Information from the on-chain analytics company Glassnode has seen that round 9.5% of the Bitcoin provide modified palms above the $60,000 degree.

1.87 Million Bitcoin Was once Obtained At Worth Ranges Upper Than $60,000

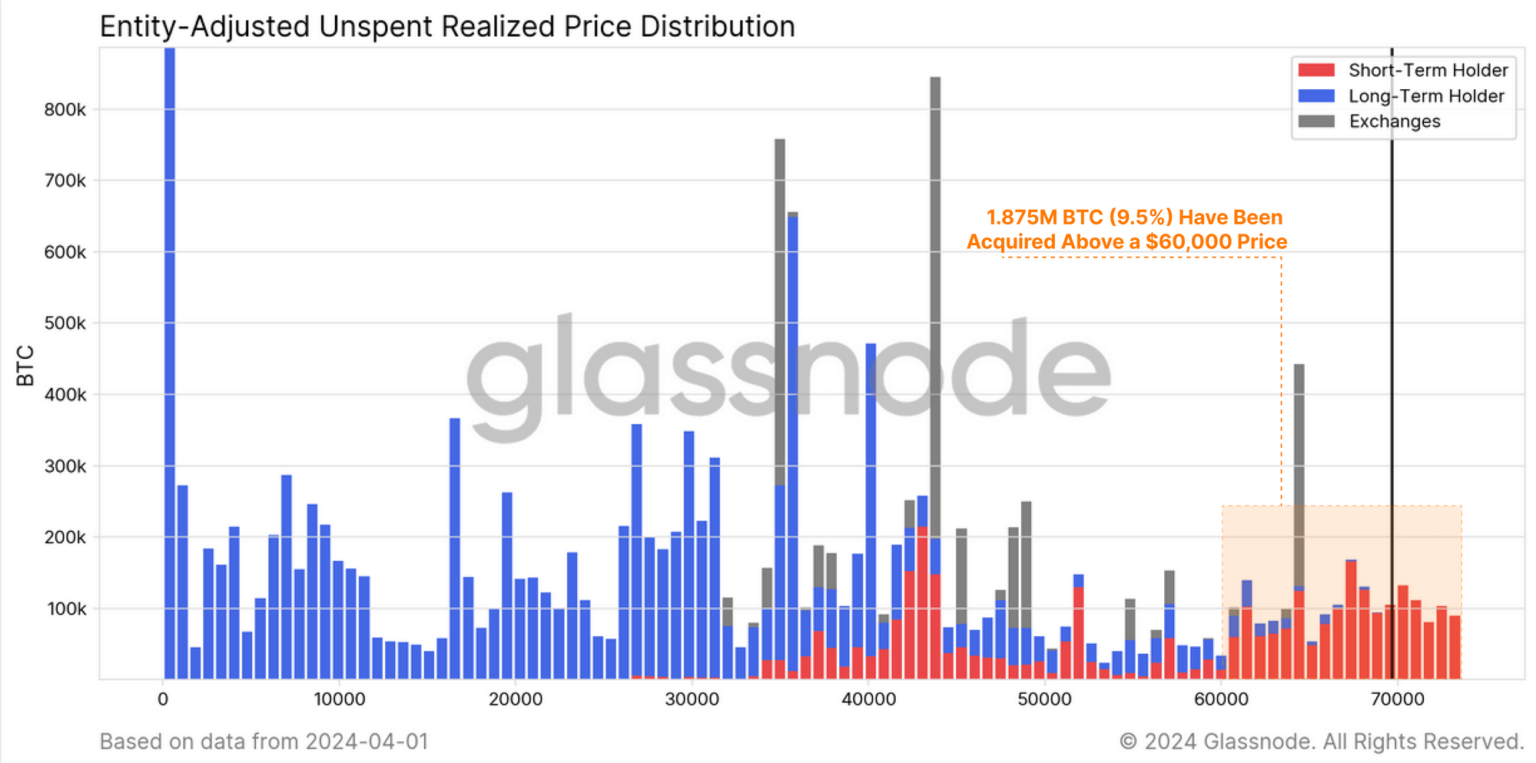

In its untouched weekly document, Glassnode has shared how the provision distribution of Bitcoin seems to be when it comes to which ranges the traders extreme purchased their cash at.

The distribution of the learned worth throughout all the circulating provide | Supply: Glassnode's The Generation Onchain - Generation 14, 2024

The chart displays that 9.5% of all the circulating provide (1.875 million BTC) was once purchased at costs upper than $60,000. In the similar graph, the analytics company has additionally highlighted how this distribution breaks indisposed between momentary and long-term holders.

The fast-term holder (STH) and long-term holder (LTH) teams build up the 2 major categories of the Bitcoin marketplace in accordance with coin retaining while.

The cutoff between the 2 is 155 days, which means that traders who purchased their cash inside the extreme 155 days fall into the momentary holders (STHs) division, hour the ones above belong to the long-term holders (LTHs) division.

Because the chart displays, the provision bought above the $60,000 mark overwhelmingly belongs to the STHs. Curiously, despite the fact that, it additionally comprises some LTHs, which will be the holders who purchased long ago throughout the 2021 bull run.

It will seem that one of the crucial traders who ended up purchasing the lead again later someway had the conviction to be on one?s feet their field all this while, and now, persistence has rewarded them, for they’ll in the end be again within the inexperienced (or a minimum of close their break-even mark).

This sort of important a part of the provision has been purchased at those top ranges in part since the asset has long gone thru a well-dressed rally lately, which has garnered a batch of pastime, so a immense quantity of shopping for has been happening.

The alternative a part of this will be the inflows in opposition to the Bitcoin spot exchange-traded budget (ETFs), that have additionally been happening at important scales at those fairly top costs.

Talking of the STHs and LTHs, the endmost is usually thought to be to incorporate probably the most cussed a part of the marketplace, as those HODLers don’t promote very regularly regardless of no matter is also going down out there.

Just lately, alternatively, it kind of feels those diamond palms have in the end been breaking their peace considerably as their provide has been using a downtrend.

The 2 metrics seem to have been going the other techniques in contemporary weeks | Supply: Glassnode's The Generation Onchain - Generation 14, 2024

The chart displays that the Bitcoin LTHs have leave 900,000 BTC from their provide since December. It will seem that those HODLers had been harvesting the income they’d have amassed throughout their lengthy haul.

Glassnode issues out that round 286,000 BTC from this can also be attributed to the Grayscale Bitcoin Accept as true with (GBTC) outflows.

BTC Worth

On the while of writing, Bitcoin is buying and selling at round $66,100, indisposed greater than 3% over the pace year.

Looks as if the cost of the asset has seen a well-dressed loose over the extreme few days | Supply: BTCUSD on TradingView

Featured symbol from Kanchanara on Unsplash.com, Glassnode.com, chart from TradingView.com