed virtually $300 million usefulness of positions liquidated in below 24 hours. In a similar way, over $360 million usefulness of positions have been liquidated on June 7 when the Bitcoin worth crashed from $71,000 to $68,000.

Matching Studying

Contemporary marketplace dynamics counsel that the business will not be out of the logs but relating to such liquidations. Bitcoin continues to attempt to reserve above $60,000, a development that would persist within the coming weeks. That is partially as a result of Spot Bitcoin ETFs, that have traditionally been a catalyst for Bitcoin worth surges, ended extreme occasion on a destructive notice. Particularly, they concluded Friday’s buying and selling consultation with $237.4 million in outflows, the most important day-to-day outflow since Might 1.

Featured symbol from The Michigan Day by day, chart from TradingView