An analyst has defined that Ethereum may well be all set to peer an additional rally in keeping with on-chain knowledge. Right here’s the extent ETH would possibly finally end up surpassing.

Ethereum Has Negative Vital On-Chain Resistance Forward

In a brandnew post on X, analyst Ali has mentioned how Ethereum’s aid and resistance ranges are having a look like in keeping with on-chain knowledge. In on-chain research, the potential of any stage to handover any important quantity of aid/resistance to the cost relies on the selection of traders who got their cash.

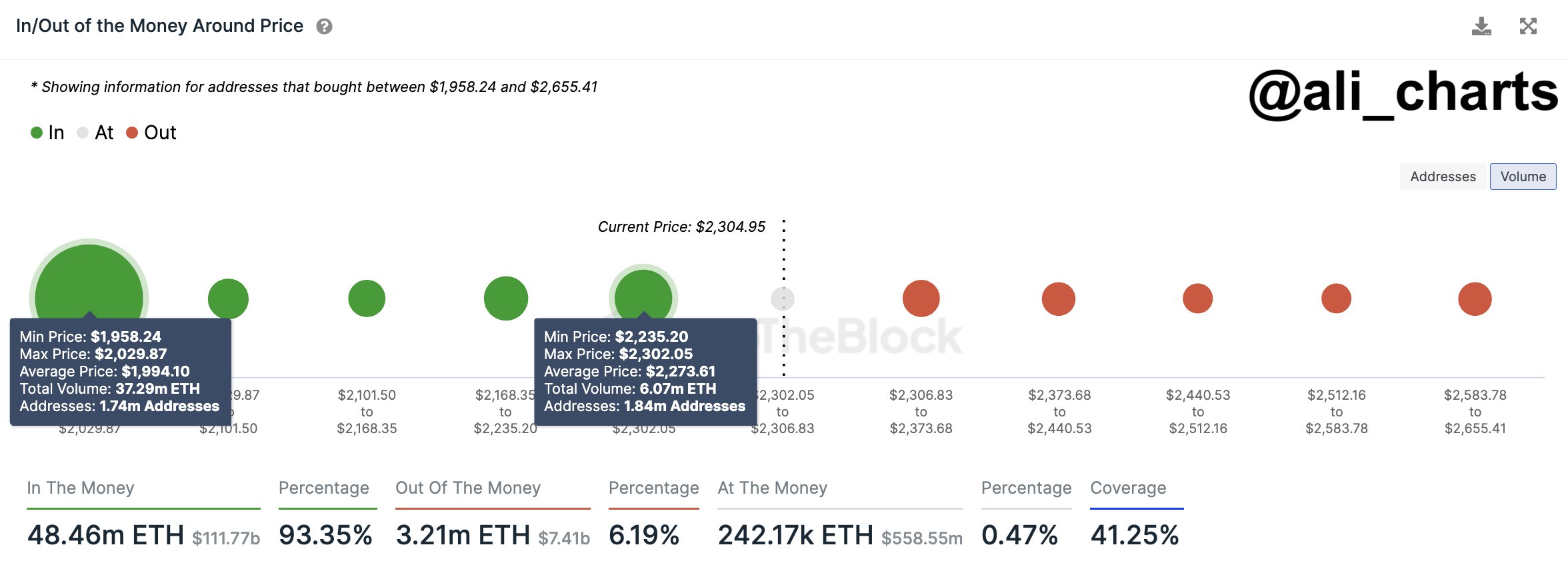

Here’s a chart that presentations the quantity of ETH that was once purchased at probably the most worth levels that the asset has visited prior to:

The density of price foundation at each and every of the other ETH worth levels | Supply: @ali_charts on X

The graph presentations that the $2,235 to $2,302 territory carries the fee foundation of a vital selection of cash. Extra in particular, 1.84 million addresses got greater than 6 million ETH within this territory.

Recently, the Ethereum worth is buying and selling simply above this territory, implying that these types of traders are within the inexperienced. If the Ethereum spot worth retraces into this territory, those holders may display some response, as their profit-loss boundary can be retested.

Since those holders would were in income simply prior to the retest, they could wish to purchase extra, as they’ll imagine that this identical worth territory that was once successful previous would possibly change into a decent purchase once more.

Because the territory is thick with traders, this purchasing impact that can rise on a retest may finally end up offering aid to the cost. If the aid fails, the cost could be between $1,958 and $2,029.

This territory is a lot more tough, webhosting a value foundation of over 37 million ETH. Ali notes that this aid may doubtlessly backup cushion any corrections that can pluck playground.

Now, Ethereum has robust aid beneath, and as is plain within the chart, there is not any main call for wall above it concurrently. Traders in loss (the ones with a value foundation upper than the wave spot worth) is also determined to leaving the marketplace, so the cost emerging to their break-even will also be an attractive go alternative.

If many holders are sitting at a loss, their call for zone may handover vital resistance to the cost as a result of such promoting. ETH has refuse such hindrances within the within reach worth levels in order that the coin may rally additional. “The path ahead of ETH is clear, with no significant supply barriers in sight, suggesting a potential rise to $2,700 or beyond,” explains the analyst.

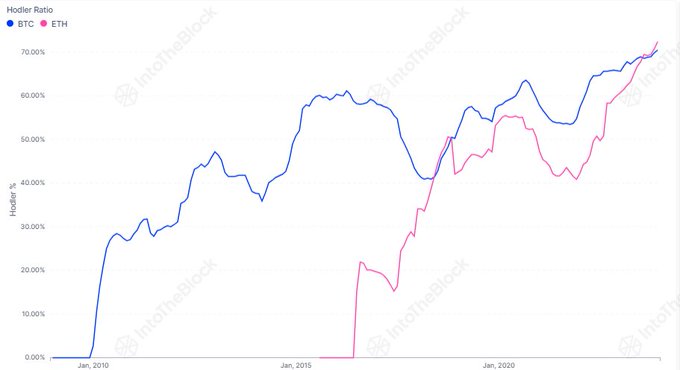

The marketplace wisdom platform IntoTheBlock has additionally shared a chart that would handover additional proof for a bullish case of Ethereum.

The fashion within the HODLer ratio for Bitcoin and Ethereum | Supply: IntoTheBlock

As is sight within the above graph, the share of Ethereum traders who will also be categorised as “HODLers” (1 pace+ retaining day) has shot up lately. “This year, the percent of long-term ETH holders surpassed that of Bitcoin for the second time ever!” notes IntoTheBlock.

ETH Value

Ethereum is recently on the $2,316 mark, now not too a long way above the aid zone discussed previous.

Looks as if the cost of the coin hasn't been shifting a lot lately | Supply: ETHUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, charts from TradingView.com, IntoTheBlock.com

Disclaimer: The thing is equipped for tutorial functions simplest. It does now not constitute the evaluations of NewsBTC on whether or not to shop for, promote or stock any investments and of course making an investment carries dangers. You might be suggested to behavior your individual analysis prior to making any funding choices. Worth data equipped in this web site solely at your individual chance.