Ethereum has been in a descending channel in opposition to Bitcoin since August of endmost 12 months, which means Bitcoin has been the easier funding over this while. Then again, ancient developments display the tides might be converting quickly, with Ethereum most likely getting ready to getting into an quantity segment.

Ethereum Worth Motion

Ethereum is buying and selling at $1600, marking a 22% shorten from its worth endmost August. Bitcoin, at the alternative hand, is 8% up over the similar duration.

It is a usual pattern that occurs right through endure markets. Cash with higher marketplace capitalizations have a tendency to be extra resilient in opposition to worth decreases as buyers grow to be extra risk-averse and glance to saving their capital. Occasion Ethereum isn’t decrease at a marketplace capitalization of $187 billion, it’s nonetheless significantly not up to Bitcoin at $525 billion.

All the way through bull markets, cash with decrease marketplace capitalization outperform Bitcoin once more as buyers incline against belongings with better doable returns.

Ethereum Worth In comparison Towards Bitcoin

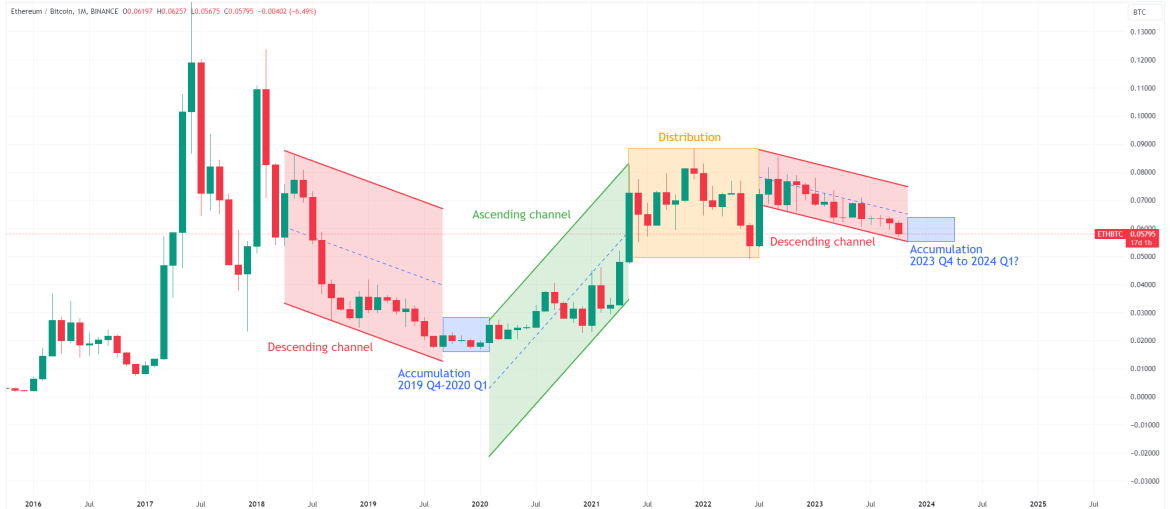

When evaluating ETH’s price to BTC, it’s perceivable that Ethereum has been buying and selling inside of a descending channel since endmost August. This development, characterised through its decrease highs and decrease lows, steadily signifies a bearish pattern available in the market.

ETH's valuation in opposition to BTC over while. Supply: ETHBTC on TradingView

The chart above highlights 3 alternative distinct levels:

Dozen segment: All the way through this segment, worth has a tendency to stabilize, hinting at an later trade in momentum

Ascending channel: Right here, the associated fee stories an important reversal, steadily on a parabolic trajectory, characterised through highs and better lows.

Distribution segment: Within the ultimate segment, the associated fee ceases its upward motion. Traders most often virtue this segment to capitalize on their beneficial properties and liquidate their positions.

The quantity segment is most often the most productive while for buyers to transform their Bitcoin into Ethereum. This segment is marked through worth maintaining on on the base and nearest appearing indicators of reversal. Ethereum remains to be initiation decrease lows in opposition to Bitcoin, so it has no longer entered the quantity segment but. Then again, the endmost cycle displays that this might be converting quickly.

Terminating Cycle

Reflecting at the endmost cycle, Ethereum was once in a descending channel in opposition to Bitcoin for 17 months. The quantity segment nearest took place from September 2019 up till February 2020. In line with the four-year idea, which means related levels available in the market happen each and every 4 years, this displays that the quantity segment will have to even be coming near very quickly on this cycle.

But, age the endmost cycle deals worthy insights, it’s noteceable to notice that refuse two cycles are the similar. Within the wave cycle, ETH’s worth motion has no longer distinguishable as a lot of a reduce as within the earlier cycle, which might be attributed to converting basics and asset maturation.

Ultimate ideas

Occasion an quantity segment for Ethereum has no longer been showed but, there remainder the opportunity of its worth to reduce even additional relative to Bitcoin. Then again, if the former cycle is anything else to journey through, shall we input the quantity segment quickly. This segment most often gifts high purchasing alternatives for Ethereum.

Funding Disclaimer: The content material supplied on this article is for informational and academic functions best. It will have to no longer be regarded as funding recommendation. Please seek the advice of a monetary guide prior to making any funding selections. Buying and selling and making an investment contain really extensive monetary menace. Time efficiency isn’t indicative of life effects. Incorrect content material in this website is a advice or solicitation to shop for or promote securities or cryptocurrencies.

Featured symbol from ShutterStock, Charts from TradingView.com