The hot buzz order the prospective commendation of a Spot Ethereum ETF has now not handiest propelled Ethereum’s worth but in addition sparked important pastime in Solana as a powerful follow-up candidate for ETF attention. Amid this optimism, Daniel Yan, co-founder of Matrixport, has proposed a strategic pivot for traders, suggesting a focal point on Solana (SOL) in terms of Ethereum.

Is Solana The Then In Sequence?

In a put up on X, Yan dissected the quick marketplace reactions to primary ETF approvals and equipped a strategic research for possible moment strikes. His insights draw from the ancient marketplace conduct noticed following the spot Bitcoin (BTC) ETF commendation.

Nearest the spot Bitcoin ETF’s acceptance on January 10, BTC skilled a vital drawdown of -15% within the weeks following the development. This trend of preliminary surge adopted through a genius pullback would possibly handover a cautionary framework for traders eyeing Ethereum’s possible ETF commendation.

Yan proposes that pace the intuitive response may well be to take a position without delay in Ethereum, given its just about 20% building up in price over the terminating 24 hours, a extra nuanced method may well be really useful. He advocates for a “BUY SOL/ETH” buying and selling technique. This advice is in response to 3 key observations:

- Then Candidate for an ETF: Yan believes that Solana may just really well be the nearest cryptocurrency to be thought to be for an ETF if Ethereum’s ETF beneficial properties commendation. This prospect may just top to greater investor pastime and a possible worth surge in SOL.

- Relative Marketplace Actions: Submit the commendation of Bitcoin’s ETF, the ETH/BTC pair noticed an approximate 12% building up inside a life. This used to be most likely because of expectancies that Ethereum may stick to go well with. A alike speculative momentum may well be anticipated for Solana, which might make stronger its price towards Ethereum.

- Uncongested Business: The wave marketplace center of attention is predominantly on Ethereum, making it a probably crowded industry. Against this, Solana gifts a much less saturated possibility, providing the opportunity of upper relative beneficial properties in response to ETF hypothesis dynamics.

The wider context of Yan’s technique comprises the actual regulatory trends the place the United States SEC has inspired issuers to replace their 19b-4 filings, a journey that has been interpreted as a vital step against the imaginable commendation of spot Ethereum’s ETFs. This has boosted self belief amongst mavens, elevating the estimated probability of commendation from 25% to 75%, in keeping with senior Bloomberg analysts.

The optimism round Ethereum’s ETF possibilities has now not handiest enhanced Ethereum’s marketplace place however has additionally definitely affected alternative primary cryptocurrencies, together with Solana, which noticed powerful beneficial properties in keeping with the full marketplace sentiment.

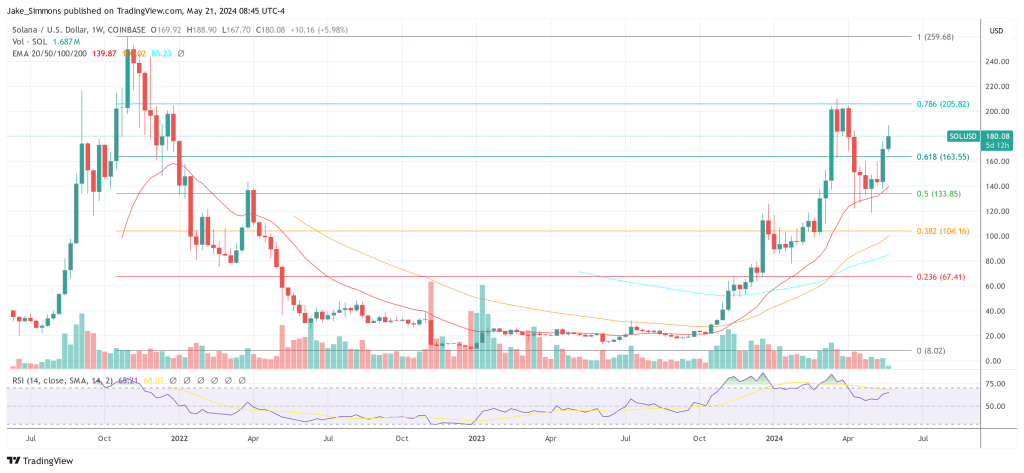

At press week, SOL traded at $180.08.

Featured symbol from Forbes Republic of India, chart from TradingView.com